Clothing and food price falls drive down UK inflation

Getty Images

