UK inflation rate falls as clothes prices drop

Getty Images

Getty ImagesSharply lower clothes prices and cheaper second-hand cars caused an unexpected fall in the UK's inflation rate in February.

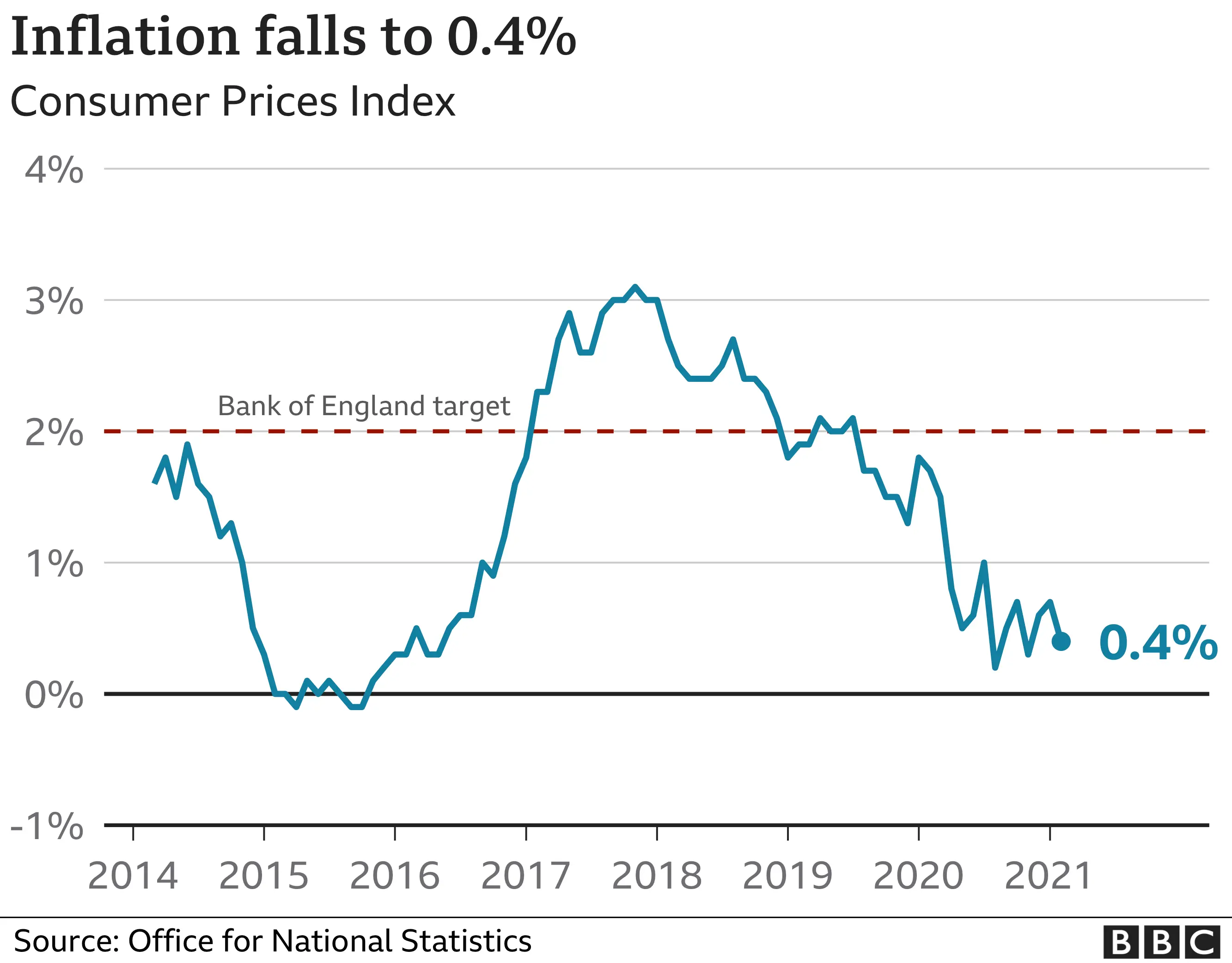

The Office for National Statistics (ONS) said the rate fell to 0.4% last month, down from 0.7% in January.

Economists had expected inflation to rise slightly, driven by increasing fuel and energy prices.

But the impact of rising fuel costs was offset by downward pressures in other areas, including travel costs and toys.

February is traditionally a month where clothing prices would rise. But ONS deputy national statistician, Jonathan Athow said: "The impact of the pandemic has disrupted standard seasonal patterns."

Clothing and footwear prices fell between January and February for the first time since 2007 and are 5.7% lower than a year before, the biggest annual decline since November 2009.

The ONS said second-hand car prices had been rising during 2020 as people sought alternatives to using public transport.

Samuel Tombs, chief UK economist at Pantheon, said that despite inflation's "sudden drop due to temporary weakness in clothing prices" he still expected the rate to exceed 2% later this year.

"The lockdown has left clothing retailers with considerable excess stock to shift. Clothing prices likely have rebounded this month, now that retailers have introduced new seasonal ranges," he said.

Hannah Audino, economist at PwC, said that as lockdowns ease, inflation will tick higher as consumers "unleash some of the £150bn of excess savings on the economy" built up during 2020.

"Businesses will also be looking to recoup lost revenues from the past year, although the extension to the VAT cut for the hospitality and leisure sector will continue to exert some downward pressure on prices," she said.

Pump prices

Many economists had predicted inflation would rise slightly in February to about 0.8%, driven higher by a big rise in fuel prices.

The ONS said that between January and February petrol prices rose by 3.6 pence per litre, and diesel prices rose by 3.4 pence per litre. Fuel prices fell in the same period last year.

Crude oil prices have been rising, which is expected to feed through into even higher costs at the pump, and household energy bills are also increasing after suppliers raised prices.

Wednesday's data came a week after the Bank of England had warned that the inflation rate would approach its 2% target level in the coming months, mainly due to energy price increases.

The BoE also left record-low interest rates at 0.1% last week and forecast that economic growth would recover towards pre-Covid levels this year.

That expectation of faster growth was underlined on Wednesday in a survey that indicated the pace of new orders being placed by companies was increasing.

The IHS Markit/CIPS purchasing managers' index rose to a seven-month high of 56.6 in March from 49.6 in February, which was much higher than economists' forecasts. A figure above 50 denotes expansion.

IHS chief business economist Chris Williamson said the surge in order activity, along with recent better news on jobs growth, "point to robust economic growth in the second quarter, especially if virus restrictions are lifted further".