Prepay energy customers disconnect over price rises

Getty Images

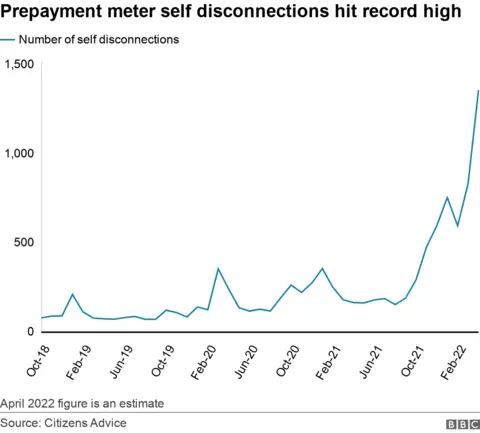

Getty ImagesRecord numbers of prepay gas and electricity customers in the UK stopped topping up their meters after energy prices soared, Citizens Advice said.

By the end of April, the charity will have seen more than 1,300 cases of people going without pay-as-you-go power - known as self-disconnection.

It comes after a 54% rise in the energy price cap added an average £700 to annual household bills.

The Treasury said energy bills were capped until the autumn.

"We won't know yet what the size of the rise will be given the volatility of prices we are seeing now and it's right that we wait until we know how big the rise will be before we decide what the solution should be," a Treasury spokesman said.

Citizen's Advice said its projected figures on the number of self-disconnections for April had increased eight-fold on the 162 cases it saw in the same month last year.

The number of callers seeking help because they cannot afford to top up their meters is already higher than the total figure for 2021, the charity told the BBC.

'Worst is yet to come'

Citizens Advice chief executive Claire Moriarty said prepayment customers were being hit hard by the April price increases.

"This can have devastating consequences - parents with no hot water to bathe their children, families sleeping in their coats and people with chronic illnesses who can't keep warm," she said.

"The warning lights could not be flashing brighter and the worst is yet to come. The government must bring in more support to help people cope with this mounting crisis."

At the start of April, about 18 million households on standard tariffs saw their energy bills rise by an average of £693 from £1,277 to £1,971 per year.

But for the 4.5 million prepayment customers, often on low incomes, the increase was higher - up £708 from £1,309 to £2,017.

The energy regulator Ofgem has previously defended the difference, saying there are higher fixed costs associated with running a prepayment meter.

Earlier this month, energy bosses warned MPs that millions of people could fall into fuel poverty this winter as a result of price increases.

Keith Anderson, chief executive of Scottish Power, told the Business, Energy, and Industrial Strategy committee (BEIS) that it was "perverse" that prepayment customers paid more than others, whilst E.ON UK's boss Michael Lewis said that April's bill increases would have "a severe impact on customers ability to pay".

Chancellor Rishi Sunak announced a repayable £200 discount on bills for homes in England, Wales and Scotland from October, and a further £150 council tax rebate for most households in England. But Labour criticised the plan, calling it a "buy now, pay later scheme".

Energy firm Utilita has over 800,000 customers, most of them on prepayment smart meters. At the company's headquarters in Eastleigh, Hampshire, the customer call centre has had a busy month, with a 60% increase in call volumes compared to last April, and 40% more applications for interest free loans.

Sasha Dixon leads the extra care team dealing with the most vulnerable customers, and says it's been a very difficult few weeks.

"I've been with Utilita for seven years, and on this team since it started and this is the worst I've ever seen it," she said."We've had so many distressing cases. So many desperate customers ringing us needing support.

"We had one customer who phoned us last week who had actually sold all their belongings, just to be able to get money to eat. They had nothing left to sell and were waiting on a benefit payment," she added.

Getty Images

Getty ImagesUtilita's founder and chief executive, Bill Bullen, said April had been a "genuine shock" for household budgets and that the price rises have had an immediate impact.

Like Citizens Advice, the company has seen a rising number of customers not topping up their meters because they're running out of money. He said they were doing everything they could but there was a limit.

"The reality of an energy business today is that it's not a profitable business. There's no spare cash to be spending with customers, and that's the really frustrating thing," he said.

"Even in a really good year, you might dream of making a 2% or 3% margin, but that's only around £20 or £30 per customer and what we're seeing here is an increase in bills of around £1,500 a year.

"There's no way that supply companies can even begin to address this problem by themselves. It's way out of our league," he added.

Mr Bullen said it was great the government was providing energy bill and council tax rebates, but it was nowhere near focussed enough.

"If they had spent £9bn on the 10 million lowest income households, I think they would have made a bigger dent in the problem," he said.

"Instead of having £200 for every household, you could have had £600 for the lowest third of households."

He said everyone in the industry was 100% focussed on how they were going to get customers through the next winter.

"I think the shock in October is going to be huge. We are definitely going to see things like unnecessary increased deaths during the winter period, and just genuine hardship. People don't have that extra £1,500," he said.

But with high demand for gas around the world continuing as countries move away from Russian supplies, he's not optimistic that prices will come down significantly any time soon.

"Everybody's hoping this is going to be relatively short lived, but the supply and demand balance to me suggests this is something that's going to go on for years, rather than months," he said.