The collapse of Enron and the dark side of business

Getty Images

Getty ImagesI was crouching on the marble floor of a US Senate committee room, hunched over a recording machine, as witnesses swore to tell the truth about the breath-taking collapse of Enron, the seventh largest company in the US.

Just a few months earlier in 2001, this brash Texan energy giant had been exposed for hiding huge losses, and declared bankruptcy.

You could have heard a pin drop as former Enron executive and whistleblower Sherron Watkins recounted to Senators how she uncovered the accounting scandal.

Later, she told me blowing the whistle had been like telling the Titanic captain "we've hit an iceberg, sound the alarm, come up with a plan" but the response was "icebergs don't matter, we're unsinkable". I went on to report on the fraud trials and convictions in 2006 of Enron's chairman Ken Lay and CEO Jeffrey Skilling.

Getty Images

Getty ImagesThis story was supposed to be a game-changer. US Senators, regulators and business leaders told me that it was a watershed moment for global business, that rules would be re-written and corporate culture changed forever.

Twenty years after Enron's demise, I wonder what has actually changed.

One of the key checks on the way businesses operate is the external audit by accountants who inspect the books. In Enron's case, that was the firm of Arthur Andersen.

Speaking today, Sherron Watkins says that "Enron was able to push Andersen around". Andersen had won lucrative, non-audit consulting work from Enron, and would not want to jeopardise the relationship by raising the red flag.

Andersen collapsed in 2002, its reputation destroyed by the Enron story. The US quickly passed the Sarbanes Oxley Act which meant auditors of publicly traded companies are barred from providing most consulting services to audit clients. It also forced CEOs and CFOs to personally vouch for the accuracy of accounts.

Getty Images

Getty ImagesIn the UK, there was little or no reform in response to Enron.

And according to Labour peer Prem Sikka, emeritus professor of accountancy at Essex University, that fundamental conflict of interest remains. He argues auditors are not independent: "Companies select their auditors. It's a bit like a beauty contest."

He says the firm which provides auditors often advises on other things and becomes dependent on the client for fees, forming a "very, very close relationship with directors".

Since 2001, we have seen a series of high-profile accounting scandals where the role of auditors has come under scrutiny. They include BHS, Patisserie Valerie and Carillion in the UK.

And Germany last year was rocked by an accounting scandal at the electronic payments company Wirecard, a politically-savvy stock-market star.

In June 2020, it admitted €1.9bn (£1.6bn) of cash on its books "probably did not exist". Its CEO Markus Braun was arrested on suspicion of accounting fraud and market manipulation. He has denied the allegations, saying that the company was the victim of fraud. He is in custody awaiting trial.

Getty Images

Getty ImagesThe scandal was first uncovered by Financial Times reporter Dan McCrum, alerted by a hedge fund manager who asked if he would be "interested in some German gangsters".

Dan McCrum told me that his investigations showed "most of Wirecard's profits and about half of their sales, were simply made up".

It took six years, with the help of whistleblowers, before the story was taken seriously. Dan says his team were subject to extensive surveillance. The German authorities even initially accused them of manipulating Wirecard's share price.

Wirecard's auditors were the accountancy firm, EY, one of the "Big Four" largest global firms. EY told us the fraud was brought about by "a highly complex criminal network designed to deceive everyone including auditors".

Financial Times

Financial TimesI've sat through some big fraud trials in my time, and I always wonder what kind of person is willing to fiddle the books. According to counter-fraud expert Mark Button, criminology professor at Portsmouth University, one study shows fraudsters are likely to be extroverts with an ability to lie, able to "rationalise fraud as a normal sort of task, just shifting money around".

Dan McCrum says in his experience of reporting numerous frauds, such businesses are run "by psychopaths" with the ability to "look people in the eye and lie and lie again".

If these characters are liable to push the envelope with our accounting rules, how are the authorities dealing with that? In the UK, radical reform of external auditing has been long overdue, according to three independent reviews.

Last year the Financial Reporting Council said more than a third of audits fell below expected standards and that there wasn't enough scepticism among auditors, or challenge of company directors.

In April 2021 the UK government published a White Paper which would hold directors of large companies responsible for the accuracy of financial statements.

A new independent regulator of auditing will be set up and the Big Four firms may be forced to share audit work with smaller rivals. There will be a "separation" of consulting and auditing arms in these firms, though this stops short of a break-up.

According to Prem Sikka, the measures do not address the "corrosive culture" in accountancy firms, devoted to keeping clients happy. He argues companies "don't really need to perpetrate frauds" as there is so much discretion available to directors to use accounting loopholes.

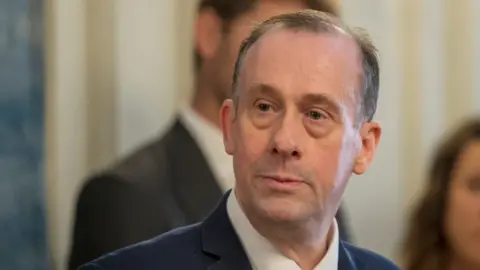

Getty Images

Getty ImagesLord Callanan, minister for corporate responsibility says: "The vast majority of companies, the vast majority of audits are honest and truthful. We can't avoid all cases of fraud. We can try to discourage it, make directors more responsible and we can certainly give auditors the power to to uncover these cases."

A Bad Business is broadcast on BBC Radio 4 on Tues 3 August at 20:00BST. A longer version will be broadcast on BBC World Service at 12:06BST on Sat 21 August.