Magnum-maker Unilever's profits higher after it raises prices

PA Media

PA MediaMagnum and Marmite-maker Unilever has reported profits soared over the first six months of this year, based almost entirely on raising its prices.

The consumer goods giant said that across the business, pre-tax profit rose 21% to €3.9bn (£3.34bn) but the number of goods that it sold fell.

Supermarkets, such as Tesco, have been critical of suppliers lifting their prices amid high inflation.

Unilever's boss said it had not passed on higher costs to its customers.

Chief executive Hein Schumacher added that he believes that inflation - the rate at which prices rise - had peaked.

"We do see inflation moderating by the end of the year and that will lead to more moderated pricing our end.

"We've seen high volatility because of drought in Europe and rice shortages in India, as well as geopolitical issues so we've had a lot to contend with," he said, referring to the costs the company has to pay for raw materials.

Supermarkets, who themselves have been accused of so-called "greedflation" - exploiting high inflation to increase their profits - have accused suppliers of hiking prices. So too have some trade unions.

"Unilever's profits are greedflation in action," said Sharon Graham, general secretary of the Unite union. "This isn't about the company shifting more stock - sales volumes have fallen."

But Mr Schumacher said: "We have not passed inflation on to customers and as you can see we have felt higher costs through lower margins as a group."

A profit margin is calculated by taking away all the costs of doing business, such as wages and energy bills, from the total sales a company generates.

Unilever's profit margin edged higher to 17.1% in the six months to June compared with a year ago, but is lower than margins seen pre-pandemic. In 2019 the figure hovered around 19% for the company.

According to analyst Emma-Lou Montgomery, associate director at the stockbrokers Fidelity Investment, it is clear that higher prices are boosting Unilever's profits, particularly with sales volumes largely flat.

"All in all, the cost of living is proving profitable for this global giant, with full-year underlying sales growth expected to beat forecasts," she added.

A recent investigation into grocers' pricing by the regulator, the Competition and Markets Authority, said it had found no evidence of profiteering by supermarkets but said it was important to keep the market "under review" and would now look into the wider supply chain.

Overall, Unilever's total turnover rose by 2.7% to €30.4bn.

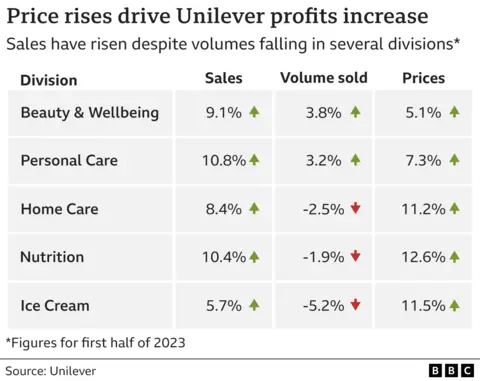

The number of goods - or volume - that Unilever sold fell by 2.5% in the six months to the end of June but its prices rose by 11.2%.

Only its personal care, and beauty and wellbeing divisions - which includes luxury make-up brands such as Hourglass - saw volumes rise over the six months.

Food costs have been one of the biggest drivers behind high UK inflation, which measures the pace at which prices are rising.

In the year to June, food and soft drink price inflation slowed to 17.4% but remains close to historically high levels. Overall UK inflation eased to 7.9% in June, said the Office for National Statistics.

Last week, Premier Foods, the maker of Mr Kipling cakes and Oxo stock cubes, said it believed recent input cost inflation was "past its peak". It added that it would not raise prices for the rest of the year.