Cost of living: 'It's hard to eat proper food'

Mandy Doakes

Mandy DoakesSome young people say higher prices are making it a struggle to find "healthy, balanced meals", as a poll for the BBC indicated one in 10 have used a food bank.

"Half of the time I live on noodles, because it is that difficult," Mandy Doakes tells BBC Newsbeat.

The 22-year-old says she has to "rely on other people" for a hot meal.

Mandy, who is on universal credit, says the costs have forced her to use a food bank on a couple of occasions.

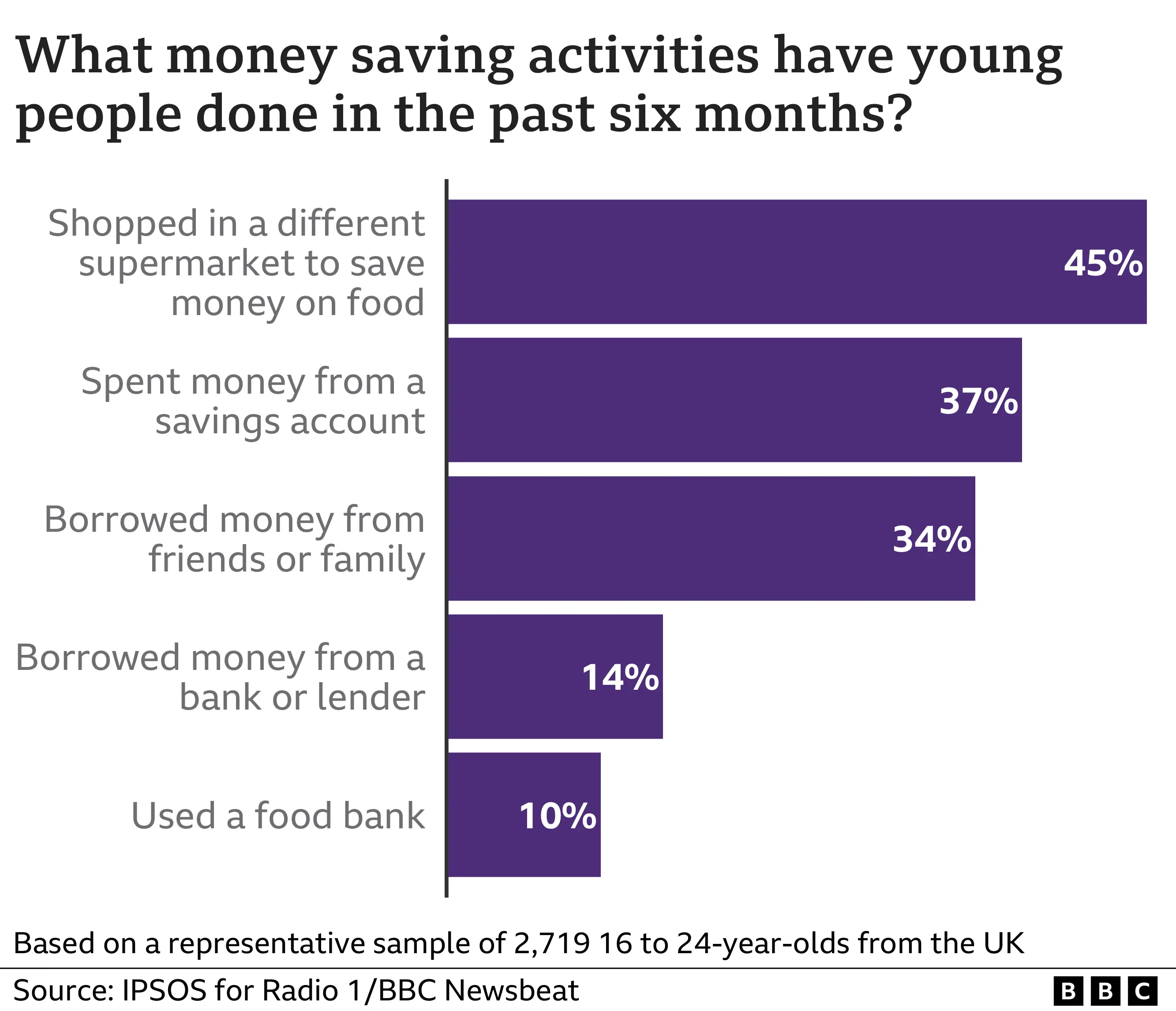

The online poll, conducted by Ipsos on behalf of Radio 1 and BBC Newsbeat, asked a representative sample of 2,719 British young people - 16 to 24-year-olds - about their worries and concerns.

Of those, 52% said their biggest worry was the rising cost of living and inflation.

Becoming financially secure was given by 40% of respondents as their number one concern.

Difficult times

In response to a set of questions about personal finances, 32% of those surveyed said they were worried about their levels of personal debt.

For Mandy, who is in Basingstoke, her debt situation means she has more money "going out than coming in", and sometimes has to turn to food banks.

"They can be helpful but sometimes they can be more of a hindrance. It's nothing against the food banks, but they're also finding it difficult at the moment."

"With the cost of everything going up they're not getting all the essential food bits that they need."

Danni Malone, a director at Britain's biggest food bank network the Trussell Trust, said there was "pressure on supplies" as more people are turning to them for support.

She said the trust was seeing a rise in the number of people coming to access food banks, and they're "preparing for the hardest winter ever" with "unprecedented levels of demand".

"Some food banks are dipping into their reserves already because of a rise in demand," she said.

"And the cost of running the food banks is going up with the increase in energy costs and fuel."

'Have to put kids first'

Mental health was the third-biggest worry reported by those surveyed, with 39% identifying it as their top concern.

Mandy says her debt worries affect her mental wellbeing.

"Sometimes I sit in my room and I think 'is there any point getting up today?' or 'is there any point going to sleep?'," she says.

