UK inflation: Price rises slow but remain close to 40-year high

Getty Images

Getty ImagesPrices for olive oil, sugar and low-fat milk have surged with food costs continuing to fuel inflation in the UK.

Food inflation is at a 45-year high, with a supermarket boss warning that grocery prices will remain elevated this year.

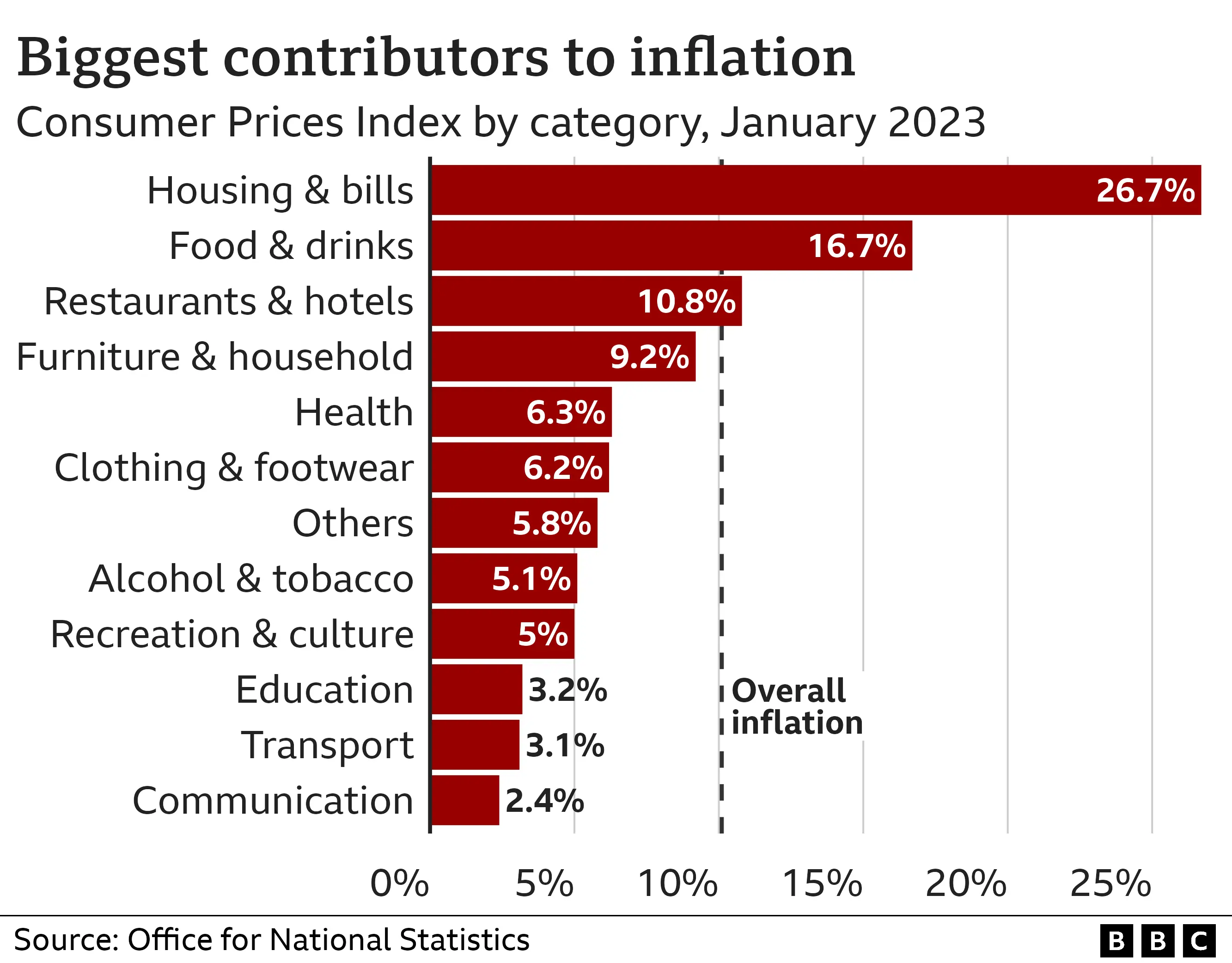

Overall UK price inflation fell for the third month in a row to 10.1% in the year to January from 10.5% in December.

