Shein: The secretive Chinese brand dressing Gen Z

Shein

SheinIt's a familiar sight scrolling through YouTube, TikTok and Instagram: A teenager dumps a "haul" of clothing from Shein on her bed, trying on each outfit in turn for likes and followers.

The popularity of the Chinese fast fashion firm has exploded during the pandemic. But if you're over 30? Odds are you haven't heard of it.

Targeting trend (and cost) conscious shoppers on social media, the online-only giant adds a staggering 6,000 new items to its range daily.

But it's also drawn criticism over its environmental impact, a lack of transparency and allegations it copies small designers, which Shein denies and says it takes seriously.

So what's behind the success of the company leaving rival fashion brands Asos and Boohoo in the dust?

1. It's cheap - the average item costs £7.90

The little-known founders of Sheinside got together in 2008, led by entrepreneur Xu Yangtian, who started out in digital marketing and selling wedding dresses online.

With a shortened name, Shein (pronounced She-in) started out in its current form five years later.

Although it's based in China, the firm mainly targets customers in the US, Europe and Australia with its cut-price crop-tops, bikinis and dresses, costing just £7.90 ($10.70) on average.

Today it's one of the biggest players in fast fashion, shipping to 220 countries.

The Covid crisis provided the company with a sales boost, says Richard Lim, chief executive of independent consultancy Retail Economics.

"Lockdowns meant that many consumers spent more time browsing online and the fight for brand awareness was taking place across digital platforms.

"This helped the online retailer grow its presence and reach a wider audience more quickly."

While the private company doesn't disclose financial figures, data provider CB Insights estimates that sales topped 63.5bn yuan (£7.4bn/$10bn) in 2020.

2. Huge choice - 600,000 products for sale

At any one time, Shein has as many as 600,000 products for sale on its online platform.

It relies on thousands of third-party suppliers, as well as about 200 contract manufacturers, near its headquarters in Guangzhou.

In what author and Chinese technology expert Matthew Brennan has branded "real-time retail", smaller companies along its supply chain are fed information from its in-house tools on what's trending or how well certain products are performing.

Based on that data, they produce a batch of 50-100 items per style. If it does well? Shein orders more. If not, it's discontinued.

Shein can turn around a new item in about 25 days. For many retailers, it can take months.

It has accelerated the "test and repeat" model, made famous by the likes of H&M and Zara owner Inditex. Just 6% of Shein's inventory remains in stock for more than 90 days, the BBC understands.

The company ships orders to its customers directly, mostly from one 16 million square foot warehouse on the outskirts of Guangzhou.

But its packages often take at least a week to arrive in markets such as the UK and US, unlike competitors such as Boohoo, Asos or OhPolly which offer next-day delivery.

3. It's big on social - 250 million followers

Using an army of influencers, from student "campus ambassadors" to reality stars such as Made in Chelsea's Georgia Toffolo, Shein has amassed more than 250 million followers across its social media channels.

Getty Images

Getty ImagesShein's online presence has been a big driver of its success "as it boosts brand awareness and engagement", says Emily Salter, a retail analyst at GlobalData.

Targeting advertising and sponsoring influencers on Instagram and TikTok has helped it remain relevant among the youngest shoppers.

These efforts have been boosted by the fact that it often hosts live shows on its platforms to promote its products.

"This is more unique to Shein, as live streaming is used less by Western brands but has huge potential to drive sales, as evidenced in China," says Ms Salter.

Its use of customer data has sparked concerns in the UK, however.

Shein was recently described as "manipulative" by web design agency Rouge Media, which identified eight prompts on its website encouraging shoppers to spend more money or give away personal data in exchange for discounts or reward points.

In a study, it analysed 30 of the biggest fast fashion retailers in the UK and scored their websites according to how many of these prompts customers saw before making a purchase.

Chair of the Foreign Affairs Committee Tom Tugendhat said: "Millions of people are signing away their personal data for cheap clothes."

