Will Taiwan's banks stay stuck in a '1980s' time warp?

Catherine Chou

Catherine ChouWalking into a Taiwanese bank for the first time, two years ago, was something of a misadventure for Catherine Chou.

The Taiwanese American professor had relocated to Taipei to wait out the end of Covid-19, but she was still processing some of her paperwork and needed to send a money order.

Back home in the US, sending money is a relatively simple procedure that requires a photo-ID, a simple form, and payment in cash or a debit card.

In Taiwan, Ms Chou found the process required a lot more work.

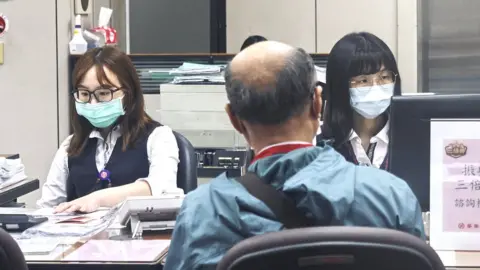

"I filled-out paperwork by hand, in triplicate, that was then input into a computer by the bank clerks. And in the meantime the dot printers are whirring in the background," she says.

"It was this very slow 1980s vibe. The afternoon fruit delivery came in, everyone passed around the boxes, and I was still waiting for my money order [to go through]."

Painstakingly slow, overly bureaucratic, and often edging into darkly comedic are common descriptions of foreigners and foreign-born Taiwanese, like Ms Chou, when they encounter Taiwan's banking industry for the first time.

Overseas, Taiwan is synonymous with sophisticated high-tech companies like TSMC and Foxconn, who supply many of the parts essential to smartphones and computers. It is also home to a growing cryptocurrency market.

Elsewhere, Taiwan is known for being quietly at the forefront of social change in Asia, as the regional leader in gender equality and the first place to legalise same sex marriage.

However, on the ground in Taiwan, things can feel decidedly more old-fashioned, especially at the bank.

The institutions can feel like a world unto themselves of pass books, pneumatic tubes, endless paperwork, and the ubiquitous "chop" - a traditional stamp - bearing one's name or company seal.

Erin Hale

Erin Hale"Taiwan's banking industry is very, very traditional. There's a lot of bureaucratic issues in it, within the system, and it's slightly more rigid than other industries," says Sharon Hsu, a financial consultant at Enlighten Law Group in Taipei, which specialises in transnational finance.

You could put this down to a legacy from being state-owned institutions prior to a major banking reform in 1989 when the first private banks were allowed to open, she says.

These days, Taiwan has 40 local banks, according to government-adjacent, Taiwan Academy of Banking and Finance, as well as branches of international banks like HSBC and Citibank.

But in a population of 23.5 million, Taiwan is commonly described as overbanked - with people's assets spread thinly across many institutions.

Getty Images

Getty ImagesMany banking services still need to be carried out in person and banks are slow to adopt new practices, unless the government makes it explicitly clear that they are allowed, says David Stinson, a project researcher at TABF.

Sometimes, even when new services like electronic document processing are deemed legal, Taiwan's banks simply decline to adopt them.

Mr Stinson says one reason behind this stagnation may be that most local customers are happy with how things are already run, even if it means sometimes standing in line with a passbook.

Banks also readily meet the relatively modest needs of the small and medium enterprises that dominate Taiwan's economy.

The pandemic, however, has helped finally nudge banking culture forwards a little - by making retail customers reconsider online banking and banking apps.

At the end of 2019, digital deposit accounts numbered just 3.83 million, according to government data, finally jumping to 10.47 million by the end of 2021.

Getty Images

Getty ImagesIn 2019, Taiwanese regulators also approved three online-only banks. But for now, they can only offer simple services like savings and loans, says Kunchou Tsai, a lawyer specialising in fintech at Enlighten Law Group, which is "only the beginning" of their potential.

Financial apps

One reason for the delay is that for years now, many Taiwanese people have met their financial needs outside the bank.

Many people rely on apps like LINE Pay - which connects their social media account to their bank account - Apple Pay and WeChat for daily payments, while bills can be easily paid offline at convenience stores or the post office.

But even as customers embrace online banking portals, banks are still many steps behind their competitors, as companies like 7-Eleven and Family Mart expand into digital payments, explains Amy Fang, deputy director of the Overseas Business Institute at TABF.

This means banks are still struggling to play catch-up.

"[Convenience stores] want to branch into digital payments and they want to build their own ecosystems for online shopping market, so it's really important now that our local banks to review their strategy," Ms Fang says.

An antiquated banking culture also risks tripping-up Taiwan's big plans to become a more attractive global destination, which includes luring 100,000 foreign workers and making English a widely-spoken language.

Large multinationals may find their banking needs met by local banks, but for individuals and entrepreneurs even getting a foot in the door can be a big challenge.

Requesting to open an account can be met with quizzical scepticism, or outright rejection for Americans - who are unpopular clients due to the hassle of IRS (US tax authorities) paperwork.

Getty Images

Getty ImagesFor those who do manage to open an account after dealing with a mountain of paperwork, they may be startled to find other restrictions such as being called in to sign for overseas transfers.

Industry groups like the European Chamber of Commerce and Taiwan's Gold Card office, which oversees a special visa program to help entrepreneurs and qualified professionals move to Taiwan have weighed-in.

"Finance is a key sector for attracting international talent, [but] a lot of time the first thing they encounter is that Taiwan is such an awesome place until the first time you go into a bank, and people get a certain impression," says TABF's Mr Stinson.

Taiwan's government has been working to address some of these issues, but some hurdles will remain firmly in place, thinks Thomas McGowan, a long-term resident of Taiwan and partner at the Taipei office of the international law firm, Russin & Vecchi.

Since the 2016 fallout from fines over the Panama Papers, Taiwan has tightened-up its "know your customer" and anti-money laundering rules. These can sometimes ensnare unsuspecting customers, alongside its foreign exchange controls that can make receiving and sending money abroad more challenging than in other places, McGowan says.

In other cases, banks are simply reacting to foreigners as banks everywhere react to someone from abroad. "Some of it is real, and some of it - you'd have the same experience in California, or you would have the same experience in Singapore," Mr McGowan says.