Shops step in to supply cash as ATMs close

Getty Images

Getty ImagesA scheme which allows shoppers at convenience stores to get cashback without having to make a purchase is being expanded rapidly over the next few weeks.

Having started as a small trial, it is now available in 900 stores, and will soon be used in 2,000 shops.

Shops are increasingly stepping in to provide cash to customers as ATMs close across the UK.

But one retail group says shopkeepers should not be a substitute for ATMs.

The system operates through a PayPoint network in local stores, and is backed by Link, which oversees the UK's cash machine network.

People using the service can choose to withdraw any amount between 1p and £50, rather than just the notes dispensed by an ATM. They do not have to buy anything in the shop to receive the money, and are not charged a fee.

During the year-long trial, more than 24,800 transactions have been made, with an average withdrawal of £27.81.

ATM closures

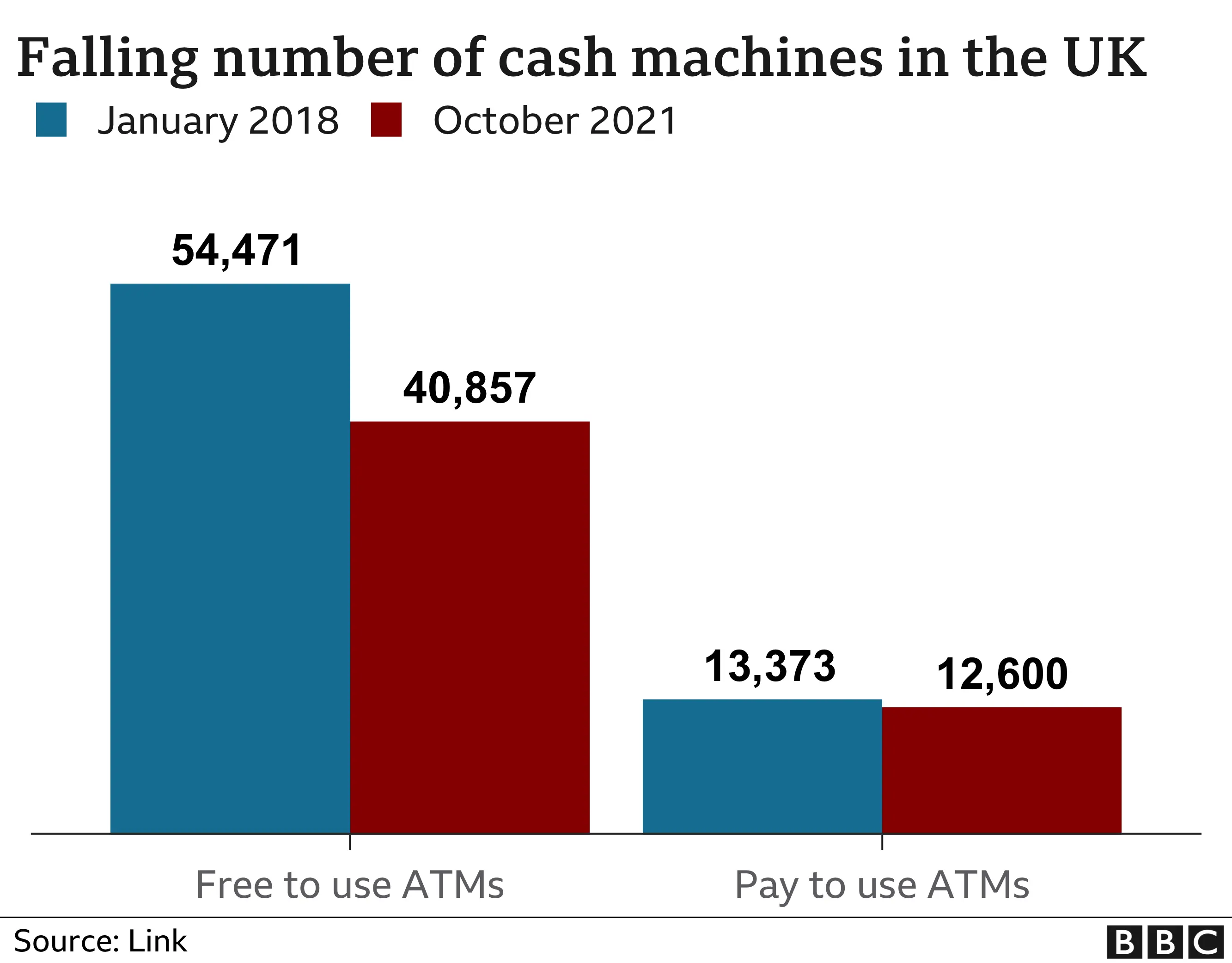

The requirement for the service is the result of disappearing free-to-use ATMs, particularly in less populated areas. There was a 25% drop in the number of free-to-use cash machines between January 2018 and October this year.

Link's own figures suggested that while some wealthier parts of Edinburgh and London saw a sharp fall in demand for cash machines, there remained a greater reliance on cash in areas such as Liverpool, Bradford and Birmingham.

Retailers receive a fee from the cardholder's bank each time the cashback service is used, and groups representing shopkeepers have given a guarded welcome to its expansion.

"Alternative ways of providing cash are essential, which is why we welcome the extension," said Tom Ironside, director of business and regulation at the British Retail Consortium.

"Nonetheless, the provision of cashback is not suitable for all retailers as it often requires them to hold significantly more cash than normal - putting them at an increased crime risk. For this reason, the availability of free-to-use ATMs in all parts of the country remains essential."

Martin McTague, from the Federation of Small Businesses, said: "There's been good anecdotal evidence from this cashback without purchase trial, especially with regards to footfall - shoppers come in to take out cash, and then make unplanned purchases when on site, leading them to build a new relationship with a small business.

"Making the wider roll-out a success depends on getting incentives right."

He said the payments to shopkeepers needed to cover bank fees, which have been ramped up as bank branches have closed, higher insurance premiums owing to having cash on site, and compensation for the time needed to take notes and coins to and from access points.

The government has also given its backing to cashback projects, having changed legislation following the UK's departure from the EU to allow it to happen.

Getty Images

Getty ImagesThe trials, and subsequent extension of the scheme, is part of a wider project trying to ensure notes and coins are accessible to everyone who needs them across the UK.

The latest Financial Lives survey from the Financial Conduct Authority (FCA) showed that more than five million people rely on cash every day.

In July, the FCA, which regulates financial firms, warned that people living in rural areas were having to travel further to find somewhere to withdraw and deposit cash free of charge.

The Age UK charity has said that people require the same guarantee of access to cash as they do for running water, electricity and the post.