Funeral firm collapses leaving fears over payments

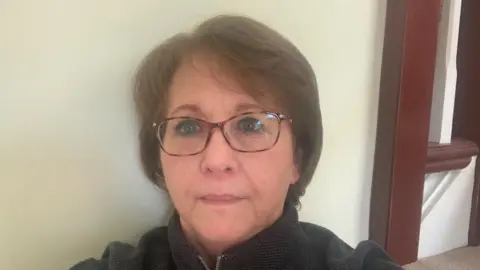

Lyn Burrow

Lyn BurrowA funeral plan provider with 45,000 customers in the UK has collapsed, throwing contracts into doubt and raising concern over refunds.

Safe Hands had already signalled its intention to stop operating, but its collapse means pre-bought funerals may not be honoured.

Administrators said the company could not provide immediate refunds, leaving many worried their money will be lost.

The sector is facing an imminent overhaul, leaving other plans in doubt.

From 29 July, any provider must be authorised and regulated by the Financial Conduct Authority (FCA) which, from that point onwards, will give consumers far greater protection than they have at the moment.

'What are we going to do?'

Safe Hands was one of dozens of companies operating in the currently unregulated pre-paid funeral sector.

Customers such as Lyn Burrow, 72, and her husband Fred, 80, signed up to contracts that saved their family the expense and emotional cost of organising their funerals when they die.

The couple spent a total of £6,310 on their plan, which she said had given them "peace of mind".

She spoke to BBC Radio 4's Money Box programme about her concerns when it emerged that Safe Hands had decided to stop operating when new regulations begin.

Now, following news that the company is in administration, those fears have heightened.

She said: "My family was supposed not to have to worry, but what are we going to do now?"

"If we could at least recover some of the money, we could make up the difference with a reputable company. But £6,000 is a lot of money. It would have to come from our savings."

Getty Images

Getty ImagesJoint administrator Nedim Ailyan, partner at FRP, said they would carry out a detailed investigation to discover what could be returned to creditors, including policyholders - whose funds are in a trust fund, which itself has a shortfall compared to what is required for full refunds.

"Regrettably, the administration means the company is not in a position to issue refunds at this time. We appreciate how upsetting this period of uncertainty will be for Safe Hands Plans' customers and their families," he said.

"Unfortunately, there is a shortfall between the level of plan holder investments and the forecast level of funeral plan costs to be paid. Essentially, the value of the investments is not enough to meet the funeral plan obligations of the company."

Any funeral plans activated in the next two weeks, because the policyholder has died, will be covered by another provider - Dignity. Mr Ailyan said a "longer-term solution" was being sought beyond that deadline, and customers - or their loved ones - would be contacted. A helpline has been set up on 0800 640 9928.

The FCA said it was reforming the sector because elderly, and very often vulnerable, customers have been subjected to unfair practices such as high pressure sales tactics and cold calls. It wants to raise standards by regulating what companies can and cannot do.

However, a FCA spokeswoman said that, in the case of Safe Hands, its powers were limited because it had yet to come under the regulator's jurisdiction.

"People who bought a pre-paid funeral plan with Safe Hands will be understandably concerned, which is why we welcome Dignity stepping in to provide funerals for the next two weeks," she said.

"We will continue to support the administrators and industry to see whether there is a longer-term solution for Safe Hands' customers."

Mike Hilliar, director for funeral planning at Dignity, said: "Dignity stands by its commitment to provide assistance where we can, and we will be working with others in the industry to come to a resolution to help customers of Safe Hands, or indeed of other plan providers that do not achieve authorisation with the regulator."

UK funeral plan sector

- 1.6 million customers

- 200,000 funeral plans taken out every year

- Approximately 65 companies

- Average plan costs £4,000

- Average plan lasts for 8 years

Source: FCA/Fairer Finance

As the funeral plan market is being reformed, industry insiders are worried that this could mean more of the 65 providers will go out of business, leaving tens of thousands of customers out of pocket.

Whilst many of the larger, more reputable firms are expected to be granted authorisation by the FCA, others are unlikely to even apply for authorisation or will be turned down. If that happens they will be unable or not allowed to operate beyond 29 July.

While customers who have signed up to plans very recently can cancel during a cooling-off period, others will have to wait to see what happens to their provider and their plan.