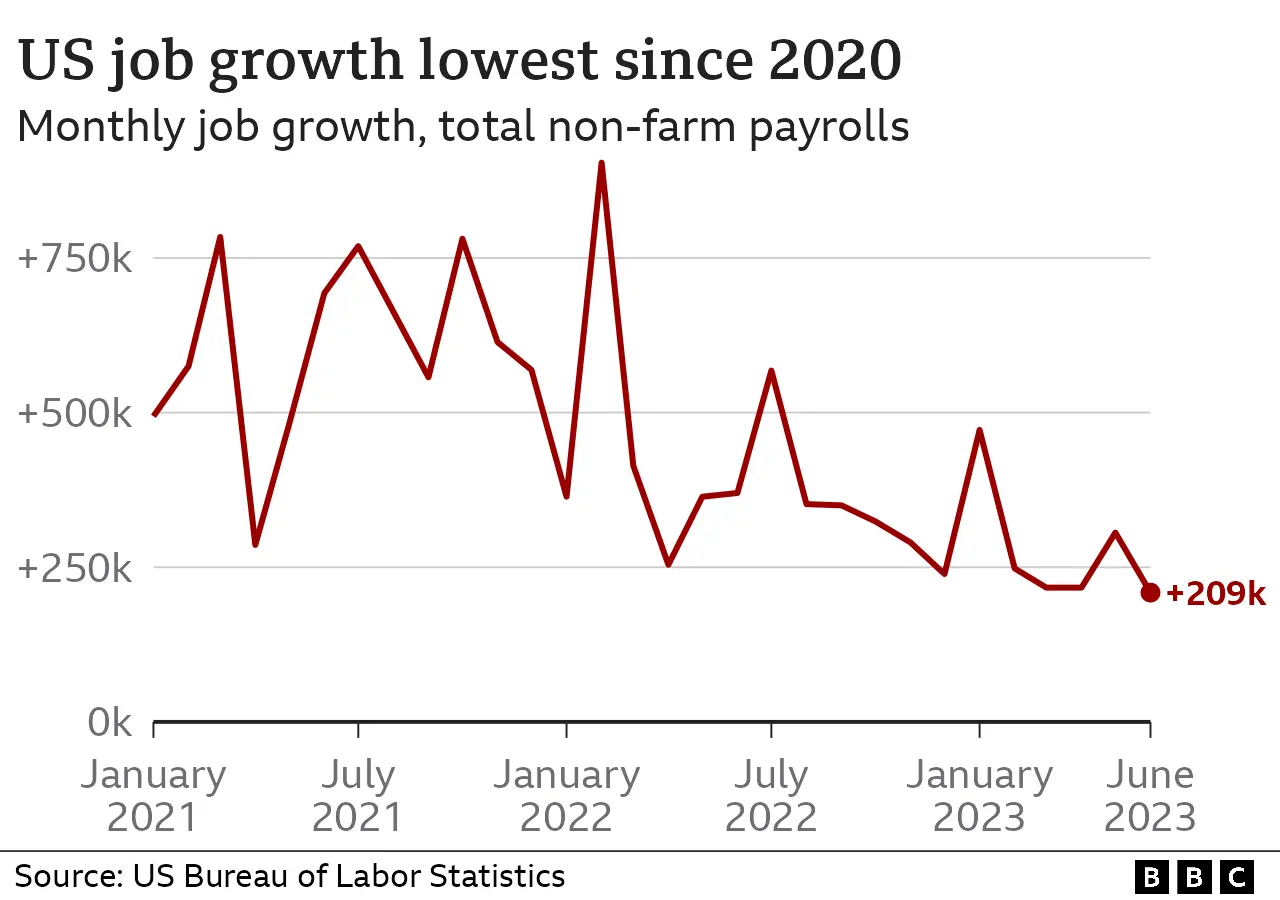

US jobs growth weakest in more than two years

Getty Images

Getty ImagesUS jobs growth slowed last month in a sign that the weight of higher interest rates may be starting to slow the world's largest economy.

Employers added 209,000 jobs in June, the smallest gain in more than two years, the Labor Department said.

That was fewer than expected, though the unemployment rate still fell to 3.6%, down from 3.7% in May.

The labour market is being watched closely, as the US central bank lifts borrowing costs to fight inflation.

Hiring has remained strong, despite the Federal Reserve's benchmark interest rate jumping to more than 5% in little over a year.

That held true in June, when analysts said the 209,000 jobs added were more than enough to accommodate growth in the labour force, despite it being the smallest number since December 2019.

Wages also continued to climb, with the average hourly pay up 4.4% from a year ago.

But the monthly report comes alongside other data, such as a drop in job vacancies, that suggest the labour market may be cooling.

"Today's jobs report is slightly weaker than many expected," said Richard Flynn, managing director at Charles Schwab UK.

"The labour market remains tight, but investors will likely interpret these numbers as a sign that cracks are beginning to emerge."

Economists have been predicting a slowdown for months, as higher interest rates force consumers to cut back spending in other areas and make borrowing for business expansions more costly.

But jobs growth had consistently outpaced forecasts and a strong hiring report from private payrolls processor ADP earlier this week raised expectations for a repeat.

The ADP figures triggered a sell-off in shares on Thursday, as investors adjusted bets on how far rates might have to climb.

However, the Labor Department report painted a slightly different picture, showing government and healthcare firms driving the hiring in June.

Retailers and transportation firms shed jobs, while leisure and hospitality businesses added just 21,000 positions - keeping overall employment in that sector below pre-pandemic levels.

Analysts said they still expected the US central bank to raise rates again at its meeting this month.

Though inflation in the US has fallen sharply since last year, at 4%, it remains higher than the Federal Reserve's 2% target.

Forecasts released by the bank at its last meeting indicated that most officials thought they would need to push interest rates higher to stabilise prices.

"Jobs growth has slowed but remains too strong to justify an extended Fed pause. More significantly, with average hourly earnings surprising to the upside, wage pressures are still too strong," said Seema Shah, chief global strategist at Principal Asset Management.

"Today's report will give the Fed little reason to hold off from hiking at the July meeting."