People cut back on food, fuel and clothes as prices rise, BBC survey suggests

Getty Images

Getty ImagesPeople struggling with the soaring cost of living are cutting back on food and car journeys to save money, according to a BBC-commissioned survey.

More than half (56%) the 4,011 people asked had bought fewer groceries, and the same proportion had skipped meals.

The findings reveal the widespread impact of prices rising at their fastest rate for 40 years.

Many people have cut spending on clothes and socialising. Some say their mental health has been affected.

Two-thirds of those surveyed also suggested government support provided so far was insufficient.

Worries growing

The BBC-commissioned survey of 4,011 UK adults in early June lifts a lid on how the economic climate is affecting lives and financial, physical and mental health.

The cost of domestic energy, petrol, and food have all increased significantly in recent months, and the findings suggest more than eight in 10 people (81%) are worried about the rising cost of living.

Concern has grown since the start of the year when 69% of those asked said they were worried in a similar BBC survey.

In the latest results, two thirds (66%) of those with worries said this was having a negative effect on their mental health. Nearly half (45%) said their physical health had been affected.

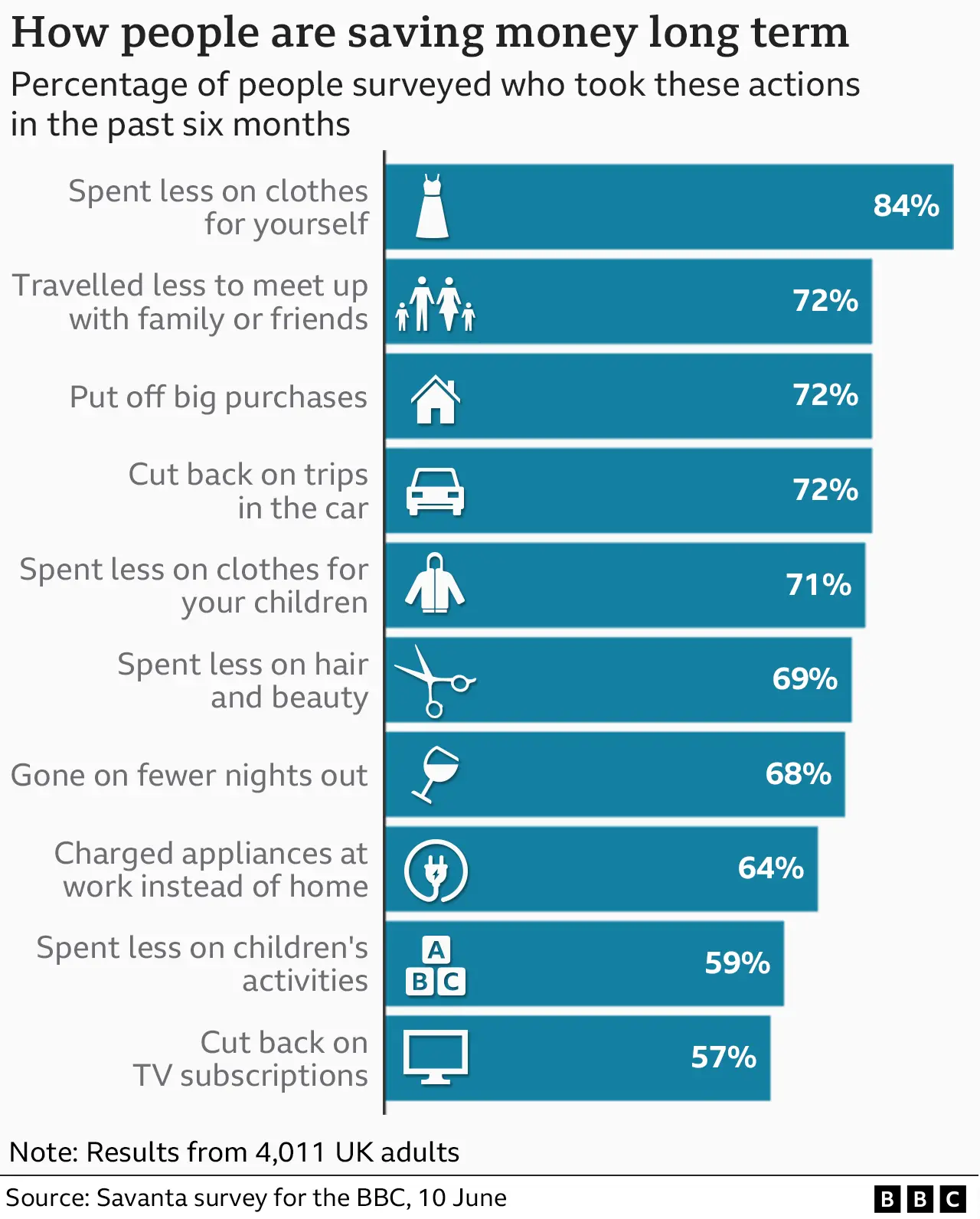

Day-to-day, individuals are making further changes to manage their budgets. The survey suggests this can be as simple as going on fewer nights out, or getting a haircut less often.

For charity worker Janine Colwill, from Easington, and those she talks to, the changes have been more fundamental.

"We get together with the family every Sunday, religiously, for Sunday roast - but my family and other families are starting to grow their own vegetables," she said.

"Those people who may not have worried about these things before are now worrying about them constantly.

"With advances in technology, I never would have thought that people would be relying on a food bank or growing their own - and just penny-pinching," she said.

