What the Autumn Statement means for you and the cost of living

Getty Images

Getty ImagesWith the cost of living rising at its fastest rate for 41 years, this is going to be a tough winter for many people.

Chancellor Jeremy Hunt has outlined plans designed to tackle rising prices and restore the UK's credibility with international markets.

It will mean further pain for many, but the chancellor argues that the most vulnerable in society are being protected. Here are some of the ways the Autumn Statement will affect you.

Expect to pay more in tax

You start to pay income tax on annual earnings of more than £12,570, charged at 20%. You then pay tax of 40% on earnings over £50,270 a year, although the bands are different in Scotland.

These bands - or tax thresholds - had already been frozen until 2026, rather than going up in line with prices as you might normally expect.

The chancellor has now extended that freeze for a further two years. That means any kind of pay rise could drag you into a higher tax bracket. Even if it does not, it will almost certainly mean a greater proportion of your income is taxed.

The highest rate of income tax - which is 45% currently on earnings above £150,000 - will be paid on earnings of more than £125,140 from April instead, the chancellor has announced. That means the highest paid could pay hundreds of pounds more a year in income tax.

The Spring Statement of March and September's mini-budget both included plans to cut the basic rate of income tax. Unsurprisingly, there were no such promises this time.

The threshold at which people start to pay inheritance tax will also be frozen, and the dividend allowance (the amount you can receive each year in dividends, if you own shares, before paying tax) will be cut from £2,000 to £1,000 next year and then to £500 from April 2024. The allowance stood at £5,000 as recently as 2018.

The annual allowance before capital gains tax is paid will also be reduced from £12,300 to £6,000 in April and then to £3,000 a year later. This tax is paid when you sell an asset, such as company shares or a second home.

Price rises to continue but not as fast

Strains over the cost of living have centred on rising prices. The rate at which prices rise is measured by inflation, currently at 11.1%, which means that a typical item that cost £100 a year ago will cost £111.10 today.

The good news from the government's independent forecasters - the Office for Budget Responsibility (OBR) - is that the inflation rate will drop to 7.4% next year. The target set for inflation is 2%.

However, a fall in the inflation rate does not mean that prices in the shops will be going down. It just means that they will be going up more slowly than now.

The OBR said soaring inflation would still hit households' real disposable income - a measure of living standards - by the largest amount since official records began in 1956-57, falling by 4.3% in the year to April.

Even so, the OBR forecast that inflation may turn negative, in other words prices may fall by late 2024.

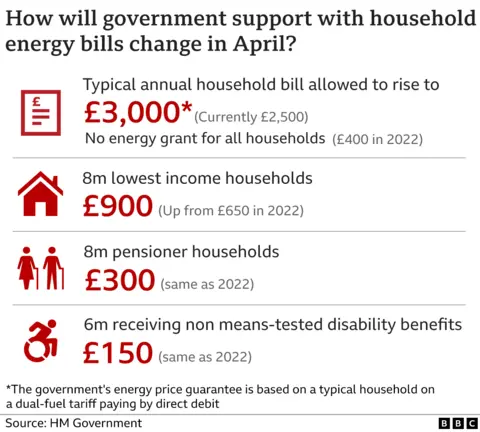

Support with energy bills

At present, there is a government cap on domestic energy bills, known as the Energy Price Guarantee. It limits the price per unit of energy used, not the total bill. It means that since October, the household using a typical amount of gas and electricity pays £2,500 a year.

That cap was due to expire in April, leaving the prospect of the typical annual bill going up to £3,700, according to analysts at consultancy Cornwall Insight.

Mr Hunt said that this cap would be extended for a further 12 months, but would be less generous than now - so the typical household pays £3,000 a year. Mr Hunt predicted that would save the typical household £500 in a year.

The government is also pumping more money into energy efficiency schemes.

Cost-of-living payments revamped

A host of cost-of-living payments have been made during the latter half of this year, including a £400 discount off everyone's energy bills this winter. Others were directed at those on lower-incomes on benefits, the elderly, and people with disabilities.

While the universal payment will end, there will be more targeted support next year. That will amount to £900 to households on means-tested benefits, £300 to pensioner households, and £150 for those on disability benefits.

Those using heating oil will receive a payment of £200 this winter, rather than £100 as previously planned.

State pension rise in April

Under the "triple lock", the state pension is supposed to increase each year in line with the highest of inflation (as measured by the Consumer Prices Index in September), the average increase in wages across the UK, or 2.5%.

After months of uncertainty, the chancellor confirmed that the state pension would go up by 10.1%, to match inflation.

That will see the "new" state pension, currently worth £185.15 a week, go up to £203.85. The basic state pension, for those who reached state pension age before April 2016, is currently £141.85 a week, and will go up to £156.20. That can be topped up for those on low incomes with pension credit, which will also go up by 10.1%.

The government's review on the age at which the state pension is received, currently 66 and going up to 67, will be published early next year.

Benefits to go up too

Some disability benefits - such as the personal independence payment - must rise, by law, in line with inflation each year. That happens in April, based on the previous September's inflation figure - which this time is 10.1%.

However, rises in most means-tested benefits - most significantly universal credit, which is received by about six million people - and tax credits are a decision for ministers.

The chancellor said these too would go up by 10.1%, which he said would mean a family on universal credit would benefit next year by around £600.

Mr Hunt said the government will cap the increase in social rents in England at a maximum of 7% in 2023-24, rather than the 11% potential rise under previous rules.

Pay is rising - but expect disputes

The minimum pay rate for those aged 23 and above - the National Living Wage - is £9.50 an hour. This will rise to £10.42 in April - a move that affects about two million people. It is employers who must shoulder this cost.

Getty Images

Getty ImagesMinisters will have to scrutinise the recommendations for public sector pay rises, such as salary increases for teachers, nurses and the armed forces. Widespread, ongoing disputes are expected.

Council tax bills in England could rise

At present, councils in England must hold a referendum if they want to increase council tax by more than 3%, but the chancellor said he would raise this to 5%.

The OBR said that could see the average Band D council tax bill rise by £250 a year by 2027-28.

New deadline for stamp duty cut

In September, the government said a cut in stamp duty tax in England and Northern Ireland for some house buyers would be permanent.

The price at which stamp duty is paid was doubled from £125,000 to £250,000 (£425,000 for first time buyers) and discounted stamp duty for first-time buyers applied to properties up to £625,000, rather than £500,000.

The chancellor has now introduced a deadline, which will see these cuts reversed at the end of March 2025.

A 'Tesla tax' for electric car drivers

The chancellor has announced electric vehicles will no longer be exempt from Vehicle Excise Duty from April 2025.

Currently there are different rates depending on the type of vehicle but electric vehicles are exempt.

How does the Autumn Statement affect you? Share your experiences by emailing [email protected].

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.