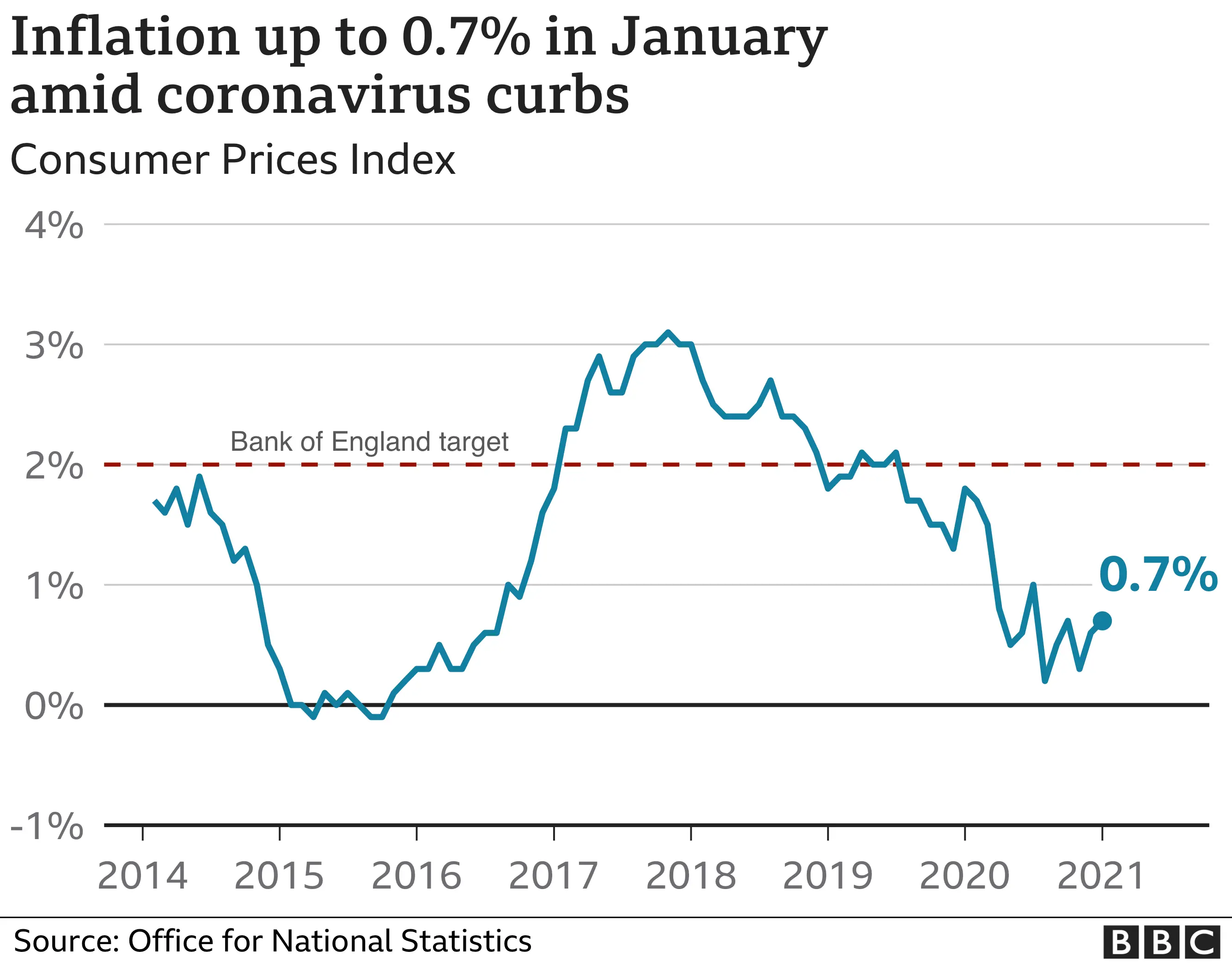

Warnings inflation could breach 2% target as prices rise

Getty Images

Getty ImagesPrices rose in January in what some economists warned could mark the first step towards increasing costs post-lockdown.

Consumers paid more for food and sellers of household goods offered smaller-than-usual New Year discounts, official figures suggest.

Inflation rose 0.7% in the 12 months to January, up from December's 0.6%.

Some experts warned inflation will exceed the Bank of England's 2% target by the end of 2021.

What is inflation?

Inflation is the rate at which the prices for goods and services increase.

As well as giving a snapshot of the price of our shopping and services, it influences interest rates and therefore our mortgages and is used to set regulated items, such as train tickets.

It's one of the key measures of financial well-being, because it affects what consumers can buy for their money. If there is inflation, money doesn't go as far.

A little inflation, however, typically encourages people to buy products sooner and makes it easier for companies to put up wages. And both of those things boost economic growth.

Most countries' central banks have an inflation target of between 2% and 2.5%.