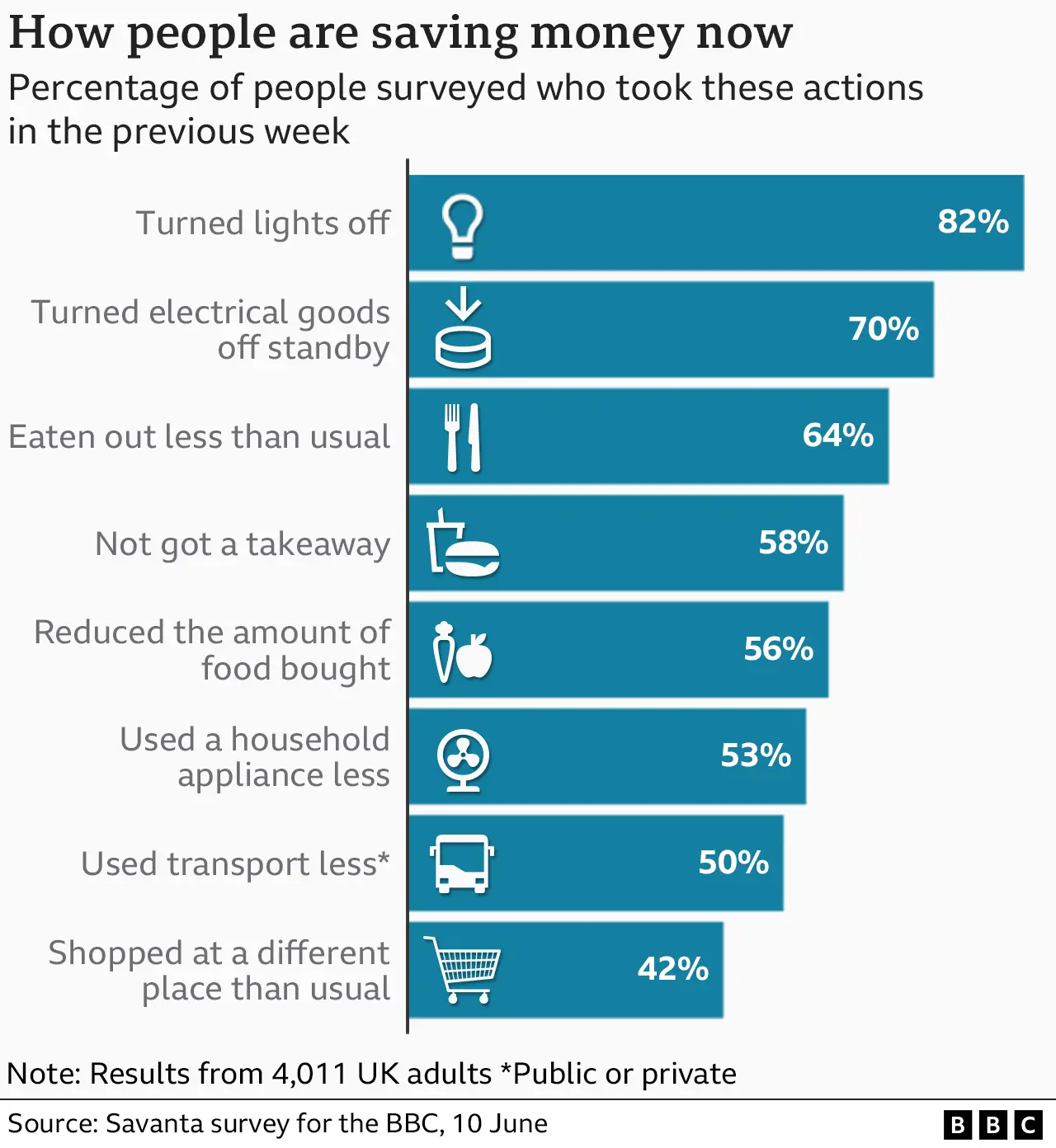

The survey suggests people are finding various ways to manage and save their money. The findings include:

- Some 82% of those asked had switched off lights in the previous week to save money

- Trips taken in the car had been limited to varying degrees in the previous six months by 72% of those asked

- A large majority (84%) said they had spent less on their clothes at some point in the previous six months

About half (52%) expect to work more hours in the next six months to help to pay the bills.

Tesco, the UK's largest supermarket, said in a trading update for the three months to 28 May that it was seeing early signs that shoppers are changing their habits due to inflation, such as buying less food and visiting more frequently.

Chief executive Ken Murphy also said people are switching to cheaper own-label brands for goods including bread and pasta which have seen prices soar due to the war between Ukraine and Russia, both of which are major wheat exporters.

Prices, as measured by inflation, are rising at a rate of 9% a year, the fastest for 40 years. Interest rates, which also affect the cost of living, were increased to 1.25% on Thursday by the Bank of England - the highest they have been for 13 years.

The situation is being driven, to a significant degree, by global factors such as the cost of oil, gas and food.

But there are UK-specific issues which are adding to inflation such as the tight labour market. Job vacancies are at a record high of 1.3 million meaning employers face paying higher wages to fill roles.

Also, the UK's dominant services sector - which includes the likes of accountancy and law firms, as well as restaurants and pubs - is seeing price rises.

Drivers now have to spend £103 for petrol and £106 for diesel to fill a family car, according to the RAC. The Institute of Grocery Distribution (IGD) has predicted food prices will rise at a rate of 15% this summer as households pay more for staples such as bread, meat, dairy and fruit and vegetables.

A typical household in England, Wales and Scotland is likely to see a rise in its annual domestic gas and electricity bill of £800 in October, on top of a £700 rise in April.

The surge in inflation is hitting wide and hitting deep, with the effects leading to significant changes in the way lives are being lived well beyond those on low incomes.

