LG Energy Solution: Battery giant jumps in market debut

Getty Images

Getty ImagesSouth Korean battery maker LG Energy Solution has jumped in its stock market debut after becoming the country's biggest ever share offering.

The shares briefly doubled from their initial public offering (IPO) price before ending the day 65.8% higher.

The company raised 12.8tn won (£7.9bn; $10.6bn) in the IPO earlier this month.

Thursday's strong performance made LG Energy Solution the second most valuable firm on Seoul's benchmark Kospi index, after Samsung Electronics.

The IPO is Asia's biggest equity fund raising since China's Alibaba Group raised $12.9bn in its Hong Kong secondary listing in 2019.

The LG Energy Solution listing attracted heavy demand from individual and institutional investors, indicating continued appetite for South Korean companies and businesses associated with the electric vehicles industry.

What is LG Energy Solution?

The company, which has more than 20,000 employees, was spun off from South Korea's biggest chemical company LG Chem.

LG Chem's parent company, LG Corporation, also owns the electronics giant which also bears the LG name.

LG Energy Solution accounts for more than 20% of the global electric vehicle (EV) battery market and supplies car making giants including Tesla, General Motors and Volkswagen.

It also makes batteries for drones and ships as well as supplying battery-powered spacesuits to Nasa.

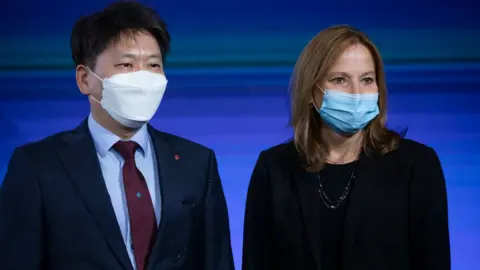

Earlier this week, it announced plans to build a $2.6bn battery factory in the US with General Motors.

The companies said they expect the plant to open in late 2024.

"We will have the products, the battery cell capacity and the vehicle assembly capacity to be the EV leader by mid-decade," General Motors chair and chief executive Mary Barra said.

Getty Images

Getty ImagesWhy are batteries hot property?

As governments and companies around the world set net zero targets, businesses are looking for ways to cut emissions of greenhouse gases, like carbon dioxide, which are released when we burn oil, gas and coal for our homes, factories and transport.

Net zero means not adding to the amount of greenhouse gases in the atmosphere.

Achieving it means reducing emissions as much as possible, as well as balancing out any that remain by removing an equivalent amount.

Reaching net zero will involve moving from fossil fuels to renewable energy for our power, and abandoning vehicles run on petrol and diesel, in favour of those powered by electricity and hydrogen.

That transition will involve a lot of batteries, especially for vehicles.

On Wednesday, Elon Musk, the chief executive of Tesla, said he expects the electric carmaker's sales to grow by more than 50% this year compared with 2021.

That came as it recorded a record $5.5bn earnings for last year as sales rocketed by 71%.

Also this week, the mining giant founded by Australia's richest man is buying the battery and technology arm of the Williams Formula One racing team for $222.2m.

Fortescue Metals is purchasing UK-based Williams Advanced Engineering from private equity firm EMK Capital and Williams Grand Prix Engineering.

The deal is aimed to help the iron ore producer achieve its target to be carbon neutral by 2030.

Last week, a firm planning mass production of electric car batteries in the UK secured government funding for its proposed factory in Northumberland.

Britishvolt announced plans for the so-called gigafactory in Cambois two years ago, saying it would create 3,000 jobs.