Millions borrowing to pay essential bills at Christmas, charities warn

Getty Images

Getty ImagesMillions of people are borrowing to pay essential bills at Christmas, charities warn, with energy debts a key concern as prices are set to rise again.

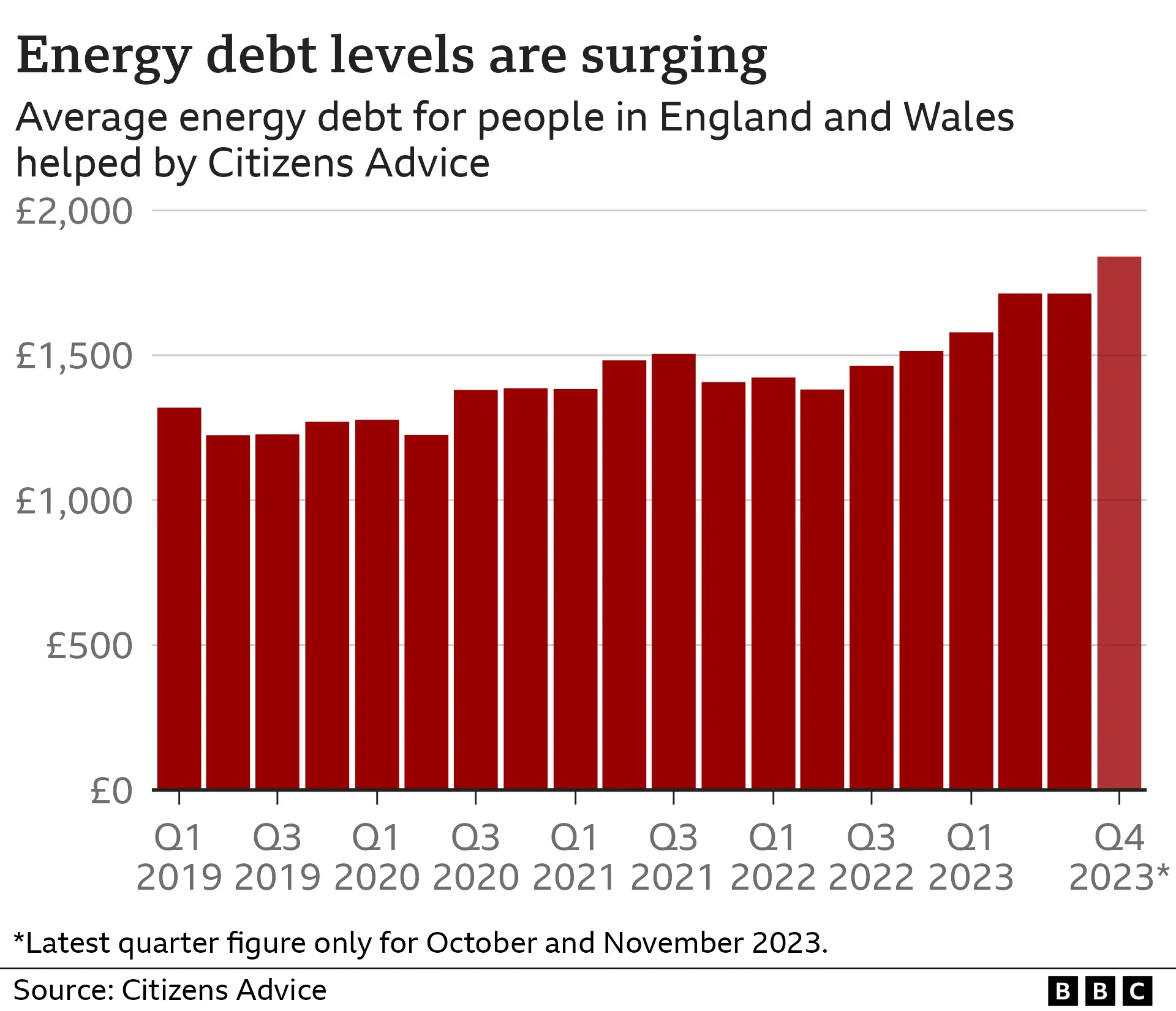

Citizens Advice said it was seeing more people falling behind on energy bills as winter began, owing an average of £1,841 to their supplier.

The government said its cost-of-living payments were easing the burden.

Charities say some families face paying off loans, adding to the financial strain as they cut back on basics.

The Joseph Rowntree Foundation, which campaigns on social issues, said a third of those it surveyed said they still had loans to pay off, which had originally been taken out to cover the costs of food, housing costs, energy bills or council tax.

Those debts can grow as interest is added, but there are warnings that people are still borrowing to make ends meet.

Debt charity StepChange estimated that 2.6 million UK adults used credit to pay for essential household bills in the last three months. Nearly half of those with existing debt faced difficulty keeping up with household bills and credit commitments.

New figures from Ofgem, the energy industry watchdog, revealed that the amount of debt and arrears faced by gas and electricity customers swelled to £2.9bn between July and September.

That is up from £1.9bn in the same three months last year and 13% higher than the previous quarter between April and June.

Households in arrears - where a customer owes a supplier but has not worked out a payment plan - make up the vast majority of the overall figure, at more than £2bn.

Customers in debt, who have a re-payment agreement with their energy company, totalled £830m.

Festive fears

The festive period always brings warnings over financial difficulties. Extra Christmas costs at a cold, dark time of year mean demand for debt services often peaks when bills come in during January.

That coincides with an increase in the cost of gas and electricity at the start of the year. Energy regulator Ofgem has said the typical annual household bill in England, Wales and Scotland will go up from £1,834 to £1,928, a rise of £94 or 5%.

Newly-published data from Citizens Advice shows that it helped 10,220 people in England and Wales with energy debts in November. That monthly total had only been surpassed once, in March this year.

The cumulative amount each of them owes on average has been rising in recent years, with the most recent data showing that hit £1,841. Citizens Advice also spoke to thousands who could not afford to top up prepayment meters.

The charity, Sense, said that pressure was particularly intense for those who need higher gas and electricity usage because of a disability.

It said many would not celebrate Christmas in the same way because of worries over bills.

That is true of Keith Butler and his family. The 73-year-old, from Worcestershire, has a son - Geordie, 22 - who has Charge syndrome and is deafblind and autistic. As a result, energy use is high because, for example, he is fed with a machine that needs to be charged.

Mr Butler said he had avoided falling behind on energy bills thanks to a grant from the charity, and because he was "from the frugal generation".

"We have been cutting back for two or three years," he said. "Now I have just had notification of our energy bill going up again."

He said they had been buying small Christmas gifts for Geordie for months, and other members of the family would only have a token present.

Mr Butler, Sense, and others such as the consumer organisation Which? are calling for a social tariff - a specific package of energy costs directed at those on certain benefits. Broadband suppliers offer something similar.

Citizens Advice also said targeted support for vulnerable residents was needed soon because "unwelcome records" were being broken.

A spokesman for the Department for Energy Security and Net Zero said: "We recognise the cost-of-living challenges families are facing, which is why we are spending £104bn supporting households with bills.

"This includes support for the most vulnerable, with three million households expected to benefit from the £150 Warm Home Discount, £900 for those on means-tested benefits, and an extra £150 for disabled people."

While facing debts, some borrowers have said they are bombarded with offers of more credit.

Radio 4's Money Box programme spoke to someone who struggled with debts called Jamie. He said that he got into trouble after losing his job, received offers with rising credit limits, and eventually needed help. He is now debt-free.

"I was definitely naive," he said. "We should be more educated about how money works, how credit works and how interest works. There should have been some protection."

UK Finance, which represents banks, said its members were committed to complying with the rules.

Are you having to borrow money to pay for Christmas or household bills? Share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

What can I do if I can't afford my energy bill?

- Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

- Pay what you can: If you can't meet your direct debit or quarterly payments, ask your supplier for an "able to pay plan" based on what you can afford.

- Claim what you are entitled to: Check you are claiming all the benefits you can. The independent MoneyHelper website has a useful guide.