Is Brexit behind the UK's inflation shock?

Getty Images

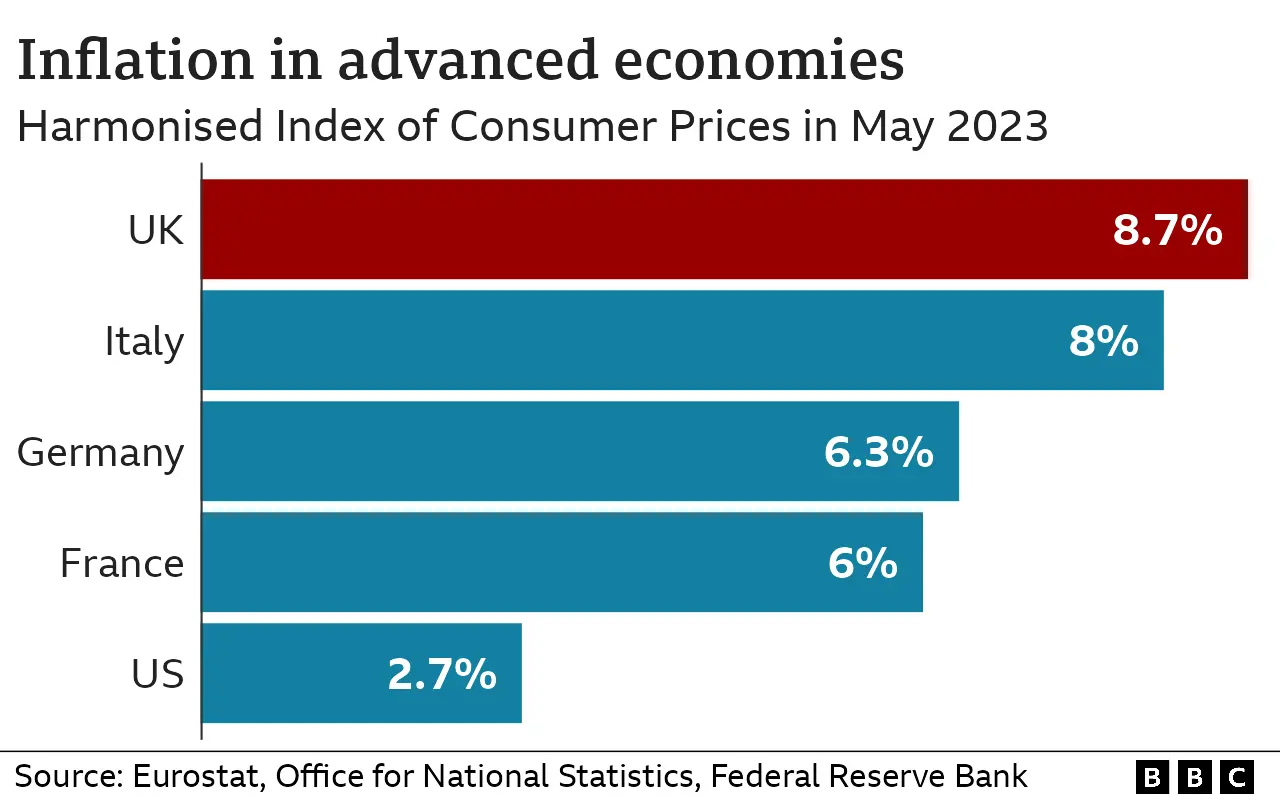

Getty ImagesThe shockwaves triggered by the impact of Russia's invasion on food and energy bills have been felt globally. But inflation in the UK has climbed faster and been more stubborn than in the US and EU.

Some, including Mark Carney, the former governor of the Bank of England, claim Brexit may be to blame. But it's a complex picture.

Singling out the impact of Brexit isn't easy, especially with the effects of a pandemic and a war. But there is evidence that the red tape - the form filling and other hurdles - required to bring goods into the country may have added to food bills.

More than a quarter of our food is imported from the EU.

Researchers at the London School of Economics (LSE) compared how the prices of some of those items rose compared with those of food from elsewhere. The differences may reflect other factors, and may not be purely down to Brexit.

But the academics claimed that if they were, then the extra red tape could have added £250 in total to the typical household's grocery shopping bills between December 2019 and March 2023, with meat and cheese particularly affected.

Most of that rise - about £210 - they say came through before our current cost-of-living crunch, in 2020 and 2021, as businesses were preparing and first implementing the new processes.

But in total, the LSE team reckons the changes could have accounted for over a quarter of the rise in food bills we've seen since the end of 2019. By contrast, the cost savings in new trade deals agreed since then have been minimal.

So while Brexit may not have been the biggest reason for our surging food inflation, the higher costs it added may have played a significant part.

But here's a small crumb of comfort - even with these changes, academics at Oxford Economics believe food is 7% cheaper in the UK than on average in the EU.

And official statistics show a smaller part of spending in the UK goes on food - less than £1 in every £8 - than in France or Germany.

However, a trip to the butchers, deli counter or nipping out for a pizza could become still more expensive.

The remainder of post-Brexit import checks and formalities on items brought into the UK to guard against risks to animal health and food fraud are due to be phased in from October, after they were postponed during the pandemic.

The government has streamlined several processes in the meantime, considerably reducing the extra bills importers were due to face.

But meat, dairy or fish products, for example, will have to be signed off as safe by a vet before entry, at a cost of hundreds of euros.

Every consignment of goods in such medium- and high-risk categories entering the UK will face a new charge at border posts of up to £43.

The changes will cost businesses hundreds of millions of pounds per year. And customers may ultimately foot the bill.

Getty Images

Getty ImagesMeanwhile, the end of free movement means 330,000 fewer workers in the UK, according to one estimate from economists at the Centre for European Reform.

That is 1% of the workforce, but it is hitting some sectors harder than others - transport, hospitality and retail are all seeing more acute staff shortages.

Such employers tend to have to offer larger pay rises to attract and keep staff. While that is good news for those in work, who might have scored a bigger pay rise than they would have done otherwise, those costs are often passed on to customers.

Then there is a less visible possible impact. Investment - in things like equipment, skills and IT - has stalled since the referendum.

Economists, including those at the government's own independent forecasters, say part of that gap may reflect Brexit-related costs or uncertainty. That makes the UK less efficient than it could be, meaning the cost of producing stuff is higher.

But with the Windsor Framework settling the arrangements for trading with the EU between Northern Ireland and the Republic of Ireland, economists hope some uncertainty has disappeared, and investment may get a boost. But that takes time.

The current inflation shock is truly global. But those escalating bills in the UK may come with a Brexit surcharge on top - just when households and businesses feel they can least cope.