The biggest factors in the rate slowing were decreases in fuel prices and the cost of dining out.

To calculate inflation, which measures the increase in the price of something over time, the Office for National Statistics (ONS) keeps track of the prices of hundreds of everyday items.

If it falls, it does not mean the prices of goods are going down, it just means prices are rising more slowly.

Many analysts believe inflation will continue to fall, although it is still currently five times the Bank of England's target of 2%.

Grocery prices are one of the main drivers fuelling overall inflation, and were up 16.7% on the year to January.

Olive oil, sugar and low-fat milk prices have all increased by more than 40% in that time.

Matt Hood, managing director of Co-op Food, which has more than 2,500 UK stores, said prices continued to rise in January as costs for grocers did, making it "incredibly tough".

"Inflation is the thing that keeps us up at night," he told the BBC's Today programme.

"Believe it or not we as retailers are trying our hardest not to flow it all through to our customers."

Heatwaves hit olive oil production

Both food and energy bills have been rising following Russia's invasion of Ukraine almost a year ago, with supplies of both commodities being disrupted.

But in the case of olive oil, prices have been higher in recent months largely due to summer heatwaves hitting crops in Spain, a huge exporter of the product.

Kyle Holland, oils analyst at data firm Mintec, said production in Spain was down to 720,000 metric tonnes, from the usual 1.5 million.

"When there is not enough rain, [olive trees] cannot produce any olives. A lot of trees have not produced enough. It's a very steep decline," he said.

Inflation rose steeply last year. Before that, the last time it was over 10% was in February 1982.

And wages are not keeping up.

Pay, excluding bonuses, increased at an annual pace of 6.7% between October and December 2022. And when adjusted for inflation, regular pay fell by 2.5%.

Kelly Hill, a hairdressing apprentice in Stafford, moved back in with her parents to save money to buy her own home.

The 31-year-old said bills and the price of everything had gone up, and her mum and dad were feeling the pinch too.

"When they've gone food shopping they've noticed how much prices have just absolutely gone right through the roof."

She said her mum used to shop at Tesco but has been getting some things from Aldi.

"So as a family we're looking at what we can cut back on food wise."

Grant Fitzner, chief economist for the ONS, said there were signs costs facing businesses were "rising more slowly", but warned "business prices remain high overall".

He said air and coach travel prices had dropped back after December's "steep rise".

"Petrol prices continue to fall and there was a dip in restaurant, cafe and takeaway prices," he added.

But the falls in those prices were offset by rising prices of alcohol and tobacco.

Chancellor Jeremy Hunt also warned the "fight is far from over" on rising prices and said it was why the government "must stick to the plan to halve inflation this year, reduce debt and grow the economy".

Although the government has pledged to halve inflation, many economists have predicted it will happen naturally, as the cost of energy falls.

Shadow chancellor Rachel Reeves said families would feel no better off following 13 years of Conservative government and repeated Labour's call for higher taxes on oil and gas companies to ease bills when energy prices go up in April.

The biggest factor driving down inflation is petrol - now only 2p a litre more than it cost before Russia invaded Ukraine.

It's because inflation compares prices last month with a year before that the rate of inflation is almost certain to slow further in the coming months.

Fuel prices were already rising this time last year, but it was the war that blasted the price of petrol and wholesale gas into the stratosphere.

Two months from now we'll be comparing prices in March 2023 with March 2022, after the fuel price had jumped, and therefore the difference - the rate of inflation - will be smaller. That will happen regardless of what the government or the Bank of England does.

Crucially, the Bank of England's big anxiety, that global inflationary pressure is becoming embedded domestically, will have been soothed. That undermines the argument for raising interest rates faster.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the fall in inflation gave the Bank of England the flexibility to keep its interest rate at 4%, rather than increase it again.

The Bank raised rates for the tenth time in a row at the start of the month in a bid to curb rising prices.

Raising interest rates is seen as a way to control inflation by making it more expensive to borrow money and thus encouraging people to borrow less and spend less, and save more.

But it is a balancing act as the Bank does not want to slow the economy too much with predictions that the UK could enter a recession - a period of economic decline - this year.