Inflation: Four things that are going up in price and why

Getty Images

Getty ImagesEveryone is braced for financial pain as the cost of living rises this year, particularly with energy bills likely to soar from April.

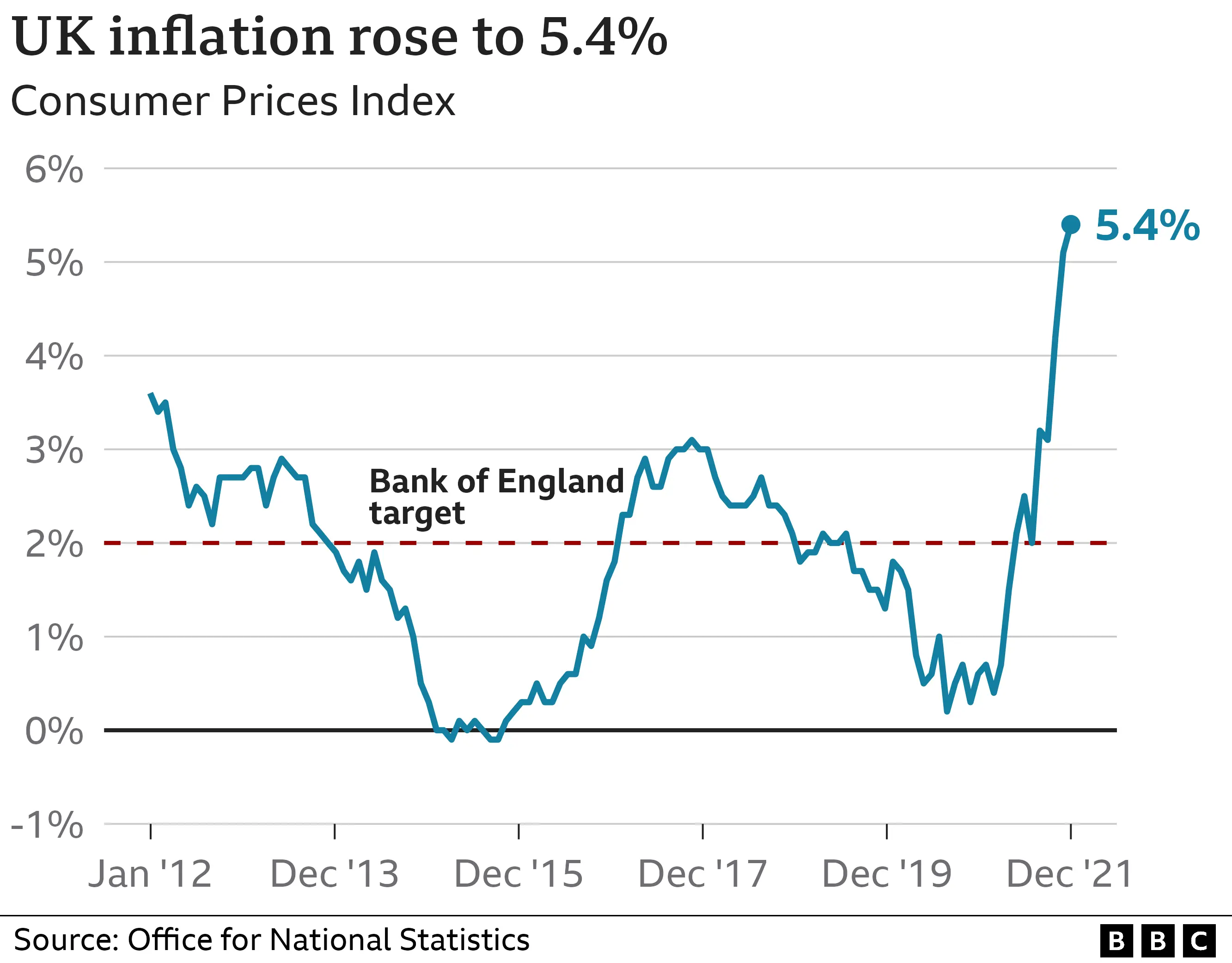

But it is not just gas that is pushing up prices at their fastest rate for nearly 30 years.

Here are some of the less obvious items which have recorded rapid price rises, and some of the reasons behind the increases.

