House prices up 8.5% in 2020 amid tax holiday

BBC

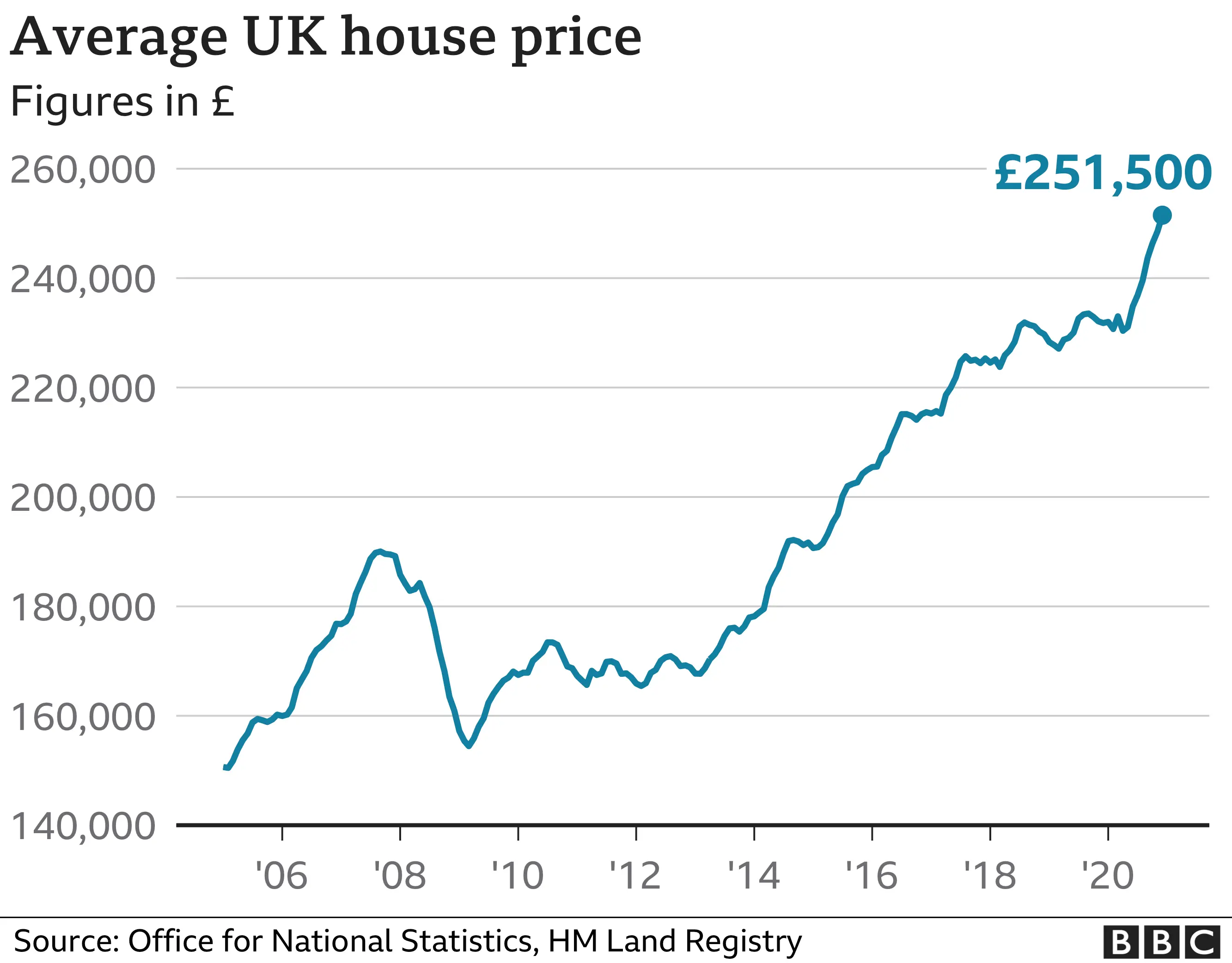

BBCUK house prices climbed 8.5% in 2020, the highest annual growth rate since October 2014, according to official figures.

The average UK house price reached a record high of £252,000 in December 2020, the Office for National Statistics said.

