FCA signs up celebrities to warn of investment risks

TikTok

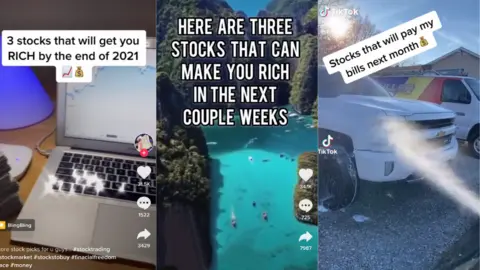

TikTokInfluencers are to be signed up by the City regulator in a campaign to warn people about the pitfalls of high-risk investments.

Some celebrities have been criticised for their part in promoting trading apps which have proved popular among young people drawn into investing.

The Financial Conduct Authority (FCA) wants to reach these risk-takers in a planned £11m awareness campaign.

It is part of a wider strategy to ensure investors are well-treated.

"Investors have never had more freedom. Technology has democratised the market, new products have become available and people have better access to their life savings than before," said Sarah Pritchard, executive director of markets at the FCA.

"But that freedom comes with risk. We want to give consumers greater confidence to invest and to help them do so safely, understanding the level of risk."

In the strategy, the FCA has repeated its warning that some people have invested money for the first time during the pandemic in products which have unsuitably high risks for their financial circumstances.

It has warned they are getting involved in cryptocurrencies and foreign exchange owing to the thrill of investing, rather than for long-term savings goals.

Getty Images

Getty ImagesAlongside that, there has been concern that some celebrities have been endorsing certain products without making their own gain clear.

In August, an Instagram post by TV star Lauren Goodger was banned because she did not clearly mark it as an advert.

A survey by investment platform Interactive Investor found that 45% of young investors aged 18 to 29 said their first ever investment was in cryptocurrency, while many were funding this through a cocktail of credit cards, student loans, and other loans.

As a result, the FCA is planning a campaign to help people make well-informed decisions.

"We plan to use a range of channels to reach our audience, including partnerships with influencers, social media, online videos, paid ads on Google and more," the strategy said.

Investment gains

The FCA also points out that nearly 8.6 million people currently hold more than £10,000 of investible assets in cash.

In a major boost for the investment industry, in the next five years the regulator aims to reduce the number of consumers by a fifth who could benefit from investment earnings but are missing out.

This could potentially mean 1.7 million people, each with more than £10,000 put away, making the jump from cash savings to investments.

Laura Suter, from investment company AJ Bell, said: "For many of these individuals, investing is a logical route, as they don't need the safety of cash or immediate access to their money, but it's often a job on the to-do list that people don't get around to."

Liz Field, of the Personal Investment Management and Financial Advice Association, said that the FCA should have been more ambitious in its supervisory role.