Here's what you should know about student debt

Getty Images

Getty ImagesStudent loans are back in the news, with new government plans saying those who start university next year could be paying off their loans for 40 years after graduating.

That's for England, with the repayment period being extended to reduce the bill for taxpayers, according to the government.

Under the current system, loans are written off after 30 years.

There will also be a change in the income level at which you start repaying your student loan - with a reduction from £27,295 to £25,000.

How does student debt currently work?

Here are the basics for England and Wales.

Most people who go to uni take out a loan in two parts - for tuition fees (the amount you pay the uni) and a maintenance loan (for living costs).

The amount you get for the maintenance loan depends on your household income.

For example, if you did a three-year course at £9,250 a year and got £6,378 a year for a maintenance loan, you'd graduate with £46,884 of debt.

That's before you add interest, which is between 9% and 12%.

Getty Images

Getty ImagesIt's unlikely you'll ever pay it all back (more on that later) - but just having that amount of debt hanging over your head could be pretty disheartening.

But student debt doesn't work like other loans.

Many graduates will see just a few pounds come out of their monthly pay cheque.

So how's it different to a bank loan?

There are some big differences between a student loan from the government and anyone else:

- Currently, any money you owe is wiped after 30 years

- How much you pay back depends on how much you earn

- It doesn't impact your credit score

- Your house or belongings won't get repossessed if you don't keep up repayments

It might be easier to think of it a bit like a tax.

Repayments come straight out of your pay cheque and the amount you pay goes up the more you earn.

At the moment, graduates don't start repaying their loans until they earn over £27,295 per year.

Over that amount, you pay back 9% of your income.

Graduates who earn £30,000 a year would pay back about £243 a year (just over £20 a month).

But remember, we also need to take interest into account.

How does interest work on a student loan?

Almost every loan you ever take out will have interest - that's the fee for borrowing the money.

For student loans, the amount of interest you pay is related to two things. Number one is the Retail Price Index (RPI) - which is a measure of inflation and is currently 9%.

Getty Images

Getty ImagesNumber two is how much you earn.

After you graduate, you pay somewhere between 9% and 12%. The amount goes up the more you earn.

While you're studying you're charged a flat rate of 4.1% interest, but you won't start repaying it until you graduate.

Under the new plans, interest rates on student loans will be cut for new borrowers and set at no higher than the rate of inflation.

How much do student loans cost the rest of the UK?

One of the main reasons tuition fees went up in 2012 was because the government wanted to reduce the amount it paid out.

The idea was for students to pay for their own tuition, rather than taxpayers.

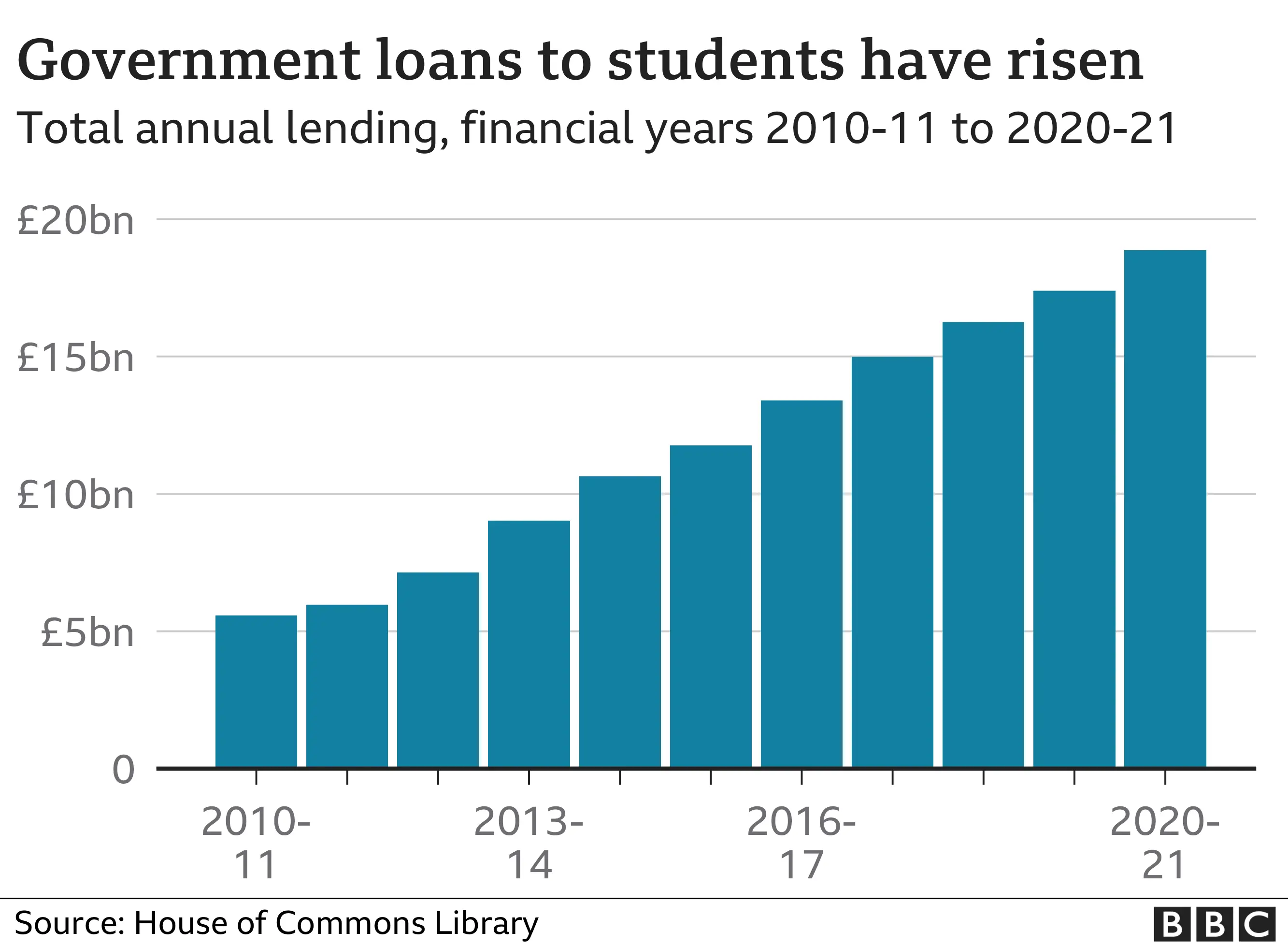

However, higher fees for students meant more amounts of money being lent out by the government.

As the graph above shows, the amount the government gives out in loans has been going up every year.

The number of students enrolling on undergraduate courses has risen in that time too - which is another reason the government is lending more money.

The reality is that most graduates won't pay back the full amount they borrow before the debt gets wiped at 30 years.

Social mobility charity The Sutton Trust estimated in 2017 that 81% of students would not pay off their loans in full.

The government's own Office for Budget Responsibility estimates only 38% of total money and interest will be repaid.

By requiring graduates to start paying back at £25,000, and to continue paying for an extra 10 years, the government hopes more will repay their loans in full.

What about Scotland and Northern Ireland?

Wherever you are in the UK, you pay 9% of your earnings over a certain level.

There are a few differences between England and Wales, Scotland and Northern Ireland.

In Scotland, you start repaying your loan when you earn £25,000 a year. The yearly interest rate stays at 1.1% throughout.

In Northern Ireland, the earnings threshold is £20,000 and the interest rate's also 1.1%.

A version of this article was first published in January 2020.