Pandemic prompts Super Bowl ad rethink in US

Anheuser-Busch

Anheuser-BuschBudweiser has said it will not advertise its beer during the Super Bowl this year, joining a growing number of big brands sitting out the annual American football championship.

The event remains one of the most-watched in the US each year, drawing more than 100 million viewers in 2020.

The advertisements are often as much a conversation-starter as the game itself, sometimes sparking controversy.

Firms say the virus has made finding the right message especially difficult.

Others are grappling with financial hits caused by the pandemic, which has dampened spending on many items, while also casting more than 10 million Americans out of work, resurfacing racial and economic inequalities and sharpening political divisions.

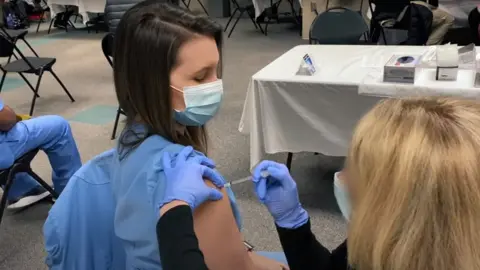

Budweiser's parent company, Anheuser-Busch, said it planned to reallocate the money it would have spent on a 30-second Budweiser spot during the game to support an Ad Council campaign promoting coronavirus vaccination.

It is the first time the flagship brand will not make a game-time appearance in 37 years.

Budweiser

Budweiser"This commitment is an investment in a future where we can all get back together safely over a beer", it said, adding that it would still promote some of its other brands, such as Bud Light, during the game.

On Monday, Budweiser released a full 90-second Super Bowl ad on YouTube entitled "Bigger Picture", which showed US citizens overcoming pandemic challenges together and aimed to raise awareness about Covid-19 vaccines.

Coke, Pepsi and Hyundai are among the other major names also planning to forego airtime during the broadcast.

Budweiser, Coke, Pepsi pull back

Coca-Cola said it had made the "difficult choice" to "ensure we are investing in the right resources during these unprecedented times". The firm did not advertise during the 2019 game either.

Hyundai cited "marketing priorities" and the timing of upcoming vehicle launches.

Pepsi has also said it would not promote its flagship soda during the game. Instead, it is spending money on an advert airing to promote the Super Bowl halftime show it has sponsored for almost a decade.

Adam Glanzman/Getty Images

Adam Glanzman/Getty Images Given all the economic, political and health questions of 2020, companies may have felt it was prudent to pull back - especially several months ago, when they would have had to start planning for such a high-profile night, said Kimberly Whitler, professor at the University of Virginia's Darden School of Business

"It's the biggest night of TV watching and so they have to plan it months in advance," she said. "There was so much uncertainty that to go and invest in a Super Bowl ad might have actually felt or seemed frivolous at the time."

The decision goes "beyond finances", she added. "It's also, 'How do we identify the right tone that will match the moment'."

'Major opportunity'

This year's Super Bowl will see star quarterback Tom Brady's Tampa Bay Buccaneers face off against reigning champions the Kansas City Chiefs on 7 February.

Last year, firms spent an average of $5.25m (£3.8m) for a 30-second spot during the championship, driving Super Bowl ad spending to a record $450m, according to Kantar consultancy.

The firm has said its research suggests Super Bowl ads are "typically 20 times more effective" in changing a brand's perception than a normal advert.

Anheuser-Busch, an official sponsor of the National Football League, is typically one of the night's top spenders, so the absence of its flagship brand may create its own buzz, said Satya Menon, a Chicago-based managing partner of of ROI practice at Kantar.

Chipotle

Chipotle"Budweiser in particular is a very established brand ... so for them, it's all about generating love and goodwill and maybe this is another way," she says.

"They do have a lot of pre-game advertising out there. When people have the expectation that they wil be there and then they don't see the brand, they'll start thinking why are they not."

Meanwhile, the sports showdown still seems to be finding plenty of firms ready to fill spots left by the stalwarts. Names of newcomers include Chipotle and Fiverr, a freelance platform that has seen business soar during the pandemic.

"It doesn't get any bigger than the Super Bowl from a branding and marketing perspective," said Fiverr's chief marketing officer Gali Arnon. "We believe this is a major opportunity for us to introduce the world to Fiverr in a unique and creative way."

Many of this year's advertisers are firms coming from the e-commerce sector, which have benefited from the pandemic, Ms Menon said.

And though audience numbers for NFL games have slipped this year, for those firms making their game-night debuts, Ms Menon says she still expects ads to have a big impact - even if the pandemic puts a damper on the traditional Super Bowl parties and other festivities, which can make championship feel like an unofficial national holiday.

"There isn't very much going on in life, so it will always have that great reach," she says. "Some of that excitement may not be there, but watching will definitely be there."