Japan's push into 'deep tech' innovation

BBC

BBCImagine if you could put an ultra-thin, transparent solar sheet on your window to generate energy, not just from sunlight but also artificial lights from inside your room?

Seen as the most promising next-generation solar cell, this technology, called perovskite, is exactly what Japanese start-up Enecoat Technologies is trying to develop.

When ready, the Kyoto-based firm hopes its product will produce as much power as a regular solar panel of the same size.

"We are hoping to market them in three to four years," says the co-founder and chief executive of the company, Naoya Kato. "But to use them outdoors, we need to make them durable for any kind of weather conditions, so that will take longer."

Start-ups such as this are called "deep tech". They are small firms who are merging high-tech engineering innovation with scientific discovery. The hope is that it will lead to the development of transformational products.

But a successful product launch in this sector takes time. As a result, private venture capital funds that lend money to entrepreneurs may be more cautious to invest in them.

That is where Kyoto University plays a crucial role. It may be best known for producing more Nobel prize winners than any other university in Asia (11 in total), but it also finances new start-ups by students and researchers through its two venture capital funds.

Enecoat Technologies is one of the beneficiaries, and has received a total of 500m yen ($3.6m; £3m). The money came from a $300m fund that the university received from the Japanese government back in 2015 to encourage entrepreneurship.

Frédéric Soltan

Frédéric Soltan"Kyoto University is strong in very hard science fields like regenerative medicine, stem cell science, and cleantech energy," says Koji Murota, who heads the university's Office of Society-Academia Collaboration for Innovation.

"But in order to commercialise these deep-tech companies it requires a long time and a large amount of money."

Mr Murota adds that while a typical venture capital fund's investment period may be eight to 10 years, that is not long enough for deep tech, so the university's scheme offers up to 20 years of support.

Since Kyoto University started its innovation department and investment fund seven years ago, the number of start-ups created by its students have more than doubled to 242.

New Tech Economy is a series exploring how technological innovation is set to shape the new emerging economic landscape.

That is second only to Tokyo University, which also received similar funding from the government, but Kyoto University's growth rate is much higher.

But even before the university started offering support to entrepreneurs, the city of Kyoto was known for producing start-ups. These include Nintendo. It may be a computer game giant today, but when it launched way back in 1889 it made playing cards.

Another successful firm set up in Kyoto is tech giant Kyocera, which was founded in 1959 by the late Kazuo Inamori, one of Japan's best-known business leaders.

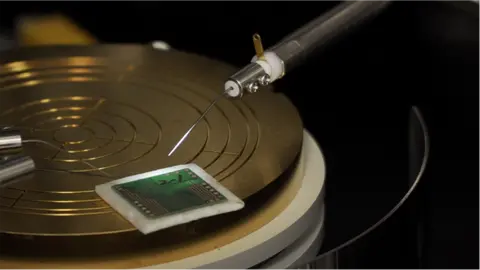

A more recent business success story in the city is microchip manufacturer and fellow deep-tech start-up Flosfia. Also backed by the university, it makes semiconductors that specialise in using energy more efficiently, thereby extending the lifespan of the product, such as electric cars.

"Kyoto's uniqueness is being small and yet diverse," says Kyoto University graduate and the boss of Flosfia, Toshimi Hitora. "The university is at the heart of it, and with so many researchers in a small community, anyone can access the information you need to start a business.

"But all the Kyoto-based companies' founders also say that, unlike firms in Tokyo, they don't have enough customers here [in Kyoto], so they had to think globally from the beginning."

Mr Hitora adds: "It has been more than 10 years since we started Flosfia because deep tech takes time, and I feel Kyoto people understand that."

Some 30 years ago, Japan was a pioneer in the semiconductor industry, but today it has less than 10% market share.

For Flosfia to establish a significant presence in the highly competitive global semiconductor industry, one dominated by firms such as South Korea's Samsung and Taiwan's TSMC, will be a challenge, especially as China and the US are also trying to put their stamp on the market.

In the US this move is being led by the White House, with the House of Representatives passing a government act in July that commits a $280bn support package for domestic chip production and research. The US wishes to reduce its dependence on other nations for supplies.

But Mr Hitora believes that Japanese producers like his have their own strengths. "Japan is good at doing basic research, and working with new materials, so I feel we have a big potential," he says.

He adds that Flosfia now has alliances with most of Taiwan's main chip manufacturers.

"Semiconductors are needed globally, so some governments may try to intervene to ensure the supply for their home markets, but it takes a long time to produce semiconductors," says Mr Hitora.

"To mass produce them, we need a lot of stakeholders and a lot of businesses in many countries. That is why I believe our alliances with other companies are important."

As Japan plays catch-up in the semiconductor sector, Kyoto University's ability to patiently play the long game with firms such as Flosfia increases the hope that the country will be successful.

Watch New Tech Economy Japan on BBC iPlayer