Autumn Statement 2022: Key points at-a-glance

Jessica Taylor/UK Parliament

Jessica Taylor/UK ParliamentChancellor Jeremy Hunt has unveiled the contents of his Autumn Statement in the House of Commons.

He has revealed tax rises and spending cuts worth billions of pounds aimed at mending the nation's finances.

Here is a summary of the main measures.

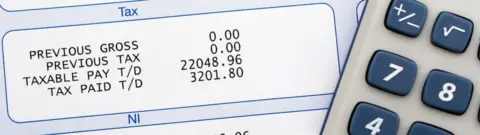

Taxation and wages

Getty Images

Getty Images- Legally-enforceable minimum wage for people aged over 23 to increase from £9.50 to £10.42 an hour from next April

- State pension payments and means-tested and disability benefits to increase by 10.1%, in line with inflation

- Apart from in Scotland, top 45% additional rate of income tax will be paid on earnings over £125,140, instead of £150,000

- Income tax personal allowance and higher rate thresholds frozen for further two years, until April 2028

- Main National Insurance and inheritance tax thresholds also frozen for further two years, until April 2028

- Tax-free allowances for dividend and capital gains tax also due to be cut next year and in 2024

- Local councils in England will be able to hike council tax up to 5% a year without a local vote, instead of 3% currently

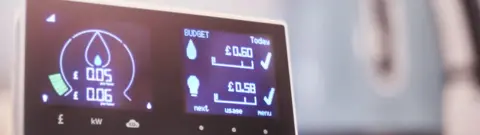

Energy

Getty Images

Getty Images- Household energy price cap extended for one year beyond April but made less generous, with typical bills capped at £3,000 a year instead of £2,500

- Households on means-tested benefits will get £900 support payments next year

- £300 payments to pensioner households, and £150 for individuals on disability benefit

- Windfall tax on profits of oil and gas firms increased from 25% to 35% and extended until March 2028

- New 45% tax on companies that generate electricity, to apply from January

Economy and public finances

Getty Images

Getty Images- The Office for Budget Responsibility judges UK to be in recession, meaning the economy has slowed for two quarters in a row

- It predicts growth for this year overall of 4.2%, but size of the economy will shrink by 1.4% in 2023

- Growth of 1.3%, 2.6%, and 2.7% predicted for 2024, 2025 and 2026

- UK's inflation rate predicted to be 9.1% this year and 7.4% next year

- Unemployment expected to rise from 3.6% to 4.9% in 2024

- Government will give itself five years to hit debt and spending targets, instead of three years currently

Government spending

PA Media

PA Media- Scheduled public spending will be maintained until 2025, but then grow more slowly than previously expected

- In England, NHS budget will increase by £3.3bn a year for the next two years, and spending on schools by £2.3bn

- It will mean larger payments to devolved governments in Scotland, Wales and Northern Ireland

- Defence spending to be maintained at 2% of national income - a Nato target

- Overseas aid spending kept at 0.5% for the next five years, below the official 0.7% target

Business and infrastructure

Getty Images

Getty Images- Support worth £13.6bn over next five years to help firms with business rates, including a mixture of freezes and reliefs

- Import taxes removed on more than 100 goods, including some food products, for two years to reduce costs

- Plans for a possible online sales tax scrapped - the government argues online retailers' warehouses will be hit harder than shops through business rate changes

- Chief Scientific Adviser Sir Patrick Vallance to lead review into how post-Brexit regulation can support emerging technologies

Other measures

- Lifetime cap on social care costs in England due in October 2023 delayed by two years

- Social housing rent increases in England capped at 7% from next April - instead of 11% due to inflation

- Electric cars, vans and motorcycles to pay road taxes from April 2025

- Suffolk will get an elected mayor - with mayors for Cornwall, Norfolk and an area in north-east England to follow