UK gas prices fall from record high after Russia steps in

Getty Images

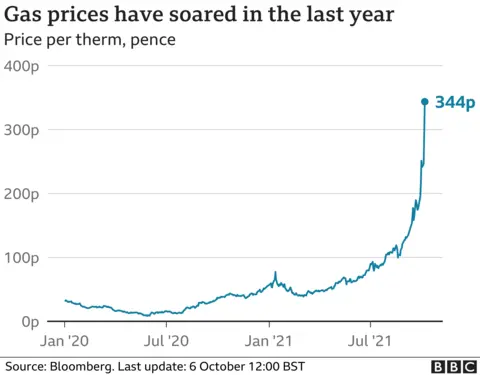

Getty ImagesUK wholesale gas prices hit a record high before falling after Russia said it was boosting supplies to Europe.

Russia President Vladimir Putin appeared to calm the market after gas prices had risen by 37% in 24 hours to trade at 400p per therm on Wednesday.

UK gas was 60p per therm at the start of the year, but high global demand and reduced supply has driven prices up.

The high cost of wholesale gas has seen several UK energy firms collapse and halted production across industries.

Following Mr Putin's comments on supplies, gas prices dropped to about 257p a therm later on Wednesday.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said the changing gas prices underlined the "volatility in the market and the nervousness amongst investors about low stockpiles of gas across Europe".

"When Putin's promises help calm the storm of rising prices which was pummelling financial markets, it's clear investors are desperate for any gust of good news blowing in," she said.

The surge in prices led to Energy Intensive Users Group, which represents steel, chemical and fertiliser firms, calling on the government to help keep businesses and industries running.

Industry leaders said surging costs had already resulted in steel production halting "at times of peak demand".

Last month, US-owned CF Industries shut two UK sites that produce 60% of the country's commercial carbon dioxide supplies because of the rise in gas prices, before the government stepped in to meet its operating costs for its Teesside plant for three weeks.

The shut down led to a shortage of carbon dioxide - a by-product of the fertiliser factories - which sparked warnings from food producers and supermarkets of shortages in the supply of fresh produce. The gas is to stun animals for slaughter and in packaging to prolong shelf life.

"We have already seen the impact of the truly astronomical increases in energy costs on production in the fertiliser and steel sectors," said Richard Leese, chairman of the Energy Intensive Users Group.

"Nobody wants to see a repeat in other industries this winter, given that UK EIIs [energy intensive industries] produce so many essential domestic and industrial products and are intrinsically linked with many supply chains."

A spokesperson for the Department for Business, Energy and Industrial Strategy said: "We are determined to secure a competitive future for our energy intensive industries and in recent years have provided them with extensive support, including more than £2bn to help with the costs of energy and to protect jobs.

"Our exposure to volatile global gas prices underscores the importance of our plan to build a strong, home-grown renewable energy sector to further reduce our reliance on fossil fuels."

Firms go under

Besides industry struggles, a total of nine energy suppliers have collapsed in recent weeks, which has affected nearly 1.73 million customers in September alone.

The companies that have gone bust have been mostly smaller firms, which have been unable to deliver price promises to customers because of the surge in gas prices.

Firms going bust has also had a knock on effect to auto-switching services, with Look After My Bills, famous for its popularity on BBC Two's Dragon's Den, "pausing" its operations, and fellow auto-switching company Flipper closing down completely.

Getty Images

Getty ImagesFlipper said in a statement that it had withdrawn from the market and was closing because it could "no longer sustain the great savings" its customers had "come to expect".

Meanwhile, Look After My Bills said it was "temporarily pausing" its switching service, but would be "back as soon as we can" access energy deals "right" for customers.

Affected customers have been told they will be switched to a new tariff by energy regulator Ofgem and be contacted by their new supplier.

It has advised people to take a meter reading and to wait until a new supplier has been appointed before looking to switch to another energy firm.

Customers face higher bills

Jonathan Brearley, the boss of Ofgem, has warned that the cost of protecting customers from failing energy providers could lead to higher bills.

A higher energy price cap came into force on Friday, with those on standard tariffs, with typical household levels of energy use, seeing bills go up by £139 to £1,277 a year.

Customers are protected from sudden hikes in gas prices through the energy price cap, which sets maximum prices and charges for those on a standard or default tariff.

However, the next revision of the cap, which will affect bills from the start of April, is likely to rise significantly to reflect the greater costs faced by suppliers.

Analysts at energy consultancy Cornwall Insight have predicted the next cap will mean the typical household will have an annual bill of £1,600 and the impact of the crisis could be felt into 2023.

"The explosion of choice and innovation seen in the sector in the last decade by challenger suppliers has been fundamentally altered in a matter of months, and while all eyes will inevitably be on this winter, the need for an enduring solution to ensure that the gains experienced by almost three decades of competition are not lost," said its senior consultant, Craig Lowrey.