Interest rates won't fall due to 4% inflation, says Bank boss

Getty Images

Getty ImagesThe Bank of England's governor has said UK inflation remaining unchanged is "encouraging", but he hinted it would not mean earlier interest rate cuts.

Andrew Bailey said inflation, which measures how prices rise over time, staying at 4% last month "pretty much leaves us where we were".

The figure surprised experts who had expected a rise in energy bills to push prices up at a faster rate.

Investors have since increased bets that interest rates will fall in June.

January saw the first monthly fall in food prices in more than two years, but the cost of a weekly shop still remains much higher than two years ago.

Falls in prices for food items such as crackers, cake and crisps helped offset the rise in electricity and gas costs to keep overall annual inflation unchanged from December. Cooking sauce and instant coffee costs also eased.

Price in the shops rose sharply after Russia's invasion of Ukraine, which had a big impact on energy prices and grain supplies worldwide. Bad weather in Europe and North Africa and labour shortages in the UK also affected crops too.

Slower price rises for many furniture and household goods also helped keep inflation lower, as retailers offered big discounts in a bid to clear the shelves after disappointing sales in the run-up to Christmas, official figures showed.

Asked if inflation remaining at the same level was good news, Mr Bailey replied: "Yes - to be honest we slightly overshot last month and undershot this month so it pretty much leaves us where we were."

The Bank's governor said he did not believe the figure "broadly changes the picture" on interest rates, adding that the differences were "pretty small numbers".

But he said policymakers had moved from deciding how high interest rates could go to return inflation back to the Bank's 2% target to "how long do we have to maintain this stance" - in other words how long do interest rates have to remain at their present 5.25%.

Following the latest inflation number, investors increased bets that the Bank of England would cut interest rates from June.

But analysts urged caution pointing to steady core inflation, which strips out the effect of items that can be more volatile, such as energy costs, alcohol and tobacco.

Service costs, which include housing services such as rent, repairs, sewage collection, house contents insurance and repair of household appliances and council tax also rose in January.

Housing and household services, including gas and electricity charges, made the biggest upward contribution to inflation with the typical annual household bill now £1,928, a rise of £94, since January.

The price for second-hand cars also rose by 1.5% between December 2023 and January - the first rise since last May.

'More evidence needed'

