Cameron's return revives memories of Greensill finance scandal

Reuters

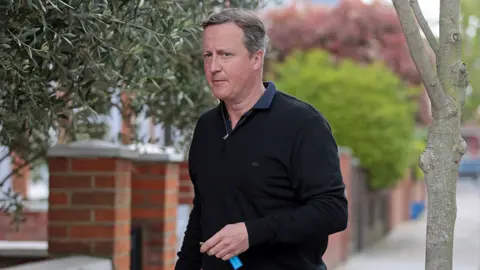

ReutersIn appointing David Cameron to one of the top four offices of state, Rishi Sunak has chosen to disregard his close association with one of the UK's biggest financial scandals of recent years.

Two years ago, BBC Panorama revealed internal documents suggesting Mr Cameron made about $10m (£8.2m) jetting around the world to promote a highly controversial finance business, Greensill Capital.

Greensill, whose disgraced boss Lex Greensill was given an office in Downing Street under Mr Cameron's premiership and later became both his friend and his employer, collapsed in March 2021.

Billions of dollars of investors' money was missing.

Criminal inquiries are ongoing in Germany and Switzerland. Mr Greensill has been named as a suspect in Switzerland.

Lex Greensill previously denied allegations from MPs on the Commons Treasury Committee in 2021 that his collapsed finance firm was a "fraud" or a "Ponzi scheme" and blamed the firm's collapse on the withdrawal of cover from its insurers.

Before Panorama's revelations, Cameron had repeatedly refused to tell Parliament how much he made promoting Greensill to investors who included customers of Swiss investment bank Credit Suisse.

Greensill Capital promoted itself as a high-tech lender of supply chain finance, where small companies awaiting payment from customers can borrow money against their invoices.

Shutterstock

ShutterstockIt made loans of more than $10bn using money from Credit Suisse customers, many of them to companies that later proved unable to repay. More than two years later, over $2bn is still to be recovered by administrators.

Losses on Greensill's loans were among the factors contributing to the collapse of Credit Suisse in March this year.

Greensill Capital lent around $5bn (£3.6bn) to GFG Alliance - a group of companies controlled by the steel magnate Sanjeev Gupta.

Sanjeev Gupta's GFG group, and its relationship with Greensill Capital, is currently the subject of an ongoing investigation by the Serious Fraud Office. The group has consistently rejected allegations of wrongdoing.

At the time the investigation was announced in 2021, GFG Alliance, Mr Gupta's family conglomerate, said it would co-operate fully with the investigation.

Duncan Mavin, author of Pyramid of Lies, a book exposing the scandal, said: "It's an astonishing decision for David Cameron to be appointed when all the lawsuits and criminal investigations are still underway."

Intensive lobbying

Before Greensill Capital collapsed in March 2021, Cameron had intensively lobbied civil servants in 2020 to allow Greensill to lend £10bn under emergency Covid loan schemes, applying pressure by making phone calls and sending dozens of texts and emails to civil servants.

The British Business Bank (BBB) eventually approved Greensill to lend a more limited amount of taxpayer-guaranteed funds under the government's emergency loans scheme for medium-sized businesses, CLBILS (Coronavirus Large Business Interruption Loan Scheme).

It later emerged that Cameron had been calling Nadhim Zahawi, then a junior business minister (later appointed chancellor of the exchequer), who according to a letter that later emerged, had been instrumental in securing the BBB's approval for Greensill to lend.

Within weeks, Greensill lent the maximum possible, £400m, in eight loans to companies with links to one customer, steel tycoon Sanjeev Gupta. The rules of the scheme forbade lenders from extending more than £50m to any one single company. The government has said it will not honour the guarantees made on those loans.

Lex Greensill, the founder of Greensill Capital, has said Greensill's access to any government-backed schemes had "always drawn upon robust advice from leading law firms to ensure Greensill complied with relevant rules".

A spokesman for David Cameron previously told the BBC he acted in good faith at all times and there was no wrongdoing in any of the actions he took.

A British Business Bank spokesperson told the BBC it had accredited Greensill for the CLBILS scheme independently of government, with ministers having no input in the decision.

"The National Audit Office concluded in its investigation report that the Bank demonstrated the independence of its decision-making by rejecting requests to prioritise Greensill over other lenders," it said.