Scenes from the crypto gold rush

Wild Crypto

Wild CryptoWant to get in on the latest investment craze and make spectacular returns while feeling that you are at the cutting edge of crypto-currency technology?

Keep this to yourself, but I've been told about two amazing schemes. And both of them provide more evidence that we're in the middle of another bubble.

The first is called Wild Crypto and is that most fashionable of financial fandangos, an ICO - or initial coin offering - where projects with somewhat hazy business models raise funds by offering for sale their own currency.

In this case, the idea is that you subscribe real cash - or rather you turn that real cash into the Ethereum crypto-currency - and in return you get a new currency called Wild coins.

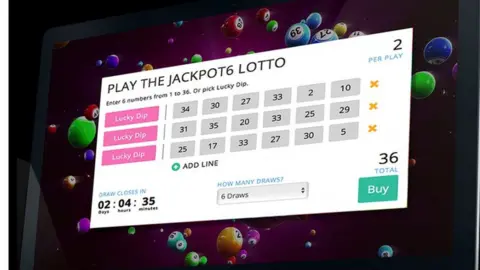

These can then be used to play on the lottery gaming platform that Wild Crypto is developing.

The white paper, the document that is an essential but often opaque accompaniment to any ICO, explains it like this: "Players will be able to take part in a global lottery and lottery-based games at significantly better odds than national lotteries.

"We can do this because we are leveraging existing certified state-of-the-art technology, without the governmental overheads and bloat."

So this is basically an online gambling business raising funds prior to its launch, while giving investors no stake in its operations.

They are handing over their money in the expectation that Wild coins will appreciate because the Wild Crypto lottery proves immensely popular with punters around the world.

It is rather as if the makers of Monopoly were to ask investors to cough up to buy Monopoly money.

But, of course, the wondrous blockchain technology underpinning this operation will enable it to run a much more efficient and trustworthy operation than the gaming world has seen to date - a claim I've seen, by the way, from other online gambling operations mounting similar ICOs.

It won't have those costly "governmental overheads", which presumably include regulation. But that means it won't be allowed to operate in the USA, where they are none too keen on online gaming, or in the UK, where Wild Crypto would need a gaming licence - and, according to the Gambling Commission, it has yet to apply for one.

Not so global a lottery as claimed, then, but that doesn't seem to have lessened interest in the ICO.

Wild Crypto is aiming to raise $5m (£3.8m), and with 23 million out of 40 million Wild tokens sold in the first two days of a seven-day sale, things are going swimmingly.

What exactly is an ICO?

Getty Images

Getty ImagesIn simple terms, an initial coin offering is an unregulated means to raise funds for a new crypto-currency business.

It allows investors to buy newly created tokens - known as coins - issued by a venture in return for more established virtual currencies, such as bitcoins or ethereum.

It is often compared to an IPO (initial public offering) - but the obvious difference is that the public does not get a stake in the business itself.

About $1.7bn (£1.3bn) has been raised via ICOs since the start of the year, according to one study, so the activity has undoubtedly been growing in popularity.

However, it was banned in China earlier this week because of the risks involved.

Singapore regulators have also warned that ICOs are potentially vulnerable to scams and terrorist financing.

And their counterparts in the US, Russia, Canada and South Korea are among others to have indicated they may also intervene.

My second example of crypto craziness is a scheme that allows holders of Bitcoin to use their ever more valuable funds to invest in property.

In what is billed as a world first, Baroness Mone - who made her fortune from a lingerie business - and the entrepreneur Douglas Barrowman are offering apartments in a Dubai development that will be priced and sold in Bitcoin.

Aston Plaza

Aston PlazaWhy? Apparently, it is a chance for those Bitcoin holders who have seen the value of their investment in the crypto-currency soar over the past year to crystallise their profits and put them into less volatile bricks and mortar.

But why would the developers want to take on the risk of acquiring those Bitcoin assets from apartment buyers?

It turns out they aren't. The buyers will have to convert their bitcoins into dollars when they complete their purchase, and although the apartments are "priced" in Bitcoin, that price will be adjusted in line with the currency's dollar exchange rate.

So, what's the point? Well, it seems slapping the label Bitcoin or crypto-currency or blockchain on any project is the modern equivalent of adding "dotcom" to any old business in the late 1990s.

Investors tempted to dive in should read up on what happened to many of those businesses a few years later.