Recession risk rises as economy unexpectedly shrinks

Getty Images

Getty ImagesThe UK economy unexpectedly shrank in August, strengthening predictions that it will fall into a recession.

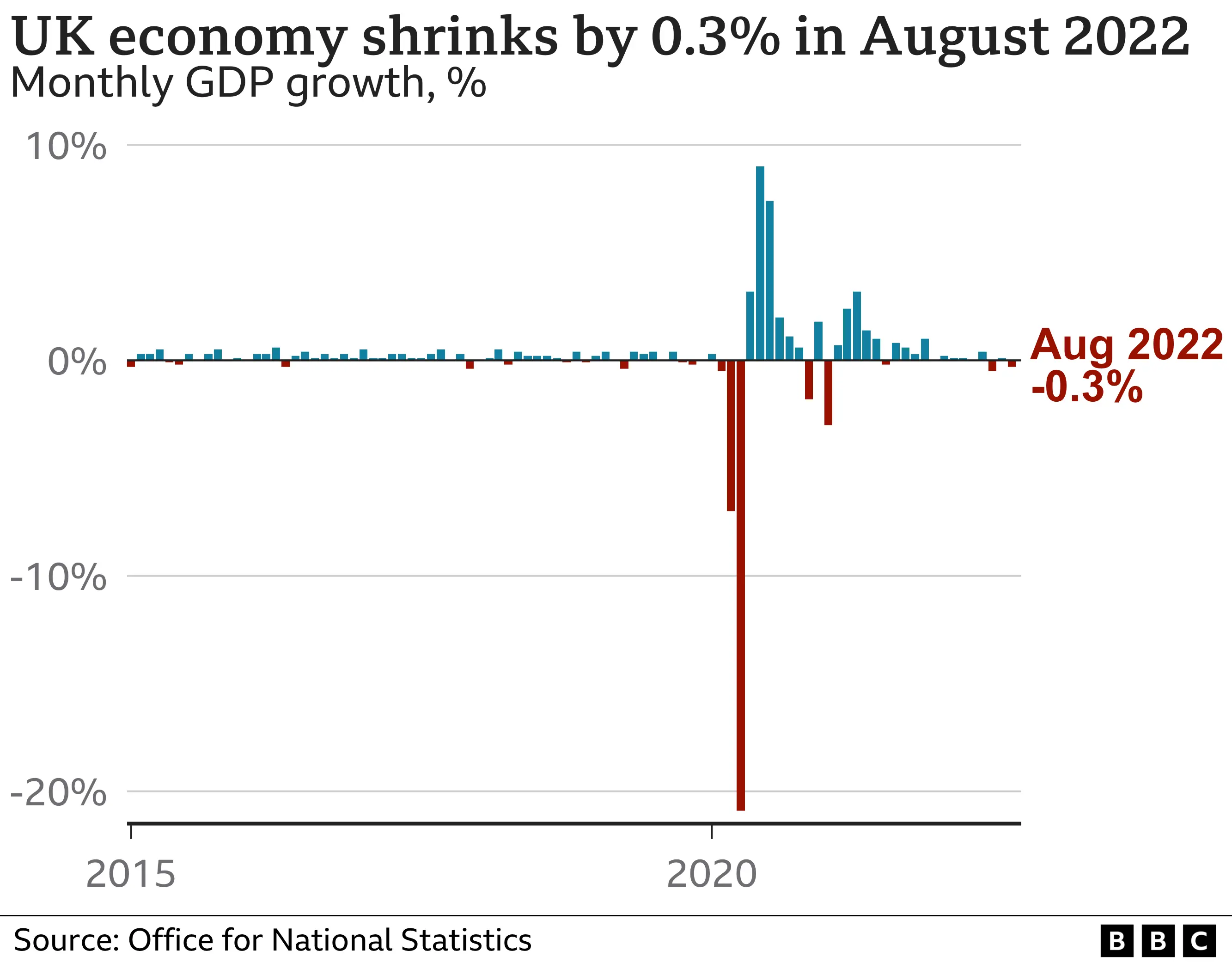

The surprise 0.3% drop came as factories and consumer-facing businesses struggled, according to official figures.

Analysts thought the economy would stall in August but not shrink as costs mount for businesses and households.

Prices are rising at their fastest rate for 40 years, eating into people's budgets, and outpacing growth in pay.

