Average two-year mortgage rate close to 6%

Getty Images

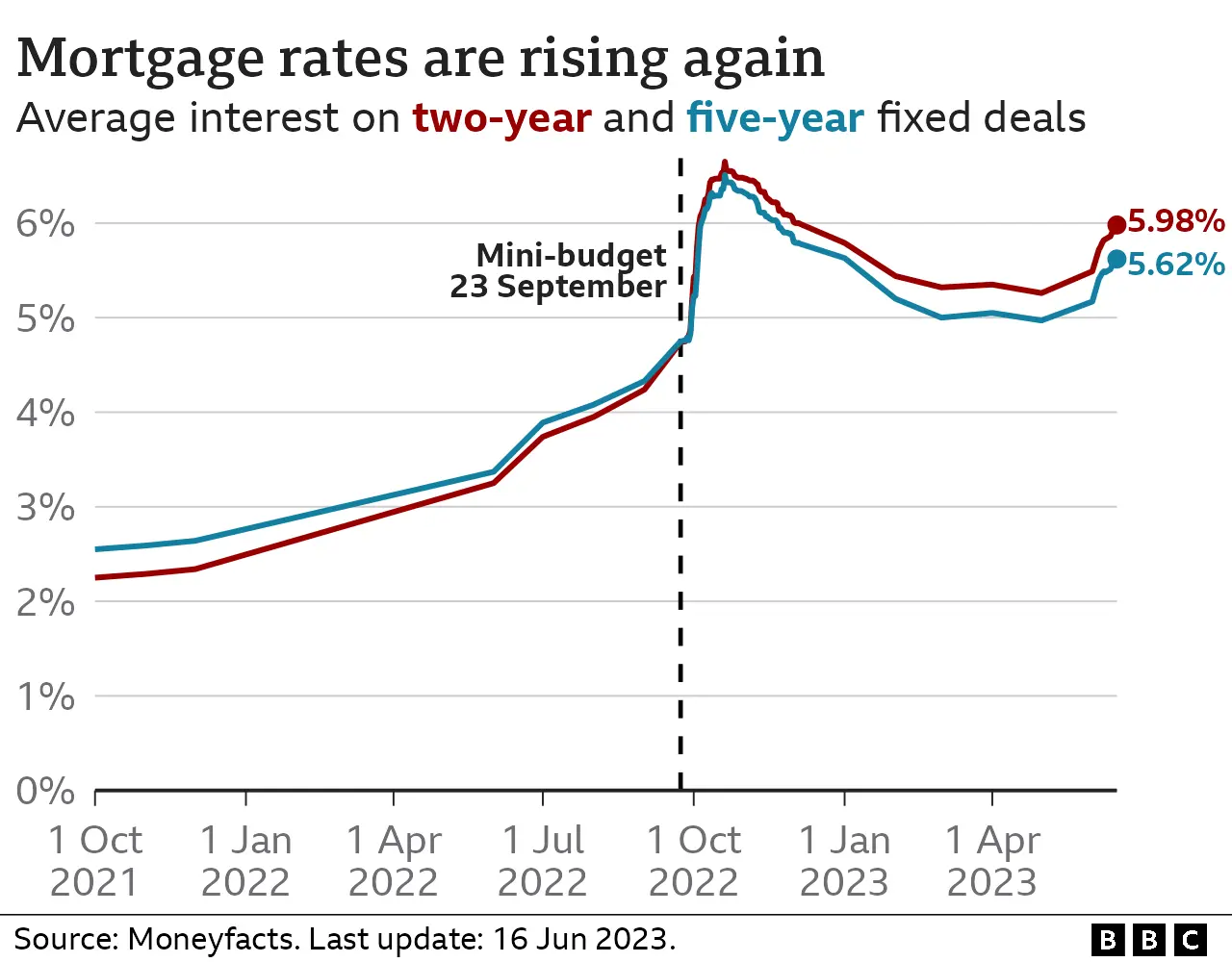

Getty ImagesThe average interest rate on new two-year fixed mortgage is likely to breach 6% in the coming days as lenders grapple with upheaval in the sector.

The typical rate rose to 5.98% on Friday, according to financial information service Moneyfacts, as more mortgage providers increased the cost of their home loans.

They included two of the UK's biggest lenders, Nationwide and NatWest,

It was NatWest's second increase in a week, echoing a similar move by HSBC.

Brokers have described a vicious circle of lenders putting up rates at short-notice, then borrowers grabbing deals, leaving lenders inundated and having to pull or raise rates again.

"It is massively hard to navigate for everyone, especially clients, who need to make quick decisions in these circumstances, whilst brokers are working round the clock to try to lock in to these rates," said Andrew Montlake of Coreco mortgage brokers.

The typical two-year fixed-rate mortgage had a rate of 5.92% on Thursday, but jumped on Friday. This still leaves it short of the peak of 6.65% in October last year, following the mini-budget during Liz Truss's premiership.

A typical five-year fixed rate is now at 5.62% compared with last year's peak of 6.51%, according to Moneyfacts.

Rates have risen consistently and - at times - sharply in the past few weeks, and commentators say there could be more increases to come. Much depends on official inflation data being published next Wednesday.

Previous figures on wages and rising prices mean markets anticipate that inflation and interest rates will stay higher for longer in the UK than previously expected, which has been reflected in the funding cost of mortgages.

How are interest rate rises affecting you? Get in touch.

- Email [email protected]

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload your pictures or video

- Please read our terms & conditions and privacy policy

First-time buyers hit

Other lenders to make changes in the past 24 hours include Clydesdale Bank, which pulled a number of deals. Coventry Building Society also said it would be re-pricing its deals on Tuesday next week.

On Friday, the rate for Skipton's new deposit-free mortgage aimed at first-time buyers went up from 5.49% to 5.89% for new customers.

The Track Record mortgage was launched recently, with some fanfare, aimed at people who are renting.

"The increased rate reflects the recent changes within the mortgage market, we have re-priced the product fairly to ensure it remains on the market at a competitive rate," said Charlotte Harrison, chief executive of home financing at Skipton Building Society.

"As a responsible lender, we need to be sensible with our approach to market with this product to ensure tenants don't take on more than they can realistically afford."

Many first-time buyers might find mortgages harder to access at higher rates, despite house prices falling.

What happens if I miss a mortgage payment?

- A shortfall equivalent to two or more months' repayments means you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

- Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future