Adani calls off share sale after price plunges

BBC

BBCIndia's Adani Enterprises has called off its share sale after the share price plunged on Wednesday.

The Adani Group's flagship company confirmed the $2.5bn (£2bn) raised from the sale would be returned to investors after shares fell 26%.

The group's companies have seen more than $90bn wiped off their value since a US investment firm made fraud claims. Adani denies the allegations.

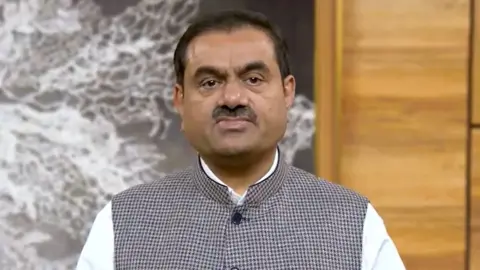

Gautam Adani, the founder, has fallen out of the top 10 richest in the world.

According to the Forbes real-time billionaires list, Mr Adani is now the 15th-richest person in the world, with a net worth of $74.7bn. He was third on the list last week.

The billionaire runs Adani Group, one of India's biggest companies. The flagship company Adani Enterprises has operations in a wide range of industries including commodities trading, airports, utilities and renewable energy.

Last week, Hindenburg Research, a company that specialises in "short-selling", or betting against a company's share price in the expectation that it will fall, released a report that accused Mr Adani of "pulling the largest con in corporate history".

It also alleged the Adani Group had engaged in decades of "brazen" stock manipulation and accounting fraud, and claimed its companies had "substantial debt" which put the entire group on a "precarious financial footing".

The group has dismissed the allegations as malicious and untrue, calling them an "attack on India".

The report came days ahead of a planned sale of Adani shares to the public, and on Tuesday, the $2.5bn share sale in the group's flagship company managed to scrape through to be fully subscribed despite the controversy.

But shares plunged 26.7% on Wednesday, taking the total fall in market value for the group over $90bn, according to Bloomberg.

After the market closed, Adani Group said the company would return the share sale proceeds due to "the unprecedented situation and the current market volatility".

"Given these extraordinary circumstances, the Company's board felt that going ahead with the issue would not be morally correct," said Mr Adani.

"The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO (follow-on public offer)."

Mr Adani said the company's balance sheet was "very healthy with strong cashflows and secure assets"

"We have an impeccable track record of servicing our debt," he added. "This decision will not have any impact on our existing operations and future plans."

Adani Group has hit back at the allegations against it and said it was evaluating "remedial and punitive action" against Hindenburg Research in the US and India.

It said it had always been "in compliance with all laws".

In an interview with Mint newspaper, the group's chief financial officer compared Hindenburg Research to General Dyer, the British officer of the Bengal Army responsible for a massacre that killed hundreds of Indians in the city of Amritsar in 1919.

Hindenburg responded saying the group was stoking a nationalist narrative to obfuscate the fraud allegations.