Oil hits seven-year high but shares rebound on Russian war

Getty Images

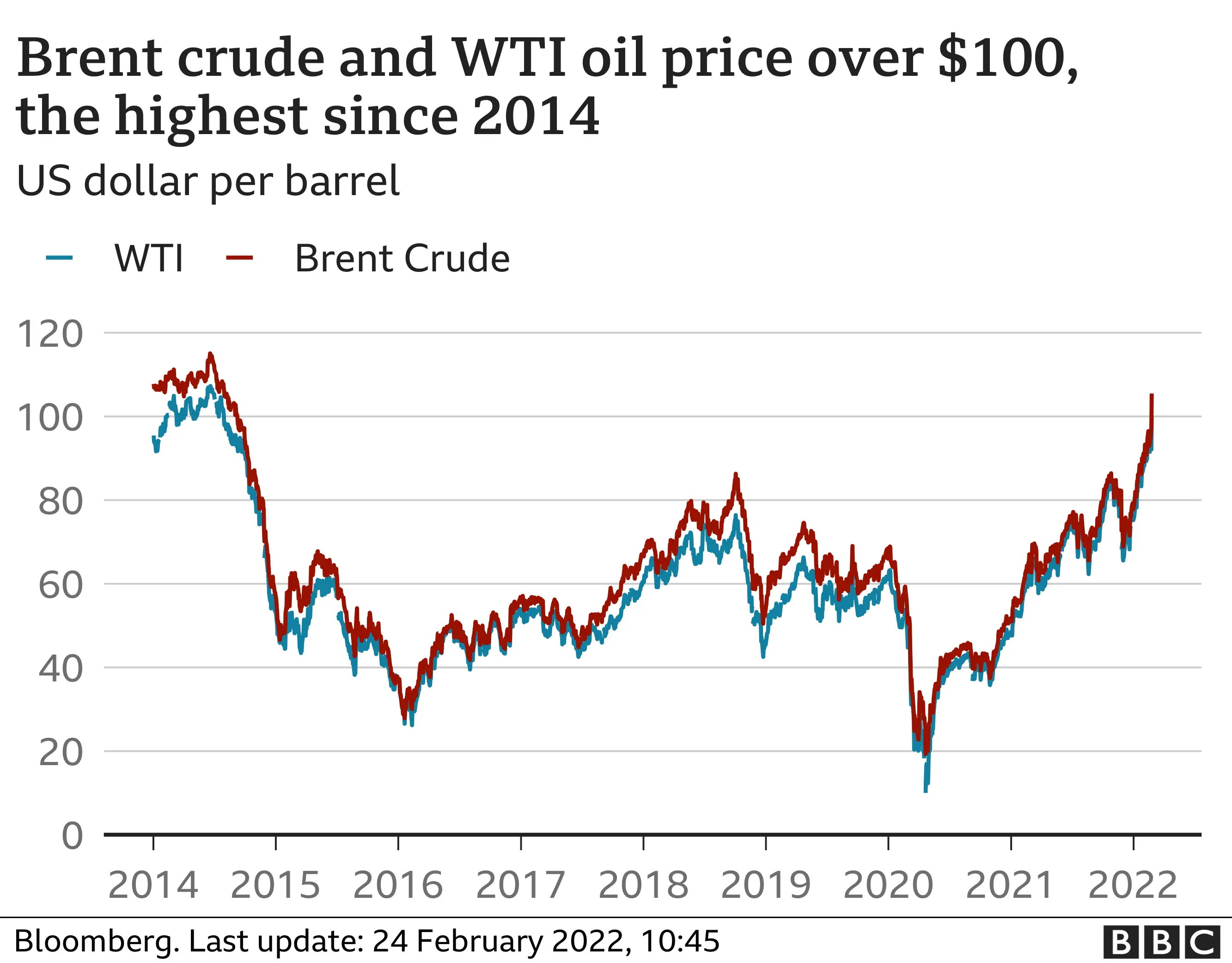

Getty ImagesOil prices surged past $100 (£74) a barrel to hit their highest level for more than seven years after Russia launched an invasion of Ukraine.

Global shares fell on worries of the possible impact of the conflict, but US tech stocks rebounded in late trading.

Russia is the second biggest exporter of crude oil, and is also the world's largest natural gas exporter.

Brent crude eased from $105 to $98 a barrel,but not before UK petrol prices had hit another record high.

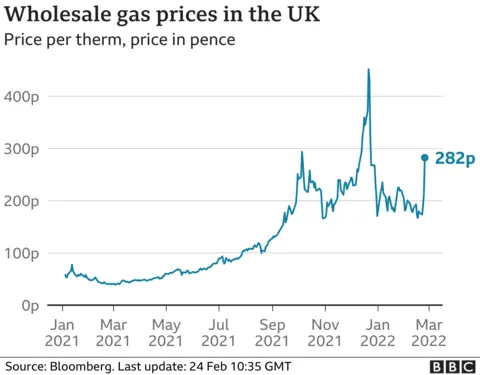

The UK imports 6% of its crude oil and 5% of its gas from Russia, but there are concerns sanctions could constrict supplies and drive up prices worldwide. The price of UK natural gas futures soared nearly 60% on Thursday.

