Could hydrogen ease Germany's reliance on Russian gas?

Getty Images

Getty ImagesThe war in Ukraine has upended Germany's energy policy.

Since the start of the war Germany has reduced its dependence on Russian oil from 35% to 12% and on Russian gas from 55% to 35%.

Nevertheless, energy trading is a huge source of revenue for Moscow. Over the first two months of the war Germany paid almost €9bn (£7.7bn; $9.6bn) for Russian oil and gas imports according to the Finnish thinktank CREA.

Veronika Grimm is an economics professor at the University of Erlangen-Nuremberg, and currently one of Germany's three special advisors to the federal government, called Economic Sages.

"We need to diversify and decarbonise our energy sources faster than initially planned," she says. To help achieve that goal, Ms Grimm wants the nation to "ramp-up" its use of hydrogen.

Hydrogen can store vast amounts of energy, replace natural gas in industrial processes, and power fuel cells in trucks, trains, ships or planes that emit nothing but vapour of drinkable water.

Getty Images

Getty ImagesMs Grimm's enthusiasm is gaining traction, according to the International Energy Agency (IEA), an energy research group, dozens of countries have published national hydrogen strategies, or are about to.

Despite this flurry of interest, it's not clear yet that the large-scale use of hydrogen can be made viable.

After all, there has been similar excitement before: in the 1970s, after two oil crises, and in the 1990s, when climate worries arose. But both petered out. So, is today's hype any different?

Sceptics warn that industry representatives, who globally dominate most hydrogen councils, are often biased in favour of hydrogen as it promises subsidies and keeps up demand for existing assets such as pipelines, tankers, turbines or boilers.

They also argue that politicians like big, green-sounding plans for a more distant future rather than more difficult solutions.

While small amounts of hydrogen are being extracted directly from the ground, most hydrogen is manufactured. That is largely done in two ways, each marked by a colour code.

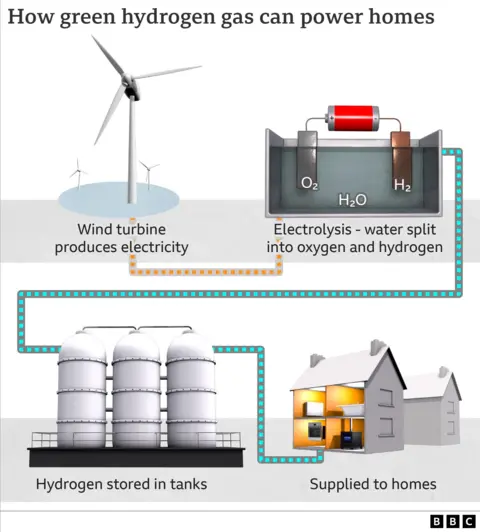

Green hydrogen is produced by using electricity from renewable power to split water into hydrogen and oxygen molecules using an electrolyser. But those machines and the electricity to run them remain costly.

These costs means that, at the moment, such emission-free hydrogen makes up only 0.03% of global hydrogen production, according to the IEA.

Getty Images

Getty ImagesUp to five times cheaper is so-called grey hydrogen, this is derived from natural gas, or in some cases from oil or coal. But due to losses during production, about 50% more CO2 is emitted than if natural gas were directly burned.

A related technique is known as blue hydrogen. This relies on the same process, but captures about 60-90% of the carbon emitted in production for re-use or storage.

The drawback with this method is that it roughly doubles the cost and lacks production facilities at large scale. So only 0.7% of globally-produced hydrogen is blue.

So, despite its environmentally-friendly image and potential, the global production of hydrogen currently emits almost three times as much CO2 as a whole country, France, for instance.

Much then will hinges on how countries decide to produce hydrogen.

Some countries already have a clear priority - to power electrolysers most sun-baked nations bet on solar power, while France relies on nuclear energy.

China meanwhile cherishes cheap grey hydrogen from coal and gas and invests in green alternatives.

