Why is the UK economy lagging behind the US, Germany and others?

Getty Images

Getty ImagesThe UK economy is struggling - and people are feeling it in their pockets, as wages fail to keep up with rising prices.

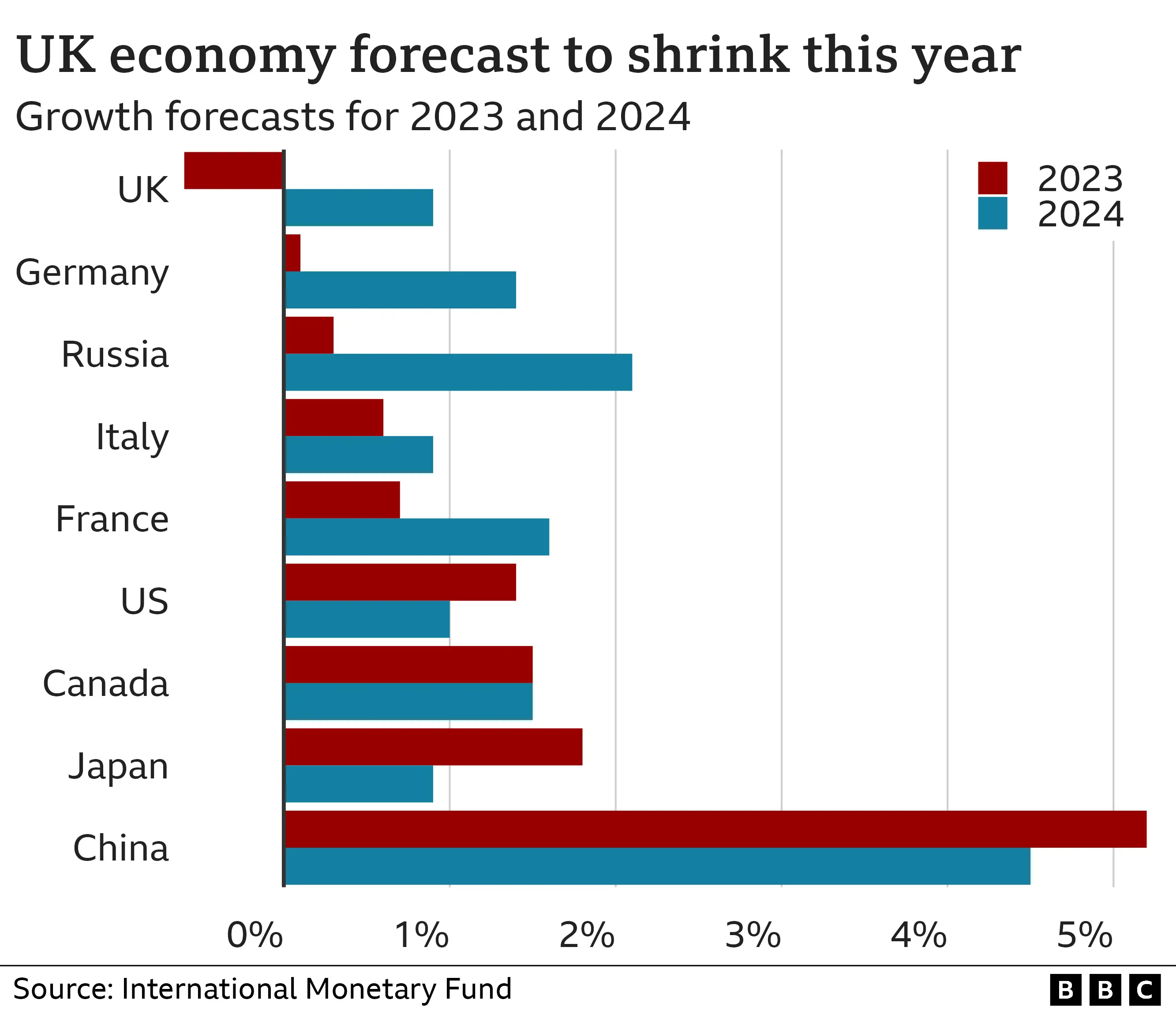

The International Monetary Fund (IMF) predicts the UK economy will shrink this year while every other major economy will grow.

The Bank of England also forecasts a recession in the UK in 2023 - albeit one that is shorter and less severe than previously forecast.

Perhaps it's not surprising the outlook is bleak given the pandemic, the war in Ukraine, and soaring costs of both energy and food.

