Five-year mortgage rates back below 6%

Getty Images

Getty ImagesThe squeeze on people renewing or trying to get new mortgages has eased slightly, according to new data.

The average five-year fixed mortgage rate fell below 6% for the first time in seven weeks on Tuesday, and remained there on Wednesday, the financial information service Moneyfacts said.

Mortgage rates spiked after the government's mini-Budget in September, driving up costs for borrowers.

Rates have stabilised since the Autumn Statement last week, experts say.

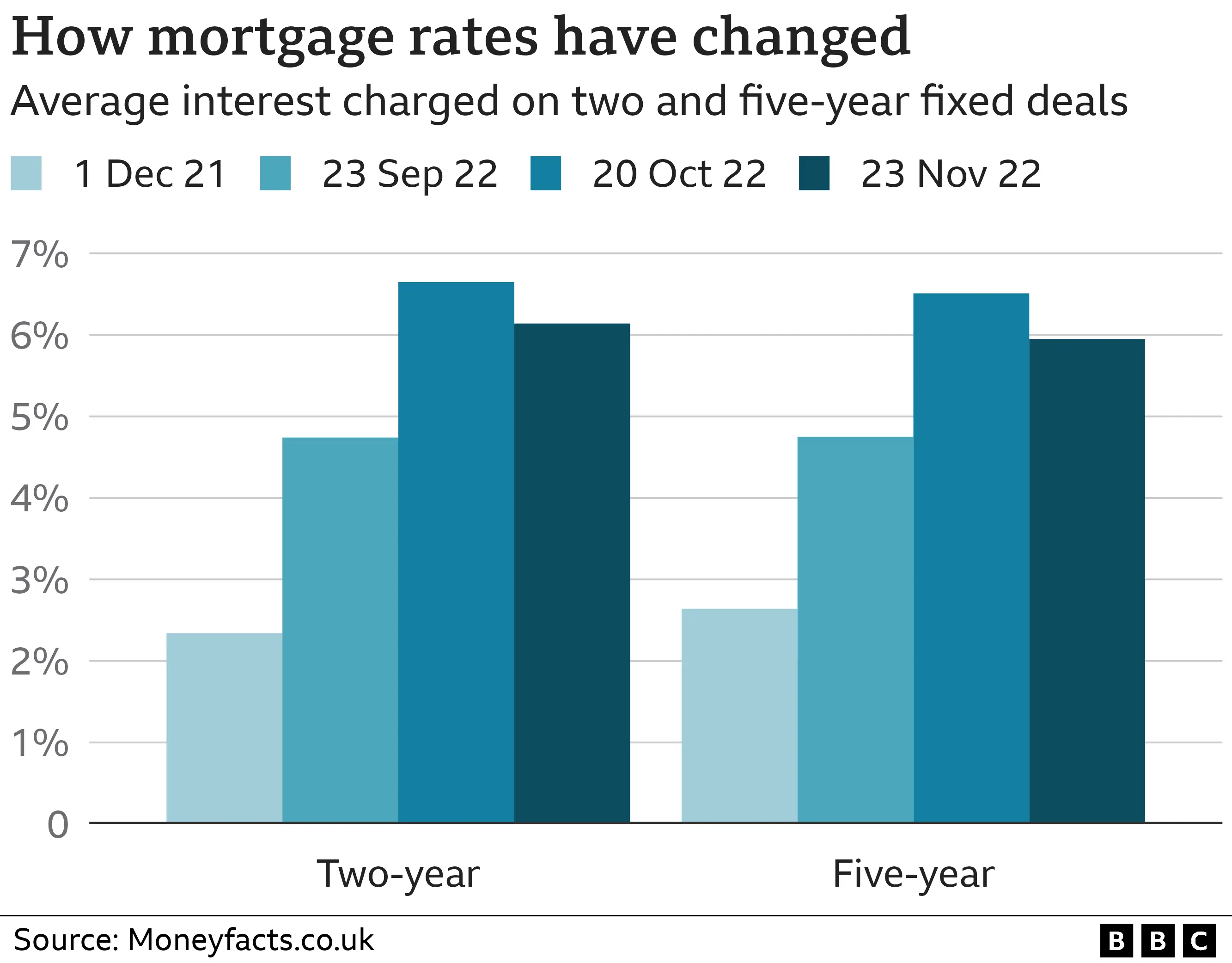

Average five-year mortgage rates hit 5.95% on Tuesday, and remained at the same rate on Wednesday, Moneyfacts said. This is down from a high of 6.51% on 20 October.

The rates on two-year mortgages, which are more common, have also been falling gradually, from 6.65% on 20 October to 6.14%.

Rachel Springall, a finance expert at Moneyfacts, said: "Borrowers who paused their home ownership plans, or indeed parked the idea of refinancing, may now be tempted to scrutinise the latest deals on offer.

"However, it is worth noting that rates could fall further still, but there is no clear answer as to how quickly that may be."

Despite the fall, rates are still high compared with this time last year, when they were closer to 2.5%.

At least 100,000 people per month are coming to the end of their current mortgage deal, and face steep rises in monthly repayments.

Rates have climbed throughout this year, as the Bank of England put up interest rates to fight inflation, but they rocketed upwards following the mini-Budget.

Former chancellor Kwasi Kwarteng promised major tax cuts without saying how he'd pay for them, sparking turmoil on financial markets.

UK borrowing costs spiked, having a direct impact on the mortgage market, where thousands of products were suspended due to uncertainty about how to price those loans.

The number of deals available has mainly recovered but it is still much lower than it was last year.

Jeremy Cox, head of strategy at Coventry Building Society, told the BBC the Autumn Statement had helped to bring down mortgage rates by giving markets "greater confidence in the fiscal outlook for the UK".

New Chancellor Jeremy Hunt has reversed most of Mr Kwasi's plans while promising £55bn in tax rises and spending cuts designed to get the economy back on track.

Mr Cox said the pace of the rise in the cost of living was "still very high" in the UK, but US inflation was starting to fall, "and that will hopefully mean that [UK] interest rates will not have to keep on rising at the pace they have been".

Try our calculator below to see how your mortgage might be affected by rising rates.