The US, Canada, UK, Netherlands and Norway are leading the push for blue hydrogen, by injecting captured carbon into oil and gas fields for long-term storage, or for so-called enhanced oil recovery that boosts extraction.

In Germany, however, the picture is less clear.

Volker Quaschning, professor for renewable energy systems at Berlin's University of Applied Sciences and criticises Germany's hydrogen strategy: "Merkel's government used it as a red herring to conceal its own failures in the energy transition."

He argues that solar and wind power should have been expanded faster to facilitate future green hydrogen production - a step that Germany's new government has promised to take.

However, on hydrogen the three parties in the governing coalition, the three responsible ministries, and the hydrogen council all internally argue whether to concentrate on green hydrogen, or to accept the blue alternative, to temporarily bridge the gap in limited supply.

Ms Grimm represents the majority view on the hydrogen council in favouring a multi-colour mix.

"Accepting blue hydrogen will help create the supply that we need for a budding industry," she argues. "It will foster technological breakthroughs in Germany and encourage potential suppliers to invest in green hydrogen production."

Getty Images

Getty ImagesIn January, Economy Minister Robert Habeck announced an ambitious push for renewables and a doubling of the two-year old target for domestic production capacity of green hydrogen to rise by a factor of 150 from 70 MW today to 10 GW by 2030.

That target represents a quarter of the entire EU's aim of 40GW, and is larger than France's goal of 6.5 GW.

So while this domestic production expands, Germany is looking to source hydrogen from abroad.

Andreas Kuhlmann, head of the German Energy Agency, (a government-owned company facilitating the energy transition coordinating the Hydrogen Council), says Germany has dramatically sped-up international negotiations to buy hydrogen.

That could include developing hydrogen pipelines to connect to southern Europe, where favourable conditions for solar and wind power allow the cost-efficient production of hydrogen.

Mr Habeck is frantically visiting energy exporters. Within one week in March, he travelled to Norway to agree on a feasibility study for the construction of a hydrogen pipeline, went to Qatar to finalise an energy partnership and visited the United Arab Emirates to sign five cooperation agreements.

The first deliveries from the UAE are expected to arrive later this year.

Other countries on Mr Habeck's hydrogen radar are Ireland, Saudi Arabia, Oman, Chile, Namibia and Australia.

Getty Images

Getty ImagesThough he acknowledges the need to import hydrogen, Mr Quaschning dashes some of Mr Habeck's hopes. "Importing hydrogen from desert plants will be sluggish, inefficient and expensive," he explains.

Each step in the supply chain uses up some of the original energy: desalinating sea water to get fresh water as raw material, electrolysis, liquification for shipping, transport via tanker, local transport via pipeline in Germany and re-conversion of hydrogen into electricity.

"Together, these steps would eat up at least 70% of the electricity originally produced in the desert," Mr Quaschning says.

"So, even though a solar panel in the desert produces 80% more electricity than one in Germany, the losses on the way are so big, that it would be twice as effective to directly produce solar power in Germany."

Due to its high-cost, hydrogen is often referred to as the champagne of the energy transition. So, who will get the first sips?

On this, most observers agree. "It is crucial that we allocate hydrogen only to those industries, where direct electrification is not possible", explains Felix Matthes energy expert at Öko-Institut, a think tank, and member of Germany's hydrogen council.

"So, we should first use it in the production of steel, chemicals and glass," he argues.

Subsequent sectors could be shipping, long distance truck transport, as well as planes for medium or long distances. Other uses in cars or heating are inefficient, costly and impractical distractions, he adds.

"Plus, Mr Habeck's new push for renewables will create a greater need to balance our electricity supply, which hydrogen could do with electrolysers producing hydrogen on sunny, windy days as large-scale storage for cloudy winter days," Mr Matthes says.

The pressure is on Germany to stop spending so much on Russian energy, but it will be a tricky process.

Many will be hoping that hydrogen eases that transition by fulfilling its promise this time around.

Correction August 22 2022: This article was updated to reflect that hydrogen can be harvested directly from the ground.