'Car payments are ruining our lives'

BBC

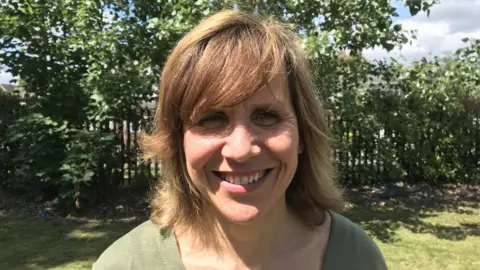

BBC"Some nights are sleepless nights. I'm totally stressed out about it, I can't stop thinking about it."

Attempting to keep up with car finance payments is having a huge impact on Mandy Quinn's family.

"It's changed our lives, it's ruining our lives and that's the honest truth of it."

Complaints about car finance have increased sharply in the past year, according to figures seen by Money Box, and Mandy feels that her family should never have been put in the position they now find themselves in. Her 23-year-old daughter, Victoria, was sold a second hand Audi A1 on a five-year hire purchase deal in early 2017.

Victoria put down £300 as a deposit and has to pay £329 a month for five years.

As a first year university student with a part-time job she'd originally gone out looking for a much smaller - and less expensive - car to help her get to and from lectures. But she was persuaded to buy the Audi, which will end up costing her more than £20,000. Mandy says her other daughter, Natasha, also took out car finance and was told to bring in three pay slips to prove she could afford the repayments.

But Mandy says there was nothing like that, what's known as an affordability assessment, for Victoria.

Two main types of car finance

Getty Images

Getty Images- Hire Purchase (HP): The total cost of the car is spread equally over each month of the deal, with the vehicle owned outright afterwards

- Personal Contract Purchase (PCP): Typically customers pay slightly less each month, but they have to hand the car back or pay a "balloon" payment of thousands of pounds at the end of an agreed period if they want to buy it outright

With Victoria having recently lost her job, Mandy and her husband have been stepping in to help meet the payments. But they say they simply can't afford to anymore. In just a few short sentences Mandy Quinn has summed up the impact that trying to meet car finance repayments is having on her family.

Victoria's now missed two payments in a row and has been told she now owes the car finance company, with other charges, more than £700. Mandy says Victoria's now being chased for the debt with multiple text messages and letters every week.

"Victoria is really embarrassed. She can see it's impacting on us," Mandy says. "I think she was just silly, but I would have hoped that some kind of safeguarding procedures would have been in place to stop this happening to families [and] causing so much distress.

"I would have hoped she would have had to produced some kind of payslip, or a bank statement or something but there was nothing. It just seemed [wrong] to me she could go there and she could walk out of there with a £21,000 car - because my daughter's got nothing to prove she could afford those repayments."

Getty Images

Getty ImagesThe Financial Ombudsman Service has given figures to Money Box which show the number of complaints it has had about hire purchase products, the majority of which it says relate to car finance, has increased sharply in the past year.

In 2017-18 there were 5,805, but last year that figure jumped by more than half to 8,943. The type of things people were complaining about were the quality of the car, not even knowing what type of finance they're on, and being sold cars on finance plans they can't afford.

Car finance: The figures

- £45.9bn was borrowed in 2018 for car finance

- 91.2% of all new cars were bought using finance

- 2.9 million cars were financed by members of the Finance and Leasing Association

Source: Finance and Leasing Association, 2018 annual report

Stuart Masson, editor of thecarexpert.co.uk, says those numbers are the tip of the iceberg.

"The complaints that make it all the way to the Financial Ombudsman Service are a small number. But that's because most people don't get that far if they have a problem. Generally the first step is to call the finance company to be told 'bad luck, you still owe us the money'."

New guidelines

The Financial Conduct Authority, the watchdog responsible for regulating the car finance industry, introduced new guidelines in November 2018 after expressing concern some lenders weren't "complying with FCA rules on assessing creditworthiness, including affordability".

That's an issue that is key to Mandy's question about how her daughter was able to sign up to a car finance plan for more than £20,000 without being asked to provide any evidence she could actually afford the repayments.

"She [Victoria] should never ever have been sold that, or offered a car like that. She should have been given [an affordability] test to prove she could afford it, but the company didn't do it.

"I think it's criminal, the impact it's had on the family, my daughter, it's outrageous."

Adrian Dally, head of motor finance for industry body the Finance and Leasing Association, says the overall numbers [of complaints] are "very small compared with size of motor finance market".

"Even if you assumed that most of the complaints were attributable to motor finance and all were upheld, it would equate to no more than one in every thousand agreements. But we are not complacent, hence all the new guidance produced for members and the development of a motor finance apprenticeship standard that was designed to ensure that training is embedded at every entry point to the industry."

If you have, or have ever taken out car finance we'd love to hear your story. Email us '[email protected]'.