Energy firms call for green levies on bills to be scrapped

Getty Images

Getty ImagesThe bosses of two energy firms are calling for green levies on bills to be scrapped to help customers facing higher prices.

The founder of Ecotricity described the levies on energy bills as a "stealth tax" of hundreds of pounds a year.

Centrica's boss is also urging government to fund green programmes through general taxation instead.

Thousands of households have seen their energy bills rise in recent months.

Spiralling wholesale gas prices, increased demand for energy in Asia and a summer with little wind have all contributed to soaring costs faced by suppliers and consumers.

Ecotricity boss Dale Vince told the BBC's Wake up to Money programme: "The government talk about high energy prices and bemoan them... but what they don't talk about is the fact they take £9bn a year from our energy bills in a combination of VAT and about five social and environmental policies."

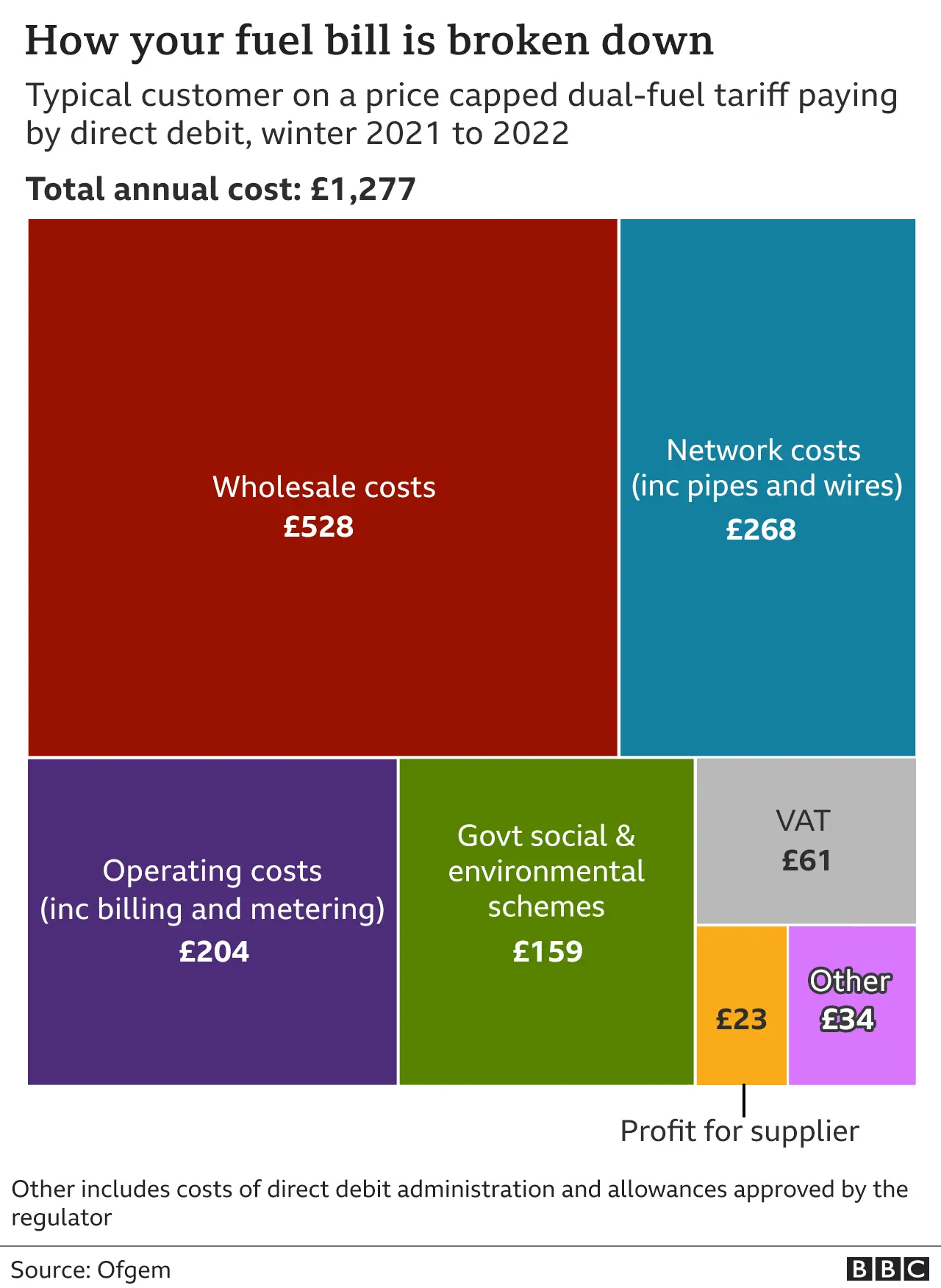

Currently, about 12% of an energy bill set at the level of the Energy Price Cap of £1,277 goes towards funding green energy programmes, such as support for low-carbon electricity generation.

The price cap, which sets the maximum rate a supplier can charge annually on a dual fuel tariff in England, Scotland and Wales, will go up again in April after a review by the regulator Ofgem.

Mr Vince suggested that prices could jump because of green levies applied to bills.

"That's about half of the rise that's coming through the price cap. [The government] could take that away in a flash," he said.

Writing in the Sun on Friday, the chief executive of British Gas owner Centrica, Chris O'Shea, suggested stripping environmental and social levies out of energy bills and to "fund 'green' programmes through general taxation instead".

Mr O'Shea argued the move would reduce annual bills by £170 and spread the cost more fairly.

He also called on the government to consider suspending VAT on energy bills to help struggling households.

Torsten Bell, chief executive of the Resolution Foundation think tank, said suspending VAT would make a "small dent" to higher costs, but that it might not be as effective as it would benefit higher-earners as well.

"The important thing is that we have a much larger intervention aimed at lower-income households," he said.

Getty Images