In normal times, a country's economy grows and on average, people become slightly richer as the value of the goods and services it produces - its Gross Domestic Product (GDP) - increases.

But sometimes their value falls, and a recession is usually defined as when this happens for two three-month periods - or quarters - in a row, and it marks a sign the economy is performing badly.

The Bank of England has previously said that it expects the UK to fall into a recession by the end of the year.

The latest data from the Office for National Statistics (ONS) means that in the three months to August, GDP also fell by 0.3%.

The drop in the monthly figure for August was driven by a sharp decline in manufacturing and maintenance work, which slowed down the oil and gas sector, the ONS said.

It marked a fall from July, when the UK economy grew by 0.1%.

What questions do you have on how you might be affected by a recession?

- Send your questions to [email protected]

- WhatsApp us at +44 7756 165803

- Tweet us @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

But ONS Chief Economist Grant Fitzner said that lots of other customer-facing businesses like retail, hairdressers and hotels were "faring relatively poorly" in August.

"The economy shrank in August with both production and services falling back, and with a small downward revision to July's growth the economy contracted in the last three months as a whole," Mr Fitzner said.

He added that sports events didn't generate as much economic value, after the economy had previously been helped by the UK hosting the Women's Euro Championship in July.

A reduction in the amount spending by the government related to the pandemic was also one of the big causes of the slump in manufacturing, which was hit by pharmaceutical companies cutting back production.

The ONS added that some falls were off-set, however, by some professional services like accounting and architecture.

The construction sector was the only one of the three main parts of the economy to see growth of 0.4% in August.

Some experts expect that September could see an even bigger drop in economic output, with the extra bank holiday for the Queen's funeral and the period of mourning affecting business opening hours, as well as higher costs starting to bite.

Yael Selfin, Chief Economist at KPMG, said that the UK was now "teetering on the edge of recession".

"The ongoing squeeze on household finances continue to weigh on growth, and likely to have caused the UK economy to enter a technical recession".

"August's drop in GDP likely marks the start of a downward trend that will continue deep into next year," said Samuel Tombs Chief UK Economist at Pantheon Macroeconomics.

Challenges to face

Meanwhile, Suren Thiru, Economics Director for ICAEW (Institute of Chartered Accountants in England and Wales) criticised Chancellor Kwasi Kwarteng's recent mini-budget for sparking market turmoil and potentially piling extra pressure on firms and families as mortgage rates have been sent soaring.

Mr Thiru said: "The government has needlessly risked a longer recession with any boost from the energy package likely to be dwarfed by a sustained squeeze on UK output from persistently high inflation, punishing interest rate rises and acute financial market turbulence."

Chancellor Kwasi Kwarteng insisted the government's energy support package and growth plan will "address the challenges that we face".

He added said: "Countries around the world are facing challenges right now, particularly as a result of high energy prices driven by Putin's barbaric action in Ukraine."

PA Media

PA MediaSpeaking to BBC's Today programme, Business Secretary Jacob Rees-Mogg also urged caution in interpreting the most recent ONS monthly figures for August.

He pointed out that monthly figures are often more volatile and "very often subject to revision".

But he acknowledged that the fall in the economic growth number for August "showed the need for the mini-budget in September to make sure we get back onto a path for growth".

It comes after the International Monetary Fund (IMF) warned that the worst was still to come for the global economy, while 2023 would "feel like a recession" for many people because of rising costs and the continued fall-out of Russia's invasion of Ukraine.

The financial institution warned on Tuesday that the UK economy could sharply reduce in 2023 as consumer spending is dented by rising prices and higher interest rates.

It downgraded its forecast for UK economic growth next year to just 0.3% in 2023 - down from 0.5% previously pencilled in.

Rachel Reeves MP, Labour's Shadow Chancellor, said: "That the IMF yesterday described the "UK like a car with two people each trying to steer the car in a different direction" leaves us an international laughing stock.

She said that the new ONS figures released on Wednesday showed that the UK economy "is still in a dire state because of this Tory government.

"The Conservatives must reverse their disastrous mini-Budget. Any continued failure to do so shows damaging levels of denial from the prime minister and her chancellor."

The IMF did welcome the news though that the chancellor has brought forward the date for his "economic plan" to 31 October, where he will set out will set out how he will fund tax cuts that he has pledged and reduce debt.