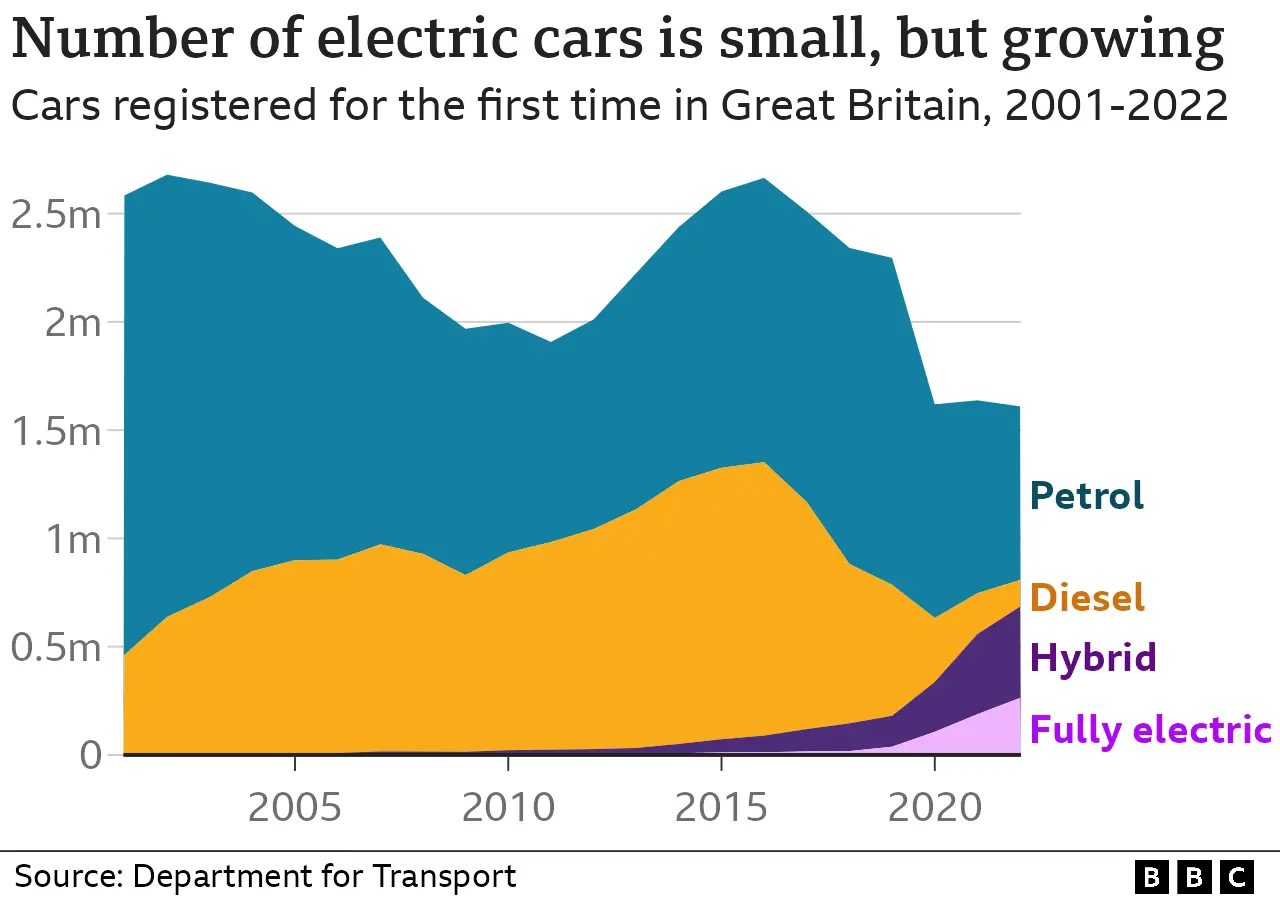

Firms still forced to sell more electric cars despite petrol ban delay

Getty Images

Getty ImagesCar firms will still be forced to meet strict quotas for selling electric cars despite the ban on sales of new petrol and diesel vehicles being delayed.

