UK inflation hits 40-year high of 9% as energy bills soar

Getty Images

Getty ImagesPrices are rising at their fastest rate for 40 years as higher energy bills hit millions of households.

UK inflation, the rate at which prices rise, jumped to 9% in the 12 months to April, up from 7% in March.

The surge came as millions of people saw an unprecedented £700-a-year increase in energy costs last month.

Higher fuel and food prices, driven by the Ukraine war, are also pushing the cost of living up, with inflation expected to continue to rise this year.

Citizens Advice said "the warning lights could not be flashing brighter" for the government to offer more support for households, and debt charities urged anyone finding it difficult to pay bills to seek help earlier rather than later in the year.

Around three quarters of the rise in inflation in April came from higher electricity and gas bills, according to the Office for National Statistics (ONS).

"There are desperate stories behind these figures," said Dame Clare Moriarty, chief executive of Citizens Advice. "People washing in their kitchen sinks because they can't afford a hot shower; parents skipping meals to feed their kids; disabled people who can't afford to use vital equipment because of soaring energy bills."

'I can't do much more'

Health analyst Cheryl Holmes, a mother-of-two, said she was trying to keep her living costs down to "as low as possible" by spending less on food and clothes, and cancelling TV subscriptions.

"I've already for several years been turning the lights off in each room, setting the heating on a timer, making sure I'm using a full dishwasher and washing machine and I'm running out of ideas.

"It's a battle and it seems like there's not really much more that I can do."

A higher energy price cap - which is the maximum price per unit that suppliers can charge customers - kicked in last month, meaning homes using a typical amount of gas and electricity are now paying £1,971 per year on average.

Up until now households of all incomes had faced similar rates of inflation, but the poorest are now being hit hardest by rising prices because they have to spend far more of their household budgets on gas and electricity, think tank the Institute for Fiscal Studies said.

The ONS, which publishes the UK's inflation rate, said the costs of food, machinery, furniture and other household goods also rose in April.

"All items" on the menus of restaurants and cafes went up too, due to the VAT rate for hospitality returning to 20% after being cut during the pandemic to help businesses.

Meanwhile, average petrol prices stood at £1.62 per litre in April 2022, the highest on record, compared with £1.26 per litre a year earlier.

Inflation is the rate at which prices are rising. For example, if a bottle of milk costs £1 and that rises by 9p, then milk inflation is 9%.

Prices have been rising for months, as fuel, energy and food prices surge higher due to the pandemic and the Ukraine war, and wages are failing to keep pace.

The ONS estimated inflation is now at its highest level since March 1982, when it stood at 9.1%.

The Bank of England warned earlier this month that the cost crunch could leave the UK on the brink of recession, with inflation peaking at over 10% later this year amid further expected rises in energy bills.

UK inflation is simply not supposed to hit levels this high. And as the Bank of England Governor Andrew Bailey has said, these sorts of rises hit the poorest the hardest.

9% is an average across the population. The older Retail Prices Index measure is already at 11%.

But Mr Bailey's institution has a battle on now to get this under control. The really painful issue is that this rate will sustain and is on course to get higher over the course of this year.

And only this week he acknowledged that there was "not a lot" the Bank could do about four-fifths of the anticipated rise, as it is being imported from globally rising prices for energy and food .

Read more here.

With households under increasing pressure, the government faces growing calls to offer more help.

Commenting on the latest figures, Chancellor Rishi Sunak said he "cannot protect people completely" from rising inflation as it was a global problem.

Mr Sunak is expected to call on businesses at the CBI's annual dinner later to boost investment and training in order to grow the economy and help ease the cost of living crunch.

He will pledge that he will cut taxes on firms in the Autumn to "invest more, train more, and innovate more".

Meanwhile, at Prime Minister's Questions, Boris Johnson said he would "look at all the measures" needed to help people struggling with rising bills.

Sir Keir Starmer pressed the PM on Labour's call for a one-off tax on oil and gas profits, arguing it would raise "billions" to help.

The PM replied that the government was "not in principle in favour of higher taxation".

The rising cost of living is already seeing people spending less money and cutting down on car journeys due to high fuel costs.

It's impacting the economy, which shrank in March and risks falling into recession next year, according to the Bank of England.

Bank of England faces criticism

The Bank's response has been to raise interest rates to try and cool prices. The idea is that when borrowing is more expensive, people will have less money to spend which dampens demand.

However, it the Bank has faced criticism from MPs for not doing enough to tackle the crisis. This week Governor Andrew Bailey defended its response, insisting inflation was being driven by global forces that limited what the Bank could do.

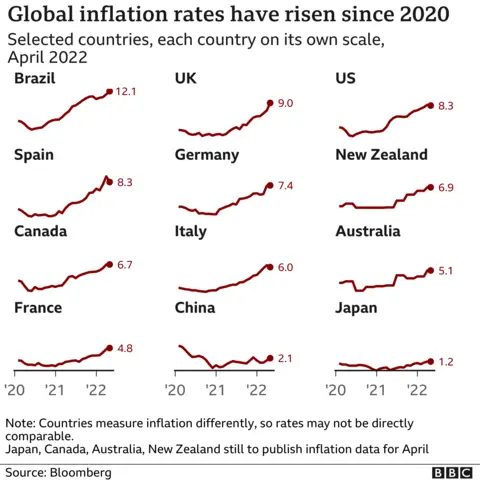

But UK now has the highest rate of inflation (9%) of any G7 country, including Germany (7.4%) and France (4.8%).

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said higher prices in the UK risked becoming embedded due to wages "spiralling upwards" as firms fought for talent.

There are currently more job vacancies than unemployed people in the UK for the first time since records began, partly because many people dropped out of the labour market during the pandemic.

Ms Streeter said prices across the hospitality and leisure industries were now at a 30-year high.

"So far companies have succeeded in passing on higher costs to customers keeping margins resilient, but worries do linger about just how long consumers will continue to pay the price," she added.