Sainsbury's: Cost of Covid has been high

Getty Images

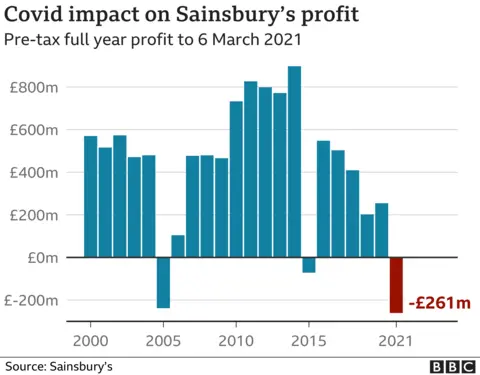

Getty ImagesSainsbury's has slumped to a £261m loss despite bumper food and Argos sales during the coronavirus pandemic.

The supermarket giant said that in the year to 6 March Covid costs "to help keep our colleagues and customers safe" had been "high".

However, it said it expected profits to bounce back in the coming year.

Rival Tesco reported a sharp fall in profits earlier this month after spending nearly £900m to carry on trading during the pandemic.

Sainsbury's said it had spent £485m on Covid-related costs, including paying colleagues that were required to shield or needed to self-isolate. It also paid back business rates relief on its stores in line with rivals.

The supermarket giant also paid out restructuring costs, including to close 170 standalone Argos stores.

Sainsbury's £261m pre-tax loss for the year was despite like-for-like sales rising 8.1%.

Online surge

Argos did especially well, with total sales rising almost 11% as digital sales boomed.

However, Argos standalone stores, rather than those inside the supermarkets, were closed for much of the year during lockdowns.

Sainsbury's online sales rose as coronavirus restrictions accelerated internet shopping. Online jumped from 8% of grocery sales to 17% during the year.

The retailer has already embarked on a restructuring, and announced in March that 1,150 jobs were at risk.

Despite a big jump in food sales Sainsbury's is nursing a £261m loss.

Supermarkets have been among the big winners during the pandemic but they've also had huge Covid-19 costs, from keeping workers and customers safe to sick pay for staff who've had to shield.

Sainsbury's also incurred £617m of exceptional costs. Most of this was the result of closing hundreds of standalone Argos stores as it restructures the business.

The boss says that like his customers, he's looking forward to things feeling more normal over the coming months.

But what is the new normal going to look like for our big grocers?

It's not just about the shift to online, grocers are thinking about the future of work, and how to respond if many of us don't return to five days a week in the office.

Sainsbury's is pressing ahead with plans to open more convenience stores and new neighbourhood hub shops - mini supermarkets in smaller towns - which could be a shrewd move if we're going to be working more from home and shopping locally.

Chief executive Simon Roberts praised the "heroic" efforts of staff to keep the business going during the pandemic, but added: "The cost of keeping colleagues and customers safe during the pandemic has been high."

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said the costs of operating through the coronavirus crisis have "seriously dented" the supermarket giant's bottom line.

"Redesigning layouts to keep customers and staff safe, paying colleagues in full who needed to shield, all added [to costs] with £485m spent on Covid related costs," she said.

Sainsbury's also spent £100m on higher staff salaries and special recognition payments to colleagues "for their efforts during the crisis", Ms Streeter added.

Keith Bowman, equity analyst at Interactive Investor, said the results offered "broad optimism" for the future.

"[But] intense competition across the sector, including from discount retailers Aldi and Lidl, cannot be ignored," he said.

Small store boost

On Wednesday Sainsbury's reiterated plans to open 25 to 30 convenience stores per year for three years.

Mr Roberts said this would tap into the coronavirus trend of more people working from home.

He said the return of people working a five day week in the office "is not going to happen".

"As customers find new ways of working it inevitably will mean some of the week working from home," he said. "We believe convenience stores will play a big part in the local community."

Sainsbury's already has more than 800 convenience stores, and those "acted as mini supermarkets in the crisis with sales up 13% on the year," he said.

"Hundreds of these stores will be in in important locations for customers as they work locally," he added.