Meta: Shares in Facebook owner dive 20% as investors lose faith

Reuters

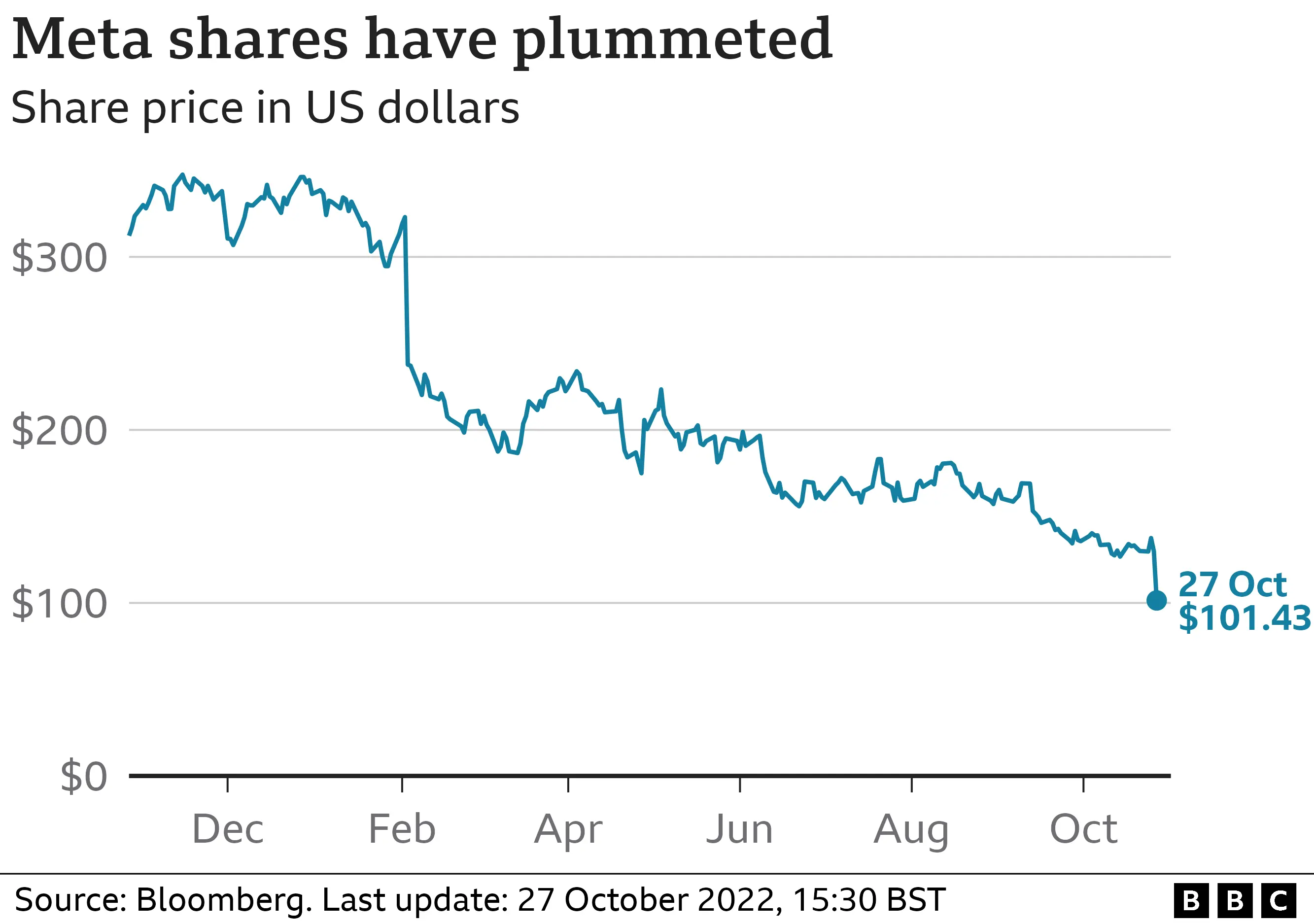

ReutersShares in Meta, which owns Facebook and Instagram, have plunged more than 20% after a downbeat set of results from the tech giant.

It comes as investor doubts about Mark Zuckerberg's vision for the future grow, and revenues and profits decline.

Meta's sales shrank by 4% in the three months ending in September to $27.7bn (£24bn), while profits halved.

The fall in shares is set to wipe $78bn off the firm's market value if the losses hold until the end of Thursday.

What's gone wrong?

A year ago, Mark Zuckerberg declared virtual reality the next frontier to drive Facebook's growth. But so far, there has been very little of it.

The company, which also owns WhatsApp, is struggling as companies cut advertising budgets in the face of economic uncertainty, changes to Apple's privacy settings hurt its targeted ads, and competition from rivals such as TikTok heats up.

Mr Zuckerberg, who founded Facebook at university almost two decades ago, acknowledged the firm faced "near-term challenges".

He said the company was focused on becoming more efficient and hinted at job cuts, saying the firm may be a "smaller organisation" next year.

But on a conference call stacked with sceptical analysts, he also maintained that the company was on the right path, as it invests in ways to keep people on its apps and stakes a claim in the emerging world of virtual reality, also known as the metaverse.

"There are a lot of things going on right now in the business and in the world," he said. "We're going to resolve each of these things... I think those who are patient and invest with us will end up being rewarded."

Investor confidence plunged in February, when the company revealed it had lost daily users for the first time ever. Then in July, the company reported its first quarterly decline in revenue, as companies spooked by the economic outlook cut their advertising budgets.

Prior to the firm's update, the value of Meta's shares had fallen 60% since the start of the year, wiping hundreds of billions off the company's value.

They slid further on Thursday, after executives warned that recovery would take an improvement in the wider economy.

Analyst Debra Aho Williamson of Insider Intelligence said the company was on "shaky legs when it comes to the current state of its business".

"Mark Zuckerberg's decision to focus his company on the future promise of the metaverse took his attention away from the unfortunate realities of today: Meta is under incredible pressure," she said.

Meta continues to generate large profits - nearly $4.4bn in the three months ended in September - and it has also fended off a decline in users.

The company said 2.93 billion people were active on one of its platforms daily in the three months ended in September, up from 2.88 billion in the quarter before.

Although the core Facebook platform is not adding users in the US or Europe, it continues to grow in other parts of the world.

Despite its strengths, many investors fear the company has lost its way.

Getty Images

Getty Images"Meta has drifted into the land of excess — too many people, too many ideas, too little urgency. This lack of focus and fitness is obscured when growth is easy but deadly when growth slows and technology changes," investor Brad Gerstner, chief executive at Altimeter Capital, told the firm in an open letter this week, which called on the company to cut staff and scale back its investments in artificial intelligence and virtual reality, also known as the metaverse.

Facebook's expenses have ramped up in recent years, as it faced questions about how it was handling the spread of misinformation on its platform and protecting user privacy.

The company said it was "making significant changes across the board to operate more efficiently" and planned to hold headcount flat over the next year.

That would be a major shift after payrolls surged from about 17,000 at the end of 2016 to more than 87,000, rising 28% just in the last year.

But it warned that losses in its Reality Labs unit, which works on virtual reality and has seen revenues drop significantly, were likely to grow.

Mr Zuckerberg said he remains committed to the project, despite the doubters.

"I get that a lot of people might disagree with this investment but from what I can tell I think this is going to be a very important thing," he said.