UK consumers are already paying a high price for energy and fuel, with demand surging following the easing of Covid restrictions.

Both the RAC and AA motoring groups said average petrol prices hit a record high of nearly 149.5p on Wednesday, with diesel at 152.83p.

The RAC said that if the oil price reached $110 a barrel the average price of petrol could hit £1.55 a litre.

If prices do get this high it will "cause untold financial difficulties for many people who depend on their cars for getting to work and running their lives as it would sky rocket the cost of a full tank to £85", said the RAC's Simon Williams.

Petrol price movements in the UK are mainly determined by the price of crude oil, and the exchange rate between the dollar and the pound, because crude oil is traded in dollars.

The price of crude oil is up, and the pound is down against the dollar.

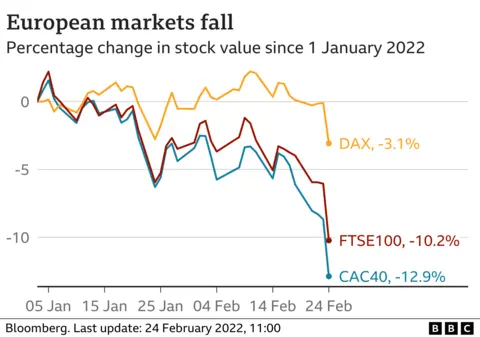

News of Russia's actions led to steep falls on global stock markets. In Europe, the UK's FTSE 100 index fell more 3.9%, its biggest one-day fall since June 2020. Germany's Dax index lost 4%.

In the US, the Dow Jones fell nearly 2% in early trading but a late rally in the tech sector meant in ended 0.3% higher. The tech-heavy Nasdaq index climbed 3.3% and the S&P 500 closed trading up 1.5%.

Shares in Netflix and Microsoft were both up more than 5%, respectively.

After talking with allies from the G7, US President Biden announced measures to impede Russia's ability to do business in the world's major currencies, along with sanctions against banks and state-owned companies.

Wall Street which traded in the red at the start of the day on news of Russia's invasion of Ukraine, hit session highs in the wake of Biden's comments.

The Moscow Stock Exchange saw trading suspended briefly, but when it reopened the index fell by more than a third. On the currency markets, the rouble sank to a record low against the US dollar.

The price of gold - which is considered a haven asset in times of uncertainty - jumped 3% to its highest price in more than a year.

Russ Mould, investment director at AJ Bell, said the oil price surge "was terrible news for businesses and consumers" because "it will serve to further stoke inflation".

"Not only will energy bills keep going up, but food prices look set to jump even higher. Ukraine and Russia are both big food suppliers and any disruption to supplies will force buyers to seek alternative sources, which could jack up prices."

The UK's cost of living is rising at its fastest rate in 30 years, as energy, fuel and food prices continued to soar, squeezing household budgets.

Meanwhile, Mr Mould said the fall in the FTSE 100 "was bad news for the millions of savers and investors who have money in UK equities".

Europe gets nearly a third of its oil and around 40% of its gas from Russia, much of it flowing through pipelines across Ukrainian territory. Small wonder then that prices are shooting up.

Brent crude oil has gone above $100 a barrel, while prices for gas on wholesale markets - where domestic suppliers buy what they need - are up sharply as well.

Supplies from Russia do not appear to have been affected - yet. But the fear that they will be, and that there could be a scramble for other resources, is pushing up costs.

Stock markets across Europe are tumbling, as investors fret about the potential economic impact of high energy prices and the potential for much wider sanctions as well.

And as for Russian shares, a graph showing the performance of the MOEX stock exchange in Moscow looks like a cliff in the Ural mountains today.

Sanctions moves

In response to Russia's military action, the UK, US and European Union are set to put more sanctions on Russia.

There are fears that sanctions, along with the impact of the invasion, could disrupt the supply of agricultural products and raw materials from Ukraine and Russia.

The two countries combined are major wheat suppliers, producing 29% of global exports, most of which travels through ports in the Black Sea.

Russia also produces aluminium, cobalt, copper, diamonds, fertiliser, gold, nickel, palladium, platinum, titanium and steel.

The European Council said it would "impose massive and severe consequences on Russia for its actions".

Ursula von der Leyen, President of the European Commission, said the sanctions "will target strategic sectors of the Russian economy by blocking their access to technologies and markets that are key for Russia".

Russian assets in the EU will be frozen and Russian banks' access to European financial markets will be stopped, she said.

"These sanctions are designed to take a heavy toll on the Kremlin's interests and their ability to finance war," she added.

The biggest economic hit would come from disconnecting Russia's banking system from the international Swift payment system, but that could also affect the US and European economies.

The US and EU have already imposed a series of sanctions in response to Mr Putin's actions against Ukraine. The UK has frozen the assets of five banks and three Russian billionaires, who have also been hit with travel bans.

Meanwhile Germany has frozen final approval for the Nord Stream 2 gas pipeline, which connects the country with Russia and was set to boost Russian gas exports to the EU.