1. Sunday lunch

Those families who still sit down to eat a traditional roast dinner together are having to be a little more imaginative if they are trying to keep the costs down.

Prices of fresh beef rose by 8.6% from a year earlier, information from data firm Kantar shows. Fresh lamb prices were up even more steeply, rising by 10% to around £11 per kilogramme.

Potatoes - another Sunday lunch staple - were also highlighted as a factor in pushing up December's official inflation rate (which measures the rising cost of living), by the Office for National Statistics (ONS).

In fact, food prices in general were key to the rate rising to a level not seen for three decades.

Fraser McKevitt, head of retail and consumer insight at Kantar, says that a lid had been kept on grocery prices for some time, especially at Christmas, but it is "inevitable" that increases are to come.

Supermarkets are facing cost pressures of their own from logistics, manufacturing, farming and distribution. Problems such as driver shortages and rising energy prices will add to those pressures.

"Retailers will be having robust discussions with suppliers, but delayed costs have to flow through and be reflected in what consumers pay," he says.

He points out that when shoppers are faced with grocery price rises of more than 3% or 4% a year, they tend to make bigger decisions, such as cutting back, seeking out promotions, or buying cheaper own-label products.

The trouble is, he says, there are price rises "in nearly every category across the supermarket shelves" and the price gap between discount brands and others is narrower than was once the case.

Richard Walker, boss of supermarket chain Iceland, says he has been seeing an "alarming" rise in the use of food banks.

2. Skincare products

Open the bathroom cabinet and the moisturisers and cleansers you see inside may well have got more expensive recently.

Prices of skincare products typically rose by 9.6% in the 12 weeks to Boxing Day compared with the same period a year earlier, data from the same Kantar survey shows.

Prestige brands, in particular, went up in price even though demand fell, according to analysts. Perhaps people were a little less hung up on their Zoom face.

Skincare tells a story typical of the general cost of living squeeze at the moment, in that no one single factor is causing prices to rise.

Emma Fishwick

Emma Fishwick"The cost of shipping, packaging and raw materials are on the rise and thereby brands have little choice but to increase the price of their products to ensure that their business is sustainable," says Emma Fishwick, from analysts NPD.

She said masks, body creams and eye treatments had recorded some of the biggest price rises towards the end of the year.

Customer behaviour has been changing as a result, she says. Shoppers are increasingly choosing mid-range brands, which can be 60% cheaper than the upmarket options.

"Whilst consumers feel the squeeze, as the cost of living increases, consumers are increasingly turning to these brands as a cheaper alternative," she says.

3. Furniture

In the official figures, sofas and the like come under quite a broad category of "furniture and household goods". The ONS points out prices in the sector have been rising steadily since the start of 2021.

That includes furniture, household appliances - including the cost of fitting them, and even garden equipment.

Getty Images

Getty ImagesThe 7.4% inflation rate of this category in December was the highest since comparable data began in 1989, according to ONS calculations.

Furniture prices are rising for many of the same reasons as skincare products and food. The cost of raw materials - such as wood in this case - as well as transporting them has gone up.

A settee may be considered a luxury item, and one only bought new after saving up the money. A fridge, on the other hand, is a necessity for every family.

What is inflation?

Inflation is the rate at which prices are rising. If the price of a bottle of milk is £1 and it rises by 5p, then milk inflation is 5%.

You may not notice price rises from month to month. But right now, prices are rising so quickly that the money people earn does not go as far.

4. Used cars

Statisticians at the ONS featured the effect of second-hand car prices on the inflation rate as a whole, and not for the first time.

They say used-car prices grew by 28% during 2021, compared with a 7.3% increase the previous year.

Getty Images

Getty ImagesThe cost of manufacturing new cars has risen and has been made difficult by a global shortage of computer chips, as well as other materials such as copper, aluminium and cobalt.

As a result fewer new vehicles have been rolling off production lines.

That has meant more buyers turning to the used-car market, which has pushed up prices.

Added to that, the ONS says there are concerns in the trade about fewer second-hand cars being made available owing to a dearth of one-year-old cars to sell on. Delays in new car supplies have meant extensions of lease contracts and fewer part exchanges, again affecting used car availability.