"Because I'm just constantly thinking about it."

Getty Images

Getty ImagesFor 22-year-old Kelly, from Birmingham, the current financial stress is "overwhelming".

She has one child and says "you have to put them first, because you can't let your children go without".

Kelly says she has to ensure her benefit payment stretches out for the month, adding: "On the last day I have like £1 left."

Allow X content?

Like Mandy, Kelly also relies on help for food.

"We make the most of what I can get, if there's things that I can see myself or my child eating. So I have been using the resources that are close to us," Kelly says.

The survey found 45% of those asked had shopped in different supermarkets to save money.

Kelly says she also travels further to find shops with cheaper deals.

"I used to eat a lot of fresh, nice foods. Now that is not on the cards," she says.

Both Mandy and Kelly receive assistance from the YMCA youth charity, which has told Newsbeat their own research indicates that "food is the first to be cut when times are tough".

"Young people who are on benefits are skipping meals, turning to food banks and making more unhealthy choices because of the lack of money they have," said Denise Hatton, chief executive of YMCA England & Wales.

"Food bank usage has not only increased, it has become normalised."

She added young parents found it "particularly hard to make healthier choices" for themselves and their children.

'A vicious circle'

The Ipsos UK survey also suggested 34% of all participants had borrowed money from friends or family, with 14% borrowing from a bank or lender.

Mandy has sought help from others and borrowed money.

"It's not really advisable but you have to do it sometimes," she says. "But then that's more money going out because you have to pay someone else back."

The survey suggested one in six of all participants agreed being financially secure was their biggest ambition in life.

"It would be nice to have the option to be able to go where I can and put a bit of money aside," Mandy says.

"Because I want to buy a property or be able to rent a property."

"But at the moment it's very difficult to do that because you haven't got the spare money. So you're in a vicious circle."

Follow Newsbeat on Instagram, Facebook, Twitter and YouTube.

Listen to Newsbeat live at 12:45 and 17:45 weekdays - or listen back here.