He added: "When the price is too good you have to ask who is really paying and how."

Heather McCurry

Heather McCurryDuring the first coronavirus lockdown, 27-year-old Heather McCurry thought she would order some new leggings to get her through YouTube workouts at home.

Shein's Facebook adverts caught her eye: "Because it's a fast fashion company, you can go on every day and there's new clothes added at a reasonable price."

Eventually, she also snapped up homeware, joggers and even got her mum into shopping on the website.

But it isn't without its faults, she says. Heather suggests that some discount items of clothing have been of a lesser quality.

While she admits she has seen comments online questioning the environmental impact of ultra-fast fashion and how much Shein's workers are paid, she would buy from the company again in future.

"I doubt that any action I would take would make that much difference."

4. It employs 200 designers

Building a colossal range of products and styles at speed means that Shein has come under fire on several fronts.

It has been criticised for selling items such as a Muslim prayer mat described as a "Greek carpet", which it was forced to withdraw.

It has also been accused of copyright infringement and faces lawsuits from the likes of the maker of Dr Martens boots, although the e-retailer has previously denied any wrongdoing.

The fast fashion giant employs 200 in-house designers, out of more than 7,000 employees.

Shein

SheinA senior Shein executive told the BBC that it also has a team reviewing new designs by its suppliers before they reach the website, to try to filter out any infringement issues, which it takes seriously.

Although the firm has paid out more than $1m (£741,000) to independent designers to date, Twitter still sees complaints from smaller businesses. Some claim that Shein has allegedly copied their designs and sold similar items at a lower cost.

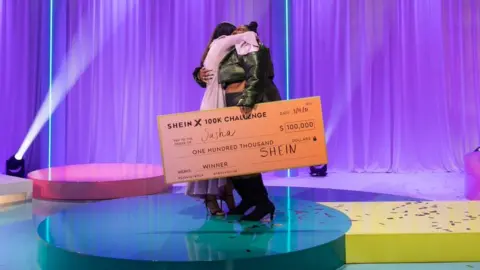

Shein X, the retailer's tutorial programme, recently ran a competition for young designers with a $100,000 (£74,227) prize and fashion collection on offer in a bid to boost its credentials.

Social media users criticised the move though, asking why judges such as fashion designer Christian Siriano and celebrity Khloe Kardashian would attach their names to the project.

5. It's raised questions over sustainability

The prices of Shein's products have also raised questions about its environmental footprint and its labour practices, like many of its rivals.

It's a huge challenge, with the fashion industry accounting for up to 8% of global carbon emissions, according to one UN study.

Roberta Lee, a sustainable fashion stylist, points out that Shein and other fast fashion firms often use polyester fabrics, which rely "on pulling more oil and coal from the ground" and don't biodegrade like natural materials.

She accuses the company of "preying on the fears of outfit repetition syndrome", with Shein pieces in haul videos "likely to be discarded to landfill after just a few wears and washes".

Getty Images

Getty ImagesThe Chinese brand insists that its method of producing clothes in small batches is more efficient and that little goes to waste. A spokesperson said that its business model "balances consumers' wants and needs and the inventory process".

It also points out on its website that it wants to source more recycled fabrics and uses printing technology that is less polluting than traditional screen printing for graphics and patterns.

Meanwhile, a recent investigation by BBC News revealed that job adverts for workers at Shein factories and warehouses appeared on Chinese recruitment websites, which said that those from certain ethnic backgrounds, including Uighur people, must not apply.

Shein said it did not fund or approve the ads and it was committed to "upholding high labour standards".

A Shein spokesperson told the BBC that it has "zero-tolerance policies for forced and child labour and discrimination".

Its customer base, retail analyst Emily Salter says, are "quite contradictory shoppers" overall, with Gen Z more willing to buy second-hand and rent clothing, but also making up the core of fast fashion brands like Shein that have come under intense scrutiny.