Fuel duty cut by 5p a litre to help motorists

Getty Images

Getty ImagesThe chancellor has announced a 5p a litre cut to fuel duty as motorists struggle with record fuel prices.

Rishi Sunak said the move, which kicked in at 18:00 GMT on Wednesday and will last until next March, was "the biggest cut to all fuel duty rates ever".

However, motoring company the RAC said the 5p cut only took prices "back to where they were just over a week ago".

It said the reduction would take £3.30 off the cost of filling a typical 55-litre family car.

Motorists have been hit by record pump prices since Russia's invasion of Ukraine led to an increase in the cost of oil because of supply fears.

Average pump prices hit new records on Tuesday, with petrol topping £1.67 a litre and diesel close to hitting £1.80 for the first time, the RAC said.

That left the cost of filling an average family car with petrol at more than £92 and nearly £99 for diesel.

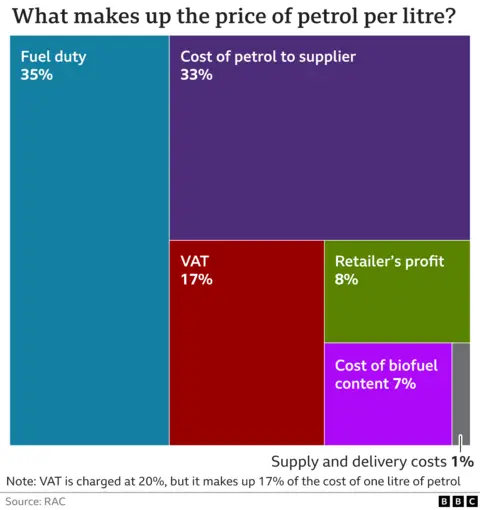

Fuel duty - a government tax which makes up part of the price when you buy petrol or diesel - is currently 58p per litre and has been for 11 years.

The Treasury said the fuel duty cut - the first is more than a decade - would cost it £2.4bn and means a one-car family will save £100 on average over the next 12 months.

The average van driver will save £200, it said, while hauliers will save £1,500.

But RAC head of policy Nicholas Lyes said the cut was "a drop in the ocean" given the recent huge rise in fuel costs, which have not fallen despite crude oil coming off its record highs of earlier in March.

He also warned there was a "very real risk retailers could just absorb some or all of the duty cut themselves by not lowering their prices".

"If this proves to be the case it will be dire for drivers," Mr Lyes said. "It also wouldn't be totally unexpected based on the biggest retailers not reducing their prices late last year when the oil price fell sharply."

The RAC added although fuel duty had been cut to 53 per litre, it could take time to be reflected in pump prices due to it being charged on wholesale purchases by retailers, who are yet to buy new fuel at the lower rate.

In response to Rishi Sunak's Spring Statement,supermarket chains Asda, Morrisons, Tesco and Sainsburys cut pump prices by 6p a litre, including a 1p reduction in VAT, but smaller independent fuel retailers have said they have to wait until current levels are depleted, before they can benefit from the tax relief in their next orders.

The average price of a litre of petrol has risen by more than 40p since last year's Spring Statement, which means the government is getting an extra 7p per litre in VAT, which is the other tax the government imposes on fuel.

Diesel prices are up by nearly 50p a litre, almost 9p of which is VAT.

The fuel duty cut will be welcomed by many drivers, particularly those with large vehicle or who drive long distances - but it also runs counter to environmental goals.

The website Carbon Brief calculated that the decision in 2010 to freeze fuel duty had led to an increase in emissions of up to 5%.

The Treasury said it had acted to cut fuel duty now because: "Unique circumstances globally, including the war in Ukraine, have pushed pump prices up to unprecedented levels."

AA president Edmund King said he was concerned that the benefit would be lost unless retailers passed it on. "Since the start of the year, the 20p-a-litre surge in pump prices has been the shock that rocked the finances of families."

He said there had been a substantial reduction in wholesale fuel costs since 9 March.

"That needs to drive lower pump prices also," he added. "The road fuel trade shouldn't leave the Treasury to do the heavy lifting when cutting motoring costs."

Fuel prices, which were already rising as global economies recovered from the coronavirus pandemic, surged after the war in Ukraine pushed up global oil prices.

Changes in prices at the pump are mainly determined by crude oil prices and the dollar exchange rate, because crude oil is traded in dollars.

Russia is one of the world's major oil exporters and it is being targeted by economic and trading sanctions.

After Brent crude oil - a global benchmark for prices - hit a near 14-year high of $139 a barrel during the early stages of the conflict, prices fell back to around $100, but have since risen again and were trading at about $120 a barrel on Wednesday.