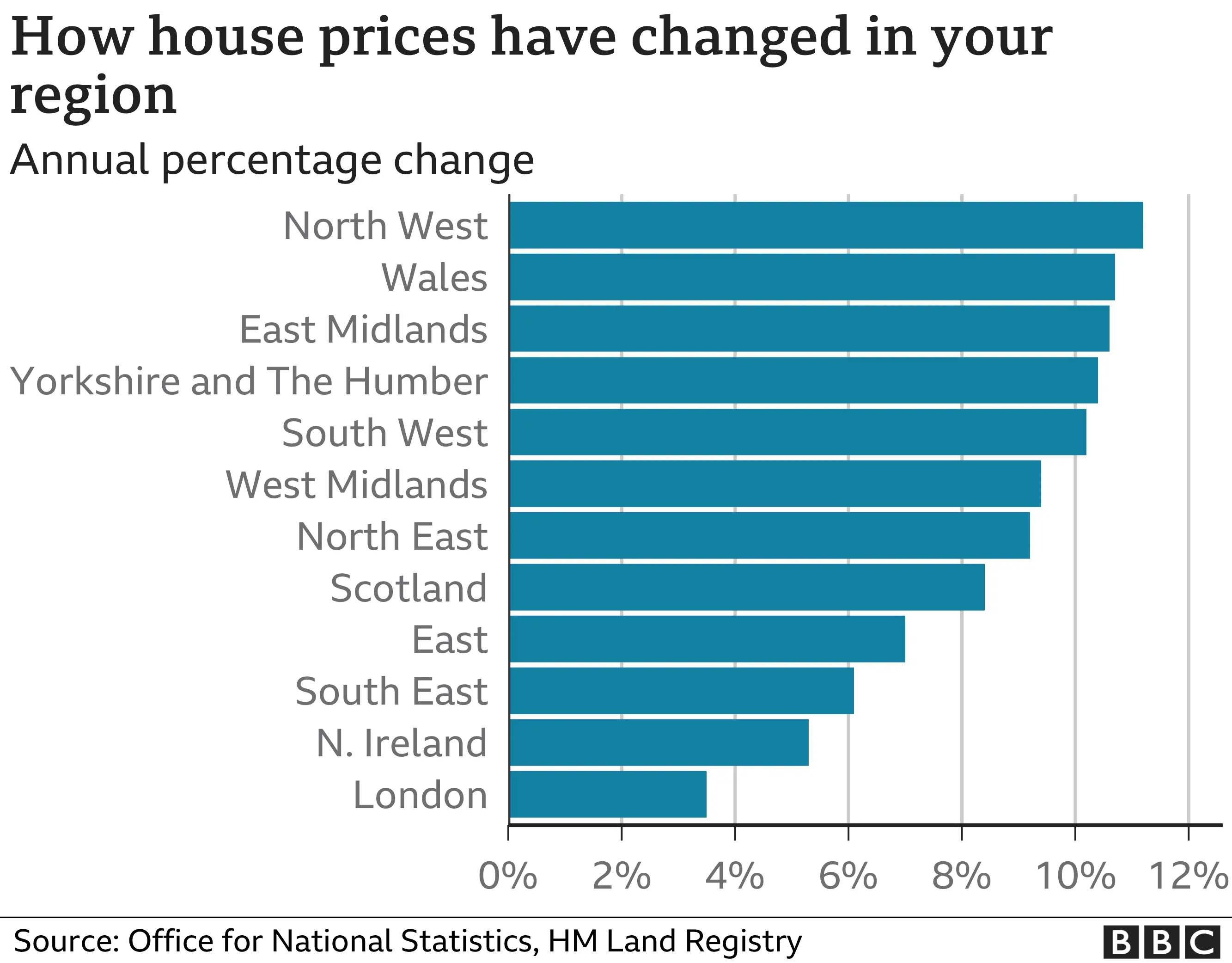

The North West had the highest growth of 11.2%, while London rose just 3.5%.

The stamp duty holiday due to end this March contributed to the rise, the ONS said.

Spending more time at home in the pandemic meant some people also decided they needed more space.

That was reflected in the average price of detached properties climbing by twice as much as flats and maisonettes during 2020, up 10% and 5% respectively.

Meanwhile Wales experienced the fastest price growth, with property values rising 10.7% to £184,000.

In England, prices climbed 8.5% to £269,000, in Scotland, 8.4% to £163,000 and in Northern Ireland 5.3% to £148,000.

"Recent price increases may reflect a range of factors including pent-up demand, some possible changes in housing preferences since the pandemic and a response to the changes made to property transaction taxes across the nations," the ONS said.

Regional variations

The UK housing market is made up of lots of local markets, with different factors affecting property prices such as the performance of schools and the availability of jobs. The ONS figures are based on sale completions.

Although average London prices were up by 3.5%, over last year, prices fell in the capital by £5,000 between November and December, despite a UK-wide price increase of 1.2% over the month.

But the city still has the highest average house price in the UK, at £496,000.

The North East continued to have the lowest average house price at £141,000, and has become the final English region to surpass its pre-economic downturn peak of July 2007.

Cheap debt

"2020 was the year that fundamentals came home to roost," said Nicky Stevenson, managing director at estate agent Fine & Country.

"There was no escaping a lack of space for households who suddenly found they were living on top of each other with little respite. That has powered annual growth that reached a six-year high."

There were four major drivers of overall house price rises in 2020, said Anna Clare Harper, chief executive of asset manager SPI Capital.

"The temporary stamp duty reduction and cheap debt as a result of very low interest rates, which give buyers a 'discount'; the release of pent-up supply and demand and desire to improve surroundings amongst existing homeowners; and the 'flight to safety', since in times of uncertainty, people want to keep their money in a stable asset with low volatility.

"But looking to the future when the temporary stamp duty reduction ends, we're likely to see a slowdown in house price rises," she said.

"However, there is still some life in the market as lockdown helps to concentrate many potential buyers and sellers' minds as far as moving is concerned," said north London estate agent Jeremy Leaf.

"Intense speculation remains as to whether the 31 March stamp duty deadline will be extended and we can't help but have sympathy for many who have started the process several months ago who have been unavoidably delayed by a backlog in searches, surveys, conveyancing, or all three, to say nothing of problems in the new-build industry."