Large swathes of Britain's middle income working households are having to make material cutbacks and even after that are part of a new class of those "just about managing".

In practice this has meant energy bill direct debits wiping out people's entire disposable income, some food banks running out of food donations, or their donors becoming users.

And it may be changing attitudes, with nearly two-thirds of those asked saying even after the recent package of support for energy bills from the government, that it is not enough. And the numbers suggest a similar proportion think the support in place needs to last at least a year longer.

Inflation this high certainly changes the economy and our spending behaviour.

But the figures raise a question about whether the high levels of government support in the pandemic and in this energy crisis too, are now becoming baked into public expectations.

Soaring prices have led the government to announce a package of financial support directed primarily at those on low incomes. This includes a £400 discount on all energy bills in October, in addition to payments totalling £650 to people on means-tested benefits. Pensioners will get more this winter, as will billpayers with disabilities.

However, the BBC survey reveals that 64% of those asked said this support was insufficient to help people with the rising cost of living.

Chief Secretary to the Treasury Simon Clarke said vulnerable households would receive £1,200 which he said was part of a "very large" amount of support, on top of what had already been provided.

He said the first payments would come in July, and would continue into the autumn to offset the key driver of the rising cost of living for households, which was energy bills.

"That, of course, is yet to filter through to people, which is why I suspect people are saying they want more support," he told the BBC.

"As this gathers pace, it will be clear to people that this will be a comprehensive package."

The impact of rising household costs has already led to the financial regulator warning lenders that they need to do more to help those in financial difficulty and support vulnerable customers.

"Early action is important for those struggling with debt," said Sheldon Mills, of the Financial Conduct Authority.