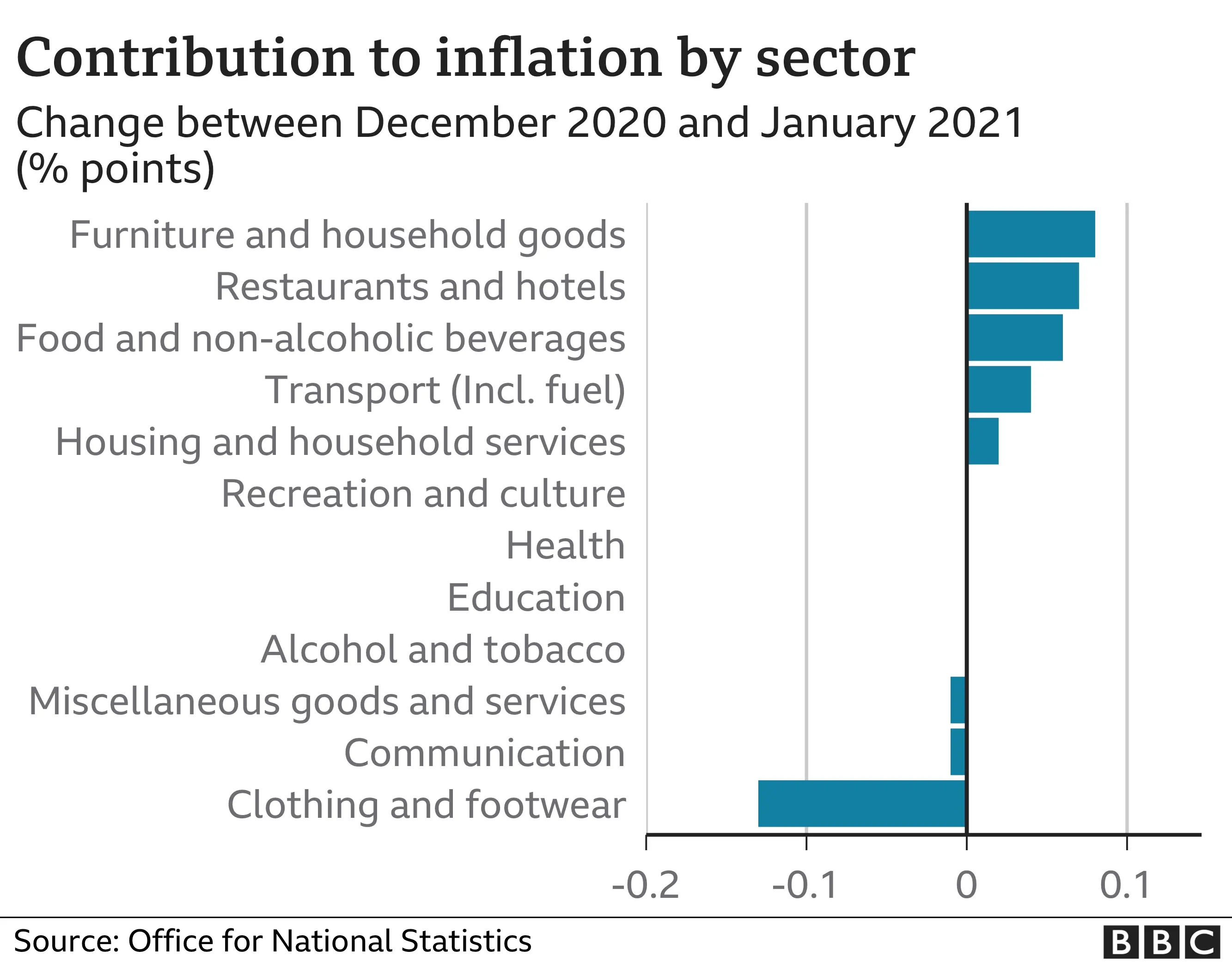

What are the main factors behind January's figures?

According to the Office for National Statistics (ONS), food prices rose by 0.6% in January, compared with a fall of 0.1% last time.

Premium potato crisps and cauliflowers saw big increases after being discounted before Christmas. The price of fresh salmon and frozen prawns also rose.

Jonathan Athow, deputy national statistician for economic statistics at the ONS, said household goods prices were also higher because there had been less discounting on items such as bedding or sofas.

But Mr Athow pointed out that January discounting had continued for some goods, and there was a 4.6% fall in the cost of clothing and footwear.

Experts said fashion is typically discounted in December and January for festive shoppers.

Surprisingly, another large contributor to rising costs was restaurants and hotels.

Prices in this category were estimated to have risen by 0.9% between December and January, largely driven by hotels. Holiday travel is not allowed under current lockdown rules, but hotels are open for people travelling for work and more recently people arriving from high risk countries who must quarantine.

Could inflation exceed the 2% target?

Some experts warned on Wednesday that inflation could exceed the Bank of England's 2% target by the end of 2021.

"January's small rise in CPI inflation marks the first step this year towards an above-target rate by the autumn," Samuel Tombs, chief UK economist at Pantheon Economics said.

As cuts in VAT for hospitality and tourism end at the end of March and energy prices rise, "that alone should push prices up and we expect it to be up at around 2% at the end of the year, but it could be higher than that", said Karen Ward, chief market strategist for Europe at JPMorgan Asset Management.

She added that there could also be an "explosion in demand and perhaps not quite enough goods and services to fulfil that" when lockdown restrictions are finally eased.

She told BBC Radio 4's Today programme that this would mean the Bank of England's next change to interest rates - which are currently at 0.1% - would probably be upwards, though not for some time.

But Ed Monk, associate director at Fidelity International, said that the picture overall was "pretty confusing for prices right now".

"It will take a few months and an ending of current restrictions for the full picture to emerge," he said.

In the long-term, he said that prices will also depend on how the labour market fares once the government's furlough scheme has ended.

"Any increase in unemployment rates could suppress wage and price rises," he said.

The UK's coronavirus vaccine rollout is also likely to push up inflation as the economy unlocks and consumers may start spending roughly £125bn in pent-up savings, the Bank of England has previously suggested.