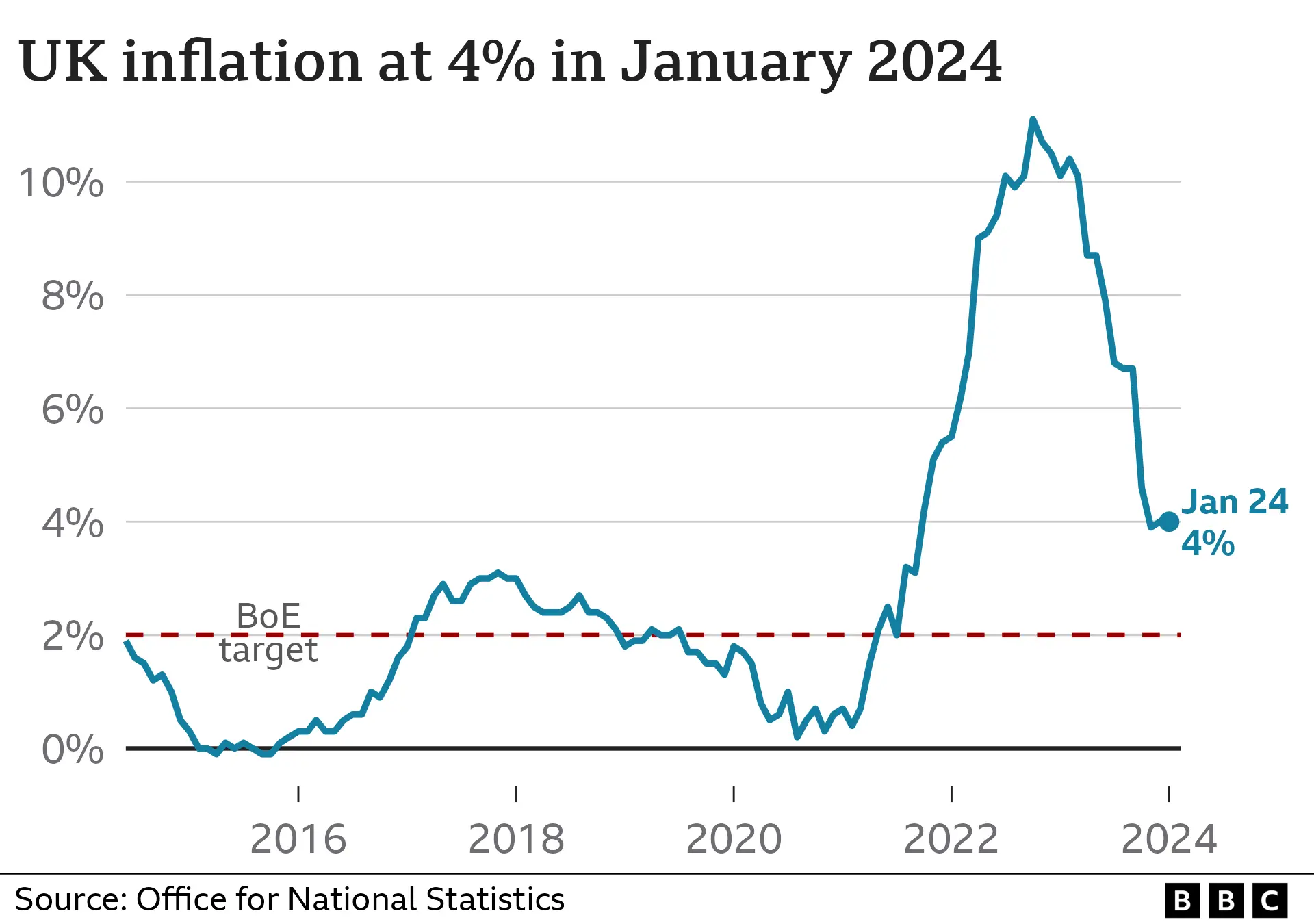

Inflation still sits far above the Bank of England's target of 2%.

The Bank has steadily raised rates to their highest in 16 years. By making borrowing more expensive, it hopes people will have less money to spend, and also may save more as saving rates increase. In turn, this reduces demand for goods and slows price rises.

Mr Bailey said that the Bank needed to see "more evidence" that services inflation and wage growth were falling before cutting rates.

Figures on Tuesday showed that pay was still going up faster than prices.

Prime Minister Rishi Sunak insisted the "economy has turned the corner and we're now pointing in the right direction".

Speaking at a business council meeting, the prime minister said inflation had now more than halved and that mortgage rates were starting to come down.

But shadow chancellor Rachel Reeves made that point in response to the latest update: "Inflation is still higher than the Bank of England's target and millions of families are struggling with the cost of living."

'If you make it too dear, they won't come'

Gareth Jones, the owner of family-run Singleton Jones delicatessen in Warrington Market, said customers' shopping habits had changed.

"The ones that haven't got a lot of money are having to watch it because they're really scraping by because of the price of heating their home, transport, cars."

He told BBC News that price rises from his suppliers put him between "a rock and a hard place".

"If I move my prices up, I've got to sell it to someone. And if you make it too dear, they don't come in."

Myron Johnson, senior personal finance analyst at Interactive Investor, said there was a sense of optimism going forward.

"For many, the cost of living burden on their finances doesn't feel as acute. But many workers haven't been so fortunate and continue to be weighed down by elevated costs."

How can I save money on my food shop?

- Look at your cupboards so you know what you have already

- Head to the reduced section first to see if it has anything you need

- Buy things close to their best before date which will be cheaper and use your freezer

Read more tips here.