But why is the UK seemingly faring worse than other rich countries such as the US, Germany and France?

Is the UK really lagging behind?

Forecasts are never perfect. There are so many factors that affect economic growth - from geopolitics to the weather - that, inevitably, predictions often miss the mark. But they can point in the right direction.

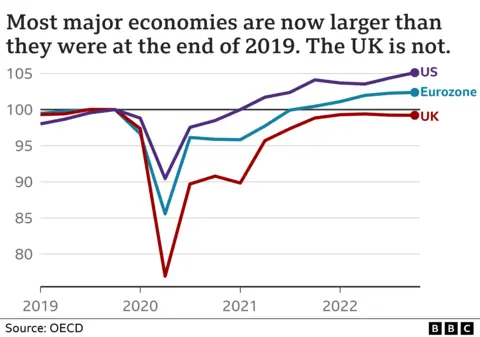

And the existing evidence shows other countries have taken less of a hit from the huge challenges of recent years than the UK has.

Figures from the Organisation of Economic Cooperation and Development (OECD), which looks at how rich countries are performing, show the UK economy fell further than others in the first months of the pandemic.

The UK's pace of recovery was fast once the economy reopened - but not fast enough to make up the lost ground.

But the difference between the UK and others may not be quite as big as it appears.

That's because most countries measure the output of their public services, such as health and education, based on the costs - a nurse's wage, for example. In the UK they are accounted for differently, by valuing the services delivered - such as operations in hospital.

As a result, the UK's figures better reflect the impact of closed schools and cancelled operations during Covid, as well as disruption due to strikes.

The bigger picture, however, remains: the Bank of England and the IMF both expect the UK economy to shrink this year, while other G7 countries are expected to grow.

Some observers, including pro-Brexit economist Julian Jessop, believe the IMF was overly gloomy about the UK's prospects and that the differences under discussion - a percentage point here or there - are small.

Nevertheless, he says, there is still definitely "something to explain" about the UK's flagging economic performance.

Is it all down to Brexit?

Estimates about the cost of Brexit vary - according to a report by Bloomberg it is costing the UK economy roughly £100bn a year, and the economy is 4% smaller than it might have been if the UK had stayed in the EU.

"The EU is a very rich part of the world," says Carl Emmerson, deputy director of the Institute for Fiscal Studies, an independent think tank. "And we've chosen, for better or worse, to make trade with that grouping of countries a lot more difficult, so it's clearly going to be something that makes it harder for the UK economy to grow."

Business investment has stagnated since the referendum vote in 2016 too, he says - another "drag on growth". A Bank of England policymaker has said that Brexit hit UK investment to the tune of £29bn.

EU workers used to come freely to work in the UK but can no longer do so, making it hard for the hospitality, agriculture, and care sectors to find enough staff.

Julian Jessop is a fellow at the free market think tank the Institute of Economic Affairs and describes himself as a "Brexit optimist". He believes there are big potential gains from leaving the EU, but agrees there have been short-term economic costs.

"We're still in a sort of transition phase, where the negatives are dominating," he says.

But he says those negatives are "smaller than people have been arguing" and "more likely to be temporary, because a lot of them have to do with uncertainty and the process of adjustment".

What else is affecting the economy?

Energy costs

Russia's invasion of Ukraine sent global energy prices soaring - but the impact varies between countries.

The US has its own domestic sources of fossil fuels and some European countries have more alternative sources of energy, Mr Emmerson says. France, for example, has a large nuclear network, and Norway has significant hydropower.

"Britain is pretty exposed," he says.

Moreover, the way the UK prices electricity is based on the cost of gas, the most expensive form of electricity generation. That has pushed up bills across the economy and made inflation worse, Mr Jessop says.

