Ukraine conflict: Russia doubles interest rate after rouble slumps

Reuters

ReutersRussia has more than doubled its interest rate to 20% in a bid to halt a slump in the value of its currency.

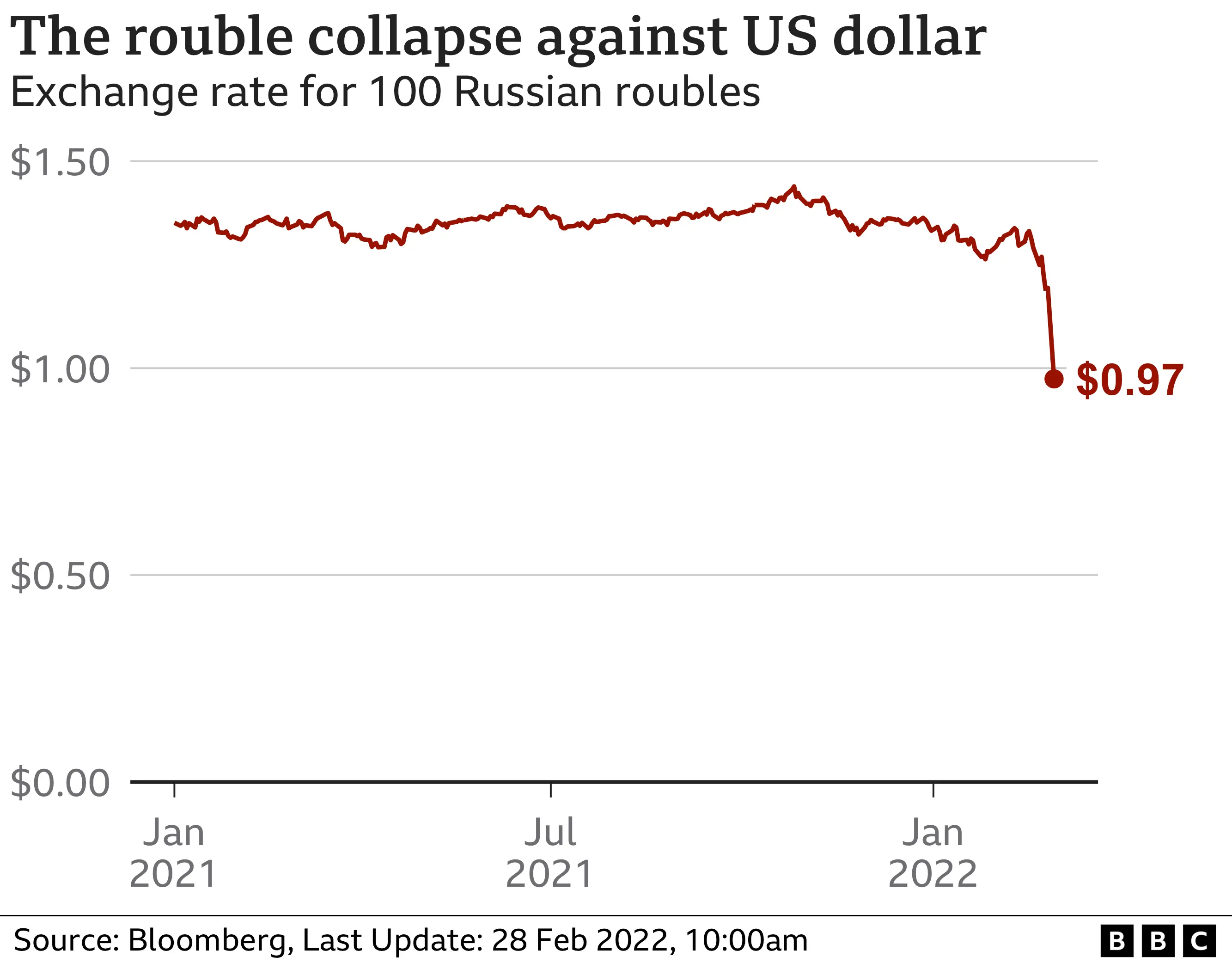

The Bank of Russia raised the rate from 9.5% after the rouble sank 30% after new Western sanctions. The currency then eased back to about 20% down.

The collapse in value erodes the currency's buying power and could wipe out the savings of ordinary Russians.

Amid pictures at the weekend of queues at cash machines, Russia said it had the resources to ride out sanctions.

President Vladimir Putin on Monday responded to the sanctions with an order barring citizens from transferring money outside of Russia, including for debt payments. Moscow's stock market, which saw heavy losses last week as investors sold, is to be closed for a second day on Tuesday.

Ahead of an emergency meeting between President Vladimir Putin and his economic advisers on Monday, Kremlin spokesman Dmitry Peskov said: "These are heavy sanctions, they're problematic, but Russia has the necessary potential to compensate the damage from these sanctions."

The UK, along with the US and EU, cut off major Russian banks from financial markets in the West, prohibiting dealings with the central bank, state-owned investment funds and the finance ministry. The moves sent the rouble tumbling.

Chancellor Rishi Sunak said the measures demonstrated the UK's "determination to apply severe economic sanctions in response to Russia's invasion of Ukraine".

Russia has about $630bn (£470bn) in reserves - a stockpile of savings - built up from soaring oil and gas prices.

But because a lot of this money is stored in foreign currencies like the dollar, the euro and sterling as well as gold, the Western ban on dealing with Russia's central bank restricts Moscow from accessing the cash.