From January, just over a fifth of vehicles sold must be electric, with the target expected to hit 80% by 2030.

The government confirmed the policy would remain even though Prime Minister Rishi Sunak announced the petrol and diesel ban would be moved to 2035.

Firms that fail to hit the quotas could be fined £15,000 per car.

Industry insiders said the quotas would be a "stretch" for manufacturers to achieve, adding the delayed ban could make it harder to sell electric cars, while Auto Trader suggested firms might cut prices to boost sales and meet targets.

Prime Minister Rishi Sunak has defended the government's decision to push back the ban, insisting the UK will meet its net zero targets.

But there was some uncertainty whether the change to the ban would affect the quotas for electric sales, before Business Secretary Kemi Badenoch confirmed that the so-called Zero Emissions Vehicle (ZEV) mandate would remain in place.

It is expected the mandate will require car makers to ensure 22% of vehicles sold are electric next year and increase each year after that to reach 80% by 2030.

If a car maker fails to hit the targets, it will either face fines expected to be £15,000 per vehicle, or have to buy a surplus credit from a company that has sold lots of electric vehicles. However, a firm could claim back penalties if it surpasses the quota in future.

One large manufacturer told the BBC that forcing firms to hit the target on electric vehicle sales, while pushing back the ban on new petrol and diesel cars, would make it harder for firms to sell the electric ones.

Ian Plummer, commercial director of online car selling site Auto Trader, said the quota on firms for electric car sales would be a "stretch for the majority of manufactures to achieve" in its current form.

He said to meet targets "some manufacturers are likely to use price reductions as a lever" to attract drivers to buy electric.

"It's likely price will need to play a big part in this," he added.

"Electric vehicles carry a hefty price premium, so if prices come down, they'll suddenly become a far more attractive proposition for a greater pool of car buyers."

According to Auto Trader, the average price of a new electric vehicle is 39% more expensive than a petrol or diesel equivalent.

Prices for second-hand electric cars are almost double (£31,946) on average compared to used petrol (£16,332) and diesel (£16,233) cars, and electric prices in the second-hand market are increasing as demand rises.

Motor industry analyst Philip Nothard, insight and strategy director at Cox Automotive, told the BBC the target for electric car sales was "arguably a greater influence" on the market than delaying the ban on new internal combustion engine vehicles.

He added that because many carmakers were already committed to hybrid and electric-only ranges based on the government's previous 2030 policy, greener vehicles might be more attractive to buyers in terms of price because consumers would eventually face a "limited choice" of new petrol and diesel cars, causing the prices of those vehicles to rise.

The targets for electric car sales mean only a maximum of 20% or less of new cars sold by 2030 can be petrol or diesel, with some of those likely to be hybrids.

Car manufacturers have given mixed responses to the decision pushing the ban on new petrol and diesel car sales back from 2030 to 2035. Ford said the move undermined its electric car investment plans, but Toyota welcomed the announcement, saying the delay was "pragmatic".

Motor industry sources said the impact of the ban being delayed was expected to be limited.

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), said the regulations compelling increased sales of electric vehicles "remains the single most important mechanism to deliver the UK's net zero commitment", rather than the ban on new cars with petrol and diesel engines being changed.

He said consumers needed to be encouraged to make the switch, which would "require a package of incentives for private buyers that complements those on offer to businesses, as well as measures to accelerate the rollout of charge points".

What's the policy now?

Prior to Mr Sunak announcing a shift in policy, the government had planned to ban the sale of new, pure petrol and diesel vehicles by 2030. Now, it will begin in 2035.

By phasing out fossil fuel-powered vehicle sales, it aims to accelerate the transition to electric and achieve net zero by 2050. Net zero is when a country's net carbon emissions are cut to zero, and is seen as vital to tackling climate change.

Under the ban, from 2035 only electric battery-powered cars and other zero-emission vehicles will be able to be bought new. However, most people will not be affected by the ban immediately, as the majority of drivers buy vehicles second hand and only sales of new petrol and diesel models would be affected - not existing ones.

The delay in the ban brings the UK into line with the European Union, which is also banning sales of new petrol and diesel cars by 2035.