'I earn £70,000 and can now get some child benefit payments'

David Stuart

David StuartDad-of-two David Stuart has not been able to get child benefit payments for several years.

On a salary of £70,000, he was deemed too high an earner.

But in Wednesday's Budget, the chancellor raised the income level at which people have to start paying back part of the benefit from £50,000 to £60,000, and the level at which it is withdrawn completely from £60,000 to £80,000.

It means that David is now eligible for 50% of the benefit, which he says is "positive" and he welcomed other proposed changes to the system.

The BBC spoke to people with a range of earnings and household set-ups about what they wanted from the Budget and their thoughts on what the chancellor delivered.

The accountancy firm EY looked at their circumstances and helped calculate how the Budget would affect their finances.

'Child benefit changes make the system fairer'

David, 36, from Whitburn. West Lothian, is a data analyst who lives with his wife and two children, aged 10 and six.

"We could claim again and then potentially keep up to 50% of the benefit for the next couple of years, which seems positive," he says.

Claiming 50% child benefit for two children in 2024-25 would total £1,106.

But he has always thought the way the underlying system works is unfair.

"Personally, I'm a high earner - I make higher than the average person in full-time employment. But as a household, I wouldn't say we're high earners."

While he makes about £70,000 a year, his wife, who works as a childminder, earns around £10,000.

Since 2013, child benefit has been based on an individual's income - whichever parent earns the most. So two parents earning £50,000 each would still be able to claim the payment in full, despite their household earning more than David and his wife.

But the chancellor has now announced plans to consult on allowing HMRC to collect household information so that from April 2026 claims would be based on household income - something which David had called for.

"I'm glad they not just raised the threshold, which would have just kicked the can down the road, but it's absolutely the right thing to move towards it being household-assessed," he says.

"Obviously it will take time. I understand that.

"But the main thing is it's fairer."

'I earn £22,000. The Budget will leave me £188 better off'

Joe Makin

Joe MakinJoe Makin, 23, earns £22,000 a year working in admin and says almost two-thirds of his take-home pay is eaten up by rent and bills.

Joe rents a one-bedroom house in Selby, North Yorkshire. "Each month I earn about £1,600 after tax. Maybe £1,000-£1,100 of that goes on rent and bills," he says.

He says he had low expectations ahead of the Budget, so found it "a smidgen more positive" than he thought it would be.

"There were some ideas that were quite good. I liked the potential ISA reforms that could help people save money. Better development in the energy grid could bring down energy prices."

But he says: "These are small things that scratch the surface of what could be good, but as usual it never tends to go far enough for me. I was waiting for him to say 'and...' but the 'and...' never came.

The 2p cut to National Insurance (NI) announced by the chancellor will leave him £188 a year better off, according to EY.

"For me it's so negligible it's going to make little difference, but it's scalable so for others it's a step in the right direction," he says.

"But I don't think [the Budget] goes far enough for people who are worse off than me as the cost-of-living crisis is still very present."

'I'm pleasantly surprised but would have liked more help with childcare'

Aga Szedzianis

Aga SzedzianisAga Szedzianis in Newham, east London says that while there was some good news in the Budget, she would have liked to have seen more help for working parents.

With price rises, the cost of childcare, and her mortgage soon set to go up by £500 a month, things are getting "quite uncomfortable".

The 37-year-old mum-of-two said the 2p cut to National Insurance was, "welcome but at the same time if that means spending less on public services then I personally don't think it's worth it".

She would have preferred to have seen income tax thresholds go up.

Usually tax thresholds rise in line with inflation, but they have been frozen since 2021. So as your pay goes up, a bigger portion of your income is taxed.

Read more on Budget

"I think it would have been better to change them in line with inflation for everyone. [The 40% rate] was supposed to be a high-income tax for the richest. But now more people are paying it."

She says over the past few years, despite her salary going up, she wasn't seeing much difference in her take-home pay as a result.

Aga and her husband earn more than £50,000 each as associate architects so are subject to the 40% rate.

However, they will benefit from the increased thresholds for child benefit.

"We currently pay about 50% of it back. So now it means we can claim it in full and don't have to do these complicated calculations for how you get it."

But she adds: "The child benefit change helps but it would be great if it was directed more towards childcare itself."

EY calculates that Aga and her husband will be £2,603 better off in 2024-25, thanks to the NI and child benefit changes.

Aga says she is pleasantly surprised. "That's great. That will definitely help."

She says she and her husband may be able to start paying into their pensions again, as they decided to stop making contributions because they couldn't afford them.

'I earn £27,000. I'm disappointed there was nothing for first-time buyers'

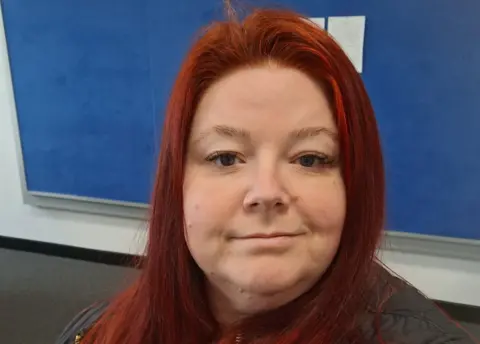

Rebecca Bostock

Rebecca BostockRebecca Bostock earns £27,000 working as a case manager in the motor industry.

The 45-year-old, who lives just outside Daventry, in Northamptonshire, would love to buy her own home but says saving for a deposit is "absolutely not possible" while still also paying rent.

"I'm disappointed that nothing was mentioned about first-time buyers," she says.

"The NI cut is a double-edged sword," she believes. "On the one hand I don't think it's fair that we have two lots of money deducted from the wage packet i.e. tax and NI, but on the other hand it does fund social care, the NHS etc, without whom we would be lost."

The changes to NI will give Rebecca savings of £288 a year, EY says.

"That will only be about £24 a month extra, which unfortunately won't make any difference to my situation at all," says Rebecca.

"But I'm not too disappointed, as I know what the NI goes towards paying for."

She adds: "Fuel duty being frozen is good, though [that was] expected."

Additional reporting by Victoria Park-Froud and Kris Bramwell