Getty ImagesEnergy suppliers have already warned that the impact of rising wholesale gas prices on households will be "an enormous crisis for 2022", with fears that bills could soar by another 50% unless the government intervenes.

The idea of targeted financial support for fuel bills - along the lines of the current Warm Home Discount scheme - is emerging as a frontrunner in the race to tackle rising costs, although a number of options are being considered by government officials.

The current scheme offers those receiving certain state benefits the option to apply for a one-off £140 payment every winter.

This could be increased and the number of people eligible could be expanded more broadly.

A spokesperson for the Department for Business said that the current energy price cap was "insulating millions of consumers from high global gas prices".

"We'll continue to listen to consumers and businesses on how to manage the costs of energy."

The department also pointed to schemes currently in place to help those facing high bills, such as the Warm Home Discount scheme, as well as the £500m Household Support Fund, which sees local councils distribute grants to struggling households in England.

Windfall tax

Ecotricity boss Mr Vince also suggested that North Sea gas suppliers should face a windfall tax as some have seen profits increase as wholesale prices have surged.

According to experts at energy consultancy Wood MacKenzie, UK North Sea oil and gas companies are set to report near-record cashflows of nearly £14.9bn for the current financial year.

Shell, for example, said on Friday that it expected "significantly higher" gas revenues in the three months to December, despite ongoing supply issues.

"The North Sea operators have been making a killing this winter," Mr Vince told the BBC.

"A windfall tax would be a fair thing to do, the North Sea operators don't need that money, weren't planning to have that money and it's a hole we've got in the economy somewhere else."

Energy watchdog Ofgem has also put forward a proposal for a third-party finance scheme, where bank loans would allow energy suppliers to spread out the cost of taking on new customers from failed competitors.

The Financial Times reported that NatWest and Barclays were in talks with the regulator, although both declined to comment when asked by BBC News.

Ofgem has launched a consultation on the scheme as an option "which would help reduce household bills from April 2022."

An Ofgem spokesperson said if the scheme were approved, it would help the industry spread extra costs over several years.