Workforce shortages

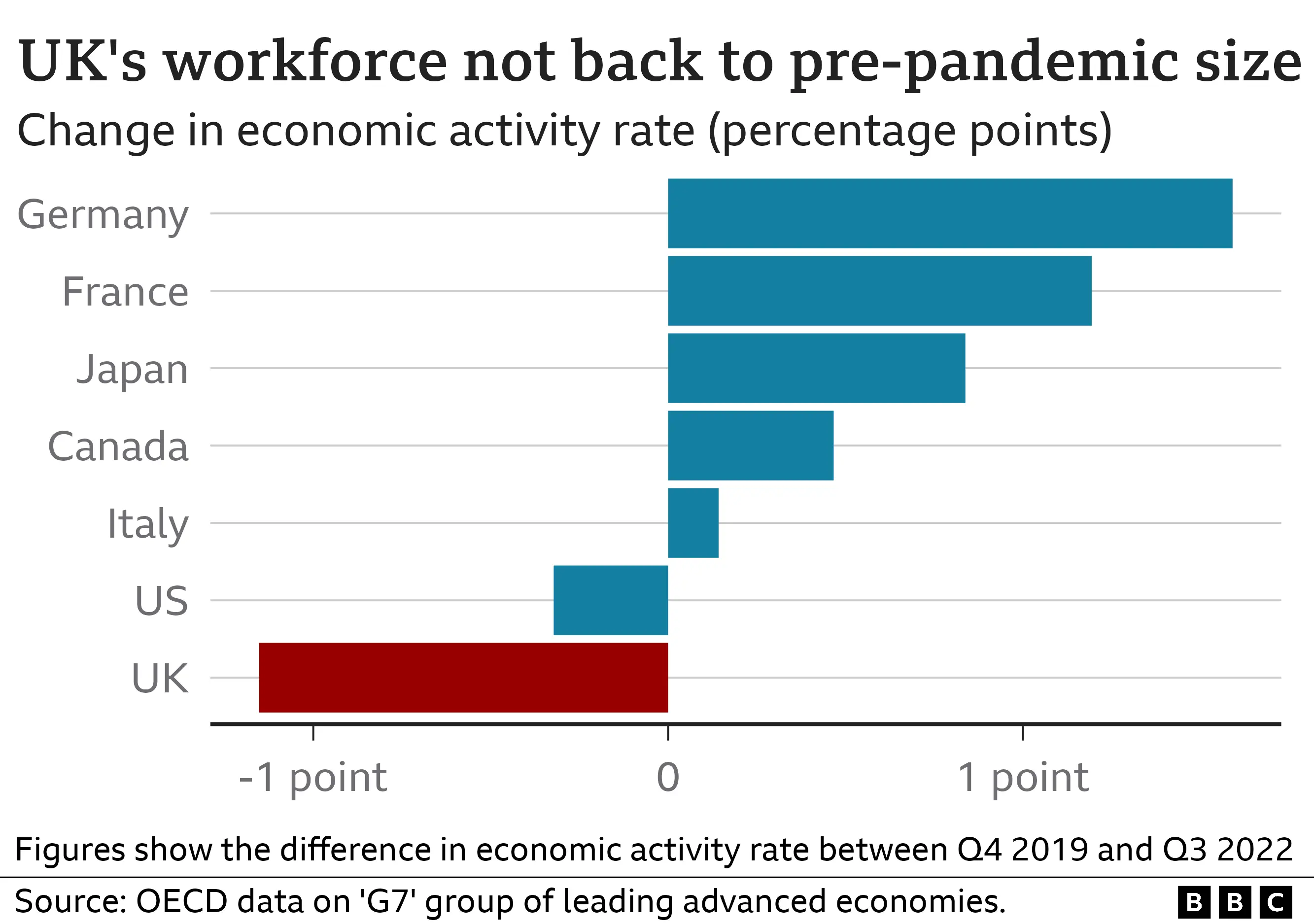

Most economies saw their workforce shrink during the pandemic.

But again, the UK is an outlier, with numbers failing to bounce back after the crisis.

Economists are still trying to work out why. It seems it is not just down to having fewer EU workers.

Young people have opted to study rather than work, older people have retired early, and more people are receiving long-term sickness benefits.

There are signs the workforce is starting to grow again, which could help boost growth and tax revenues later this year.

Long-term problems

There are also more fundamental reasons behind the UK's weaker performance, suggests Cambridge University economist Diane Coyle.

While the economy has slowed since the financial crisis in 2008, the roots of the problems go back much further, she argues, with investment in decline since the 1990s.

That left the economy lacking the resilience to cope with the triple shocks of Covid, Brexit and the war in Ukraine.

"That's down to the long-term weaknesses, long-term under investment, in the private and the public sector, [and] degradation of public services and infrastructure, which are just essential if the economy is going to grow," she says.

For its part, the government says the UK economy is resilient.

Responding to figures showing that the UK narrowly avoided a recession in 2022, Chancellor Jeremy Hunt said the numbers showed "underlying resilience" - but added the country was "not out of the woods".