Last week, Russia's central bank was forced to increase the amount of money it supplies to ATMs after demand for cash reached the highest level since March 2020.

Videos on social media on Sunday appeared to show long queues forming at cash machines and money exchanges in Moscow, with people worried that their bank cards may stop working or that limits will be placed on the amount of cash they can withdraw.

Chris Weafer, chief executive at consultancy firm Micro-Advisory and based in Moscow, said on Monday he was seeing some queues in food stores.

"You are beginning to see a little bit of queuing in some grocery stores, particularly people buying some goods that they think might come into short supply due to trade restrictions or maybe will be subject to big price increases because of the rouble devaluation.

"This set of sanctions is hitting ordinary Russians to an extent that previous sanctions have not and people are now becoming aware of that.

"People are a lot more fearful. There is already talk about some companies having to either go on reduced working hours, or even suspend production because they're not able to access maybe key parts from the West due to sanctions or due to trade limitations, so there's a great deal of concern on the street."

Moscow resident Anastasia told Reuters that she expected her economic situation to get worse. "It's inevitable in these circumstances," she added. Whilst another Moscow resident Sergey said he was already seeing an impact. "Prices are rising, of course, savings are shrinking and stocks are falling."

On Monday, the central bank said it had ordered brokers to suspend the execution of all orders by foreign legal entities and individuals to sell Russian investments.

The sanctions that have been imposed by the EU, the US, the UK and others are unprecedented. It's one thing to block the foreign reserves of a country like Iran or Venezuela, quite another to act against Russia - a country with a major role in global trade and a very significant supplier of oil and gas.

The reaction on the currency markets has been dramatic - with the rouble plummeting, despite the central bank's efforts to prop it up using interest rates. There may already have been a rush to the foreign currency ATMs in Russian cities, but citizens there have yet to feel the full impact.

At the very least prices will rise dramatically; banking collapses, hyperinflation and a deep recession are all potential consequences.

But sanctions are a two-way street. Cutting the central bank off from its reserves and limiting Russian institutions' access to the Swift network will not only hurt Russia - western institutions also face losses from debts that cannot or will not be repaid, for example. And then there is the risk of countermeasures from Russia - potentially hitting energy exports.

Such sweeping sanctions being imposed in such a unified way is remarkable. It's also a very big gamble.

'Economic pariah'

Attempts to put a stranglehold around Russia's finances reverberated across the financial and corporate world:

- The price of crude oil jumped to $101 per barrel, and the dollar and gold rose as investors sought safer places to put their money.

- The price of gas for delivery over the next couple of months soared by 24%.

- European markets tumbled at the open amid fears over financial stability, but later pared losses with London's FTSE 100 closing down 0.4%. Paris fell 1.3% and Frankfurt 0.7%.

- BP's share price slumped more than 6% after it decided to exit Russian oil and gas operations at a cost of up to $25bn. Shell also said it would quit its Russian ventures.

- Russian gold producer Polymetal was the biggest faller on the FTSE 100, down 56%, while shares in Evraz - the steel firm controlled by Roman Abramovich and Alexander Abramov - sank 29%.

- US markets were mixed, with the Dow closing down 0.5%, the S&P 500 off 0.2%, while the Nasdaq gained 0.4%. The major exchanges temporarily halted trading of Russian stocks to understand the impact of the sanctions.

- US bank Citigroup was among the biggest losers, falling more than 4.4% after the firm disclosed nearly $10bn in exposure to Russia, including more than $5bn in loans, securities and funding commitments

- Equinor, the energy firm majority owned by the Norway government, started to divest its joint ventures in Russia.

- Wheat prices saw their biggest one-day gain in a decade on supply worries from Russia and Ukraine.

- Switzerland also said it would follow the European Union's sanctions, breaking its tradition of neutrality.

Will Walker-Arnott, senior investment manager at Charles Stanley, told the BBC's Today programme that "it looks like Russia is increasingly becoming an economic pariah, increasingly isolated from the global financial system".

Cutting some Russian banks from international payments system Swift is among the harshest measure so far imposed to date on Moscow over the Ukraine conflict.

The assets of Russia's central bank will also be frozen, limiting the country's ability to access its overseas reserves.

Russia is heavily reliant on the Swift system for its key oil and gas exports. It was not clear whether those deals would be exempt from the bans.

The intention is to "further isolate Russia from the international financial system", a joint statement said.

On Monday, the European Central Bank (ECB) said several European subsidiaries of Sberbank Russia, which is Russia's largest bank and majority owned by the Russian government, were failing or likely to fail due to reputational cost of the war in Ukraine.

Sberbank Europe AG, which had total assets of €13.64bn (£11.4bn) at the end of last year, along with its Croatian and Slovenian units, suffered a rapid deposit outflow in recent days and is likely to fail to pay its debts or other liabilities, said the ECB, which is the lenders' supervisor.

Russia attacks Ukraine: More coverage

- LIVE: Latest updates from on the ground

- THE BASICS: Why is Putin invading Ukraine?

- DNIPRO: Terrified residents jolt into action

- MAPS: Tracking day four of Russia's invasion

- IN DEPTH: Full coverage of the conflict

What questions do you have about the Russian invasion of Ukraine?

In some cases your question will be published, displaying your name, age and location as you provide it, unless you state otherwise. Your contact details will never be published. Please ensure you have read our terms & conditions and privacy policy.

Use this form to ask your question:

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or send them via email to [email protected]. Please include your name, age and location with any question you send in.