An election giveaway but taxes will still rise

Getty Images

Getty ImagesWhat is the public to make of the one hour and five minutes that Chancellor Jeremy Hunt was on his feet?

That famous red box actually contained a relatively modest amount of treats - leaving some to speculate we may see another such event before voters go to the polls.

My main takeaway from Wednesday's Budget is that many are still going to see their tax bills rise.

Underpinning all the chancellor's choices on tax and spending is the level of public debt, built up over time, relative to the size of the economy.

To meet the rules Mr Hunt sets himself, this has to be falling in five years' time. According to his independent forecasters' best stab - it is - but so slightly you can barely see it and with a tiny margin, less than £9bn, to spare.

He's chosen to spare some cash for those widely trailed tax cuts - at a cost of £13bn by 2029. But despite that long, detailed speech, £11bn will be going on that National Insurance cut - a tax giveaway that will be a relief to many workers.

What does it mean for you?

Where is that money coming from? Some of it is being funded by raiding other pockets - a new duty on vapes, a crack down on tax avoidance - and almost half will come from changing the treatment of "non-doms", those normally not classed as resident for tax purposes.

But the money raised from those sources is particularly uncertain and they raise a measly amount compared with the "hidden" or stealth taxes the government receives from frozen tax bands.

Welcome to fiscal drag. An earlier decision by the government not to raise the thresholds at which different rates of taxes on income apply means many have had more of their money siphoned off as tax.

That policy creates four million more income taxpayers between 2022 and 2029 overall and three million more move into the 40p higher rate bracket.

That will raise over £40bn per year by 2029 alone - overshadowing Mr Hunt's tax cuts. The amount of the national income going to the Treasury will reach 37% by 2029 - the highest tax burden since the war.

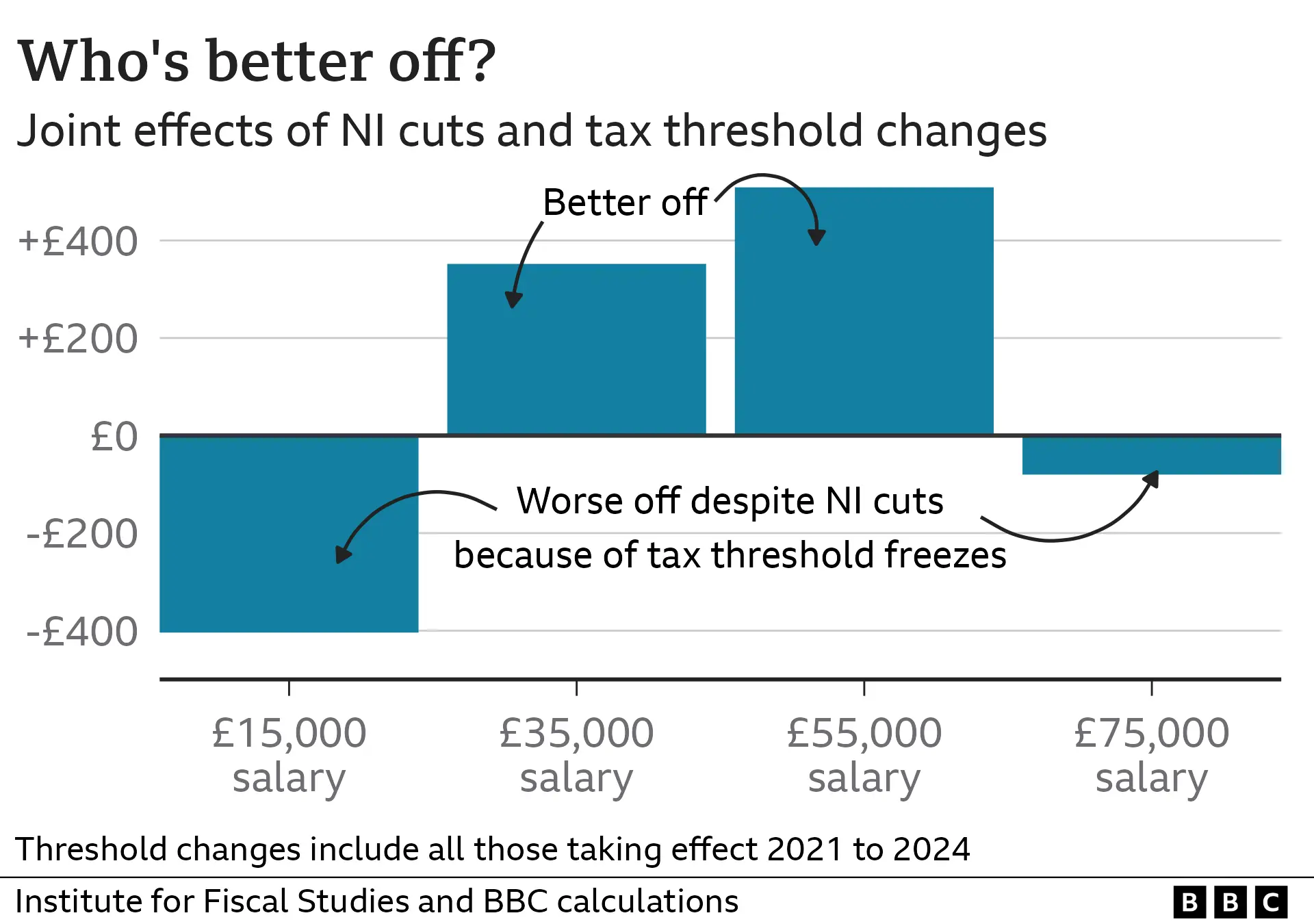

The combined effect of November's and Wednesday's cuts in National Insurance - totalling 4% - and the threshold freezes between 2021 and this April gives you a mixed picture depending on your salary.

Lower earners are worse off, middle earners are still better off and higher earners are very slightly worse off.

- Someone on £15,000 will be about £400 worse off overall

- Someone on £35,000 will be about £300 better off

- Someone on £55,000 will be about £500 better off

These changes do not include the changes to child benefit.

However, by opting for tax cuts the chancellor's chosen curbs on spending that could hit public services.

He's pledged a new drive to increase efficiency, but the numbers pencilled in suggest future cuts in some areas - universities, courts, prisons - perhaps reaching up to at least 12% after inflation and population growth, to make his sums add up.

Read more on Budget

And there's a mixed picture on growth - the chancellor's independent forecasters indicate the recession will be short lived, but take into account population growth and we're typically £260 worse off, after inflation this year, than two years' ago.

But growth is expected to pick up - we could be £1,700 better off in total over the years between 2024 and 2028. But these, like all forecasts, are uncertain.

And they still point to voters perhaps heading to the polls feeling worse off. Whoever wins that election may face an awkward decision - to raise taxes - or confront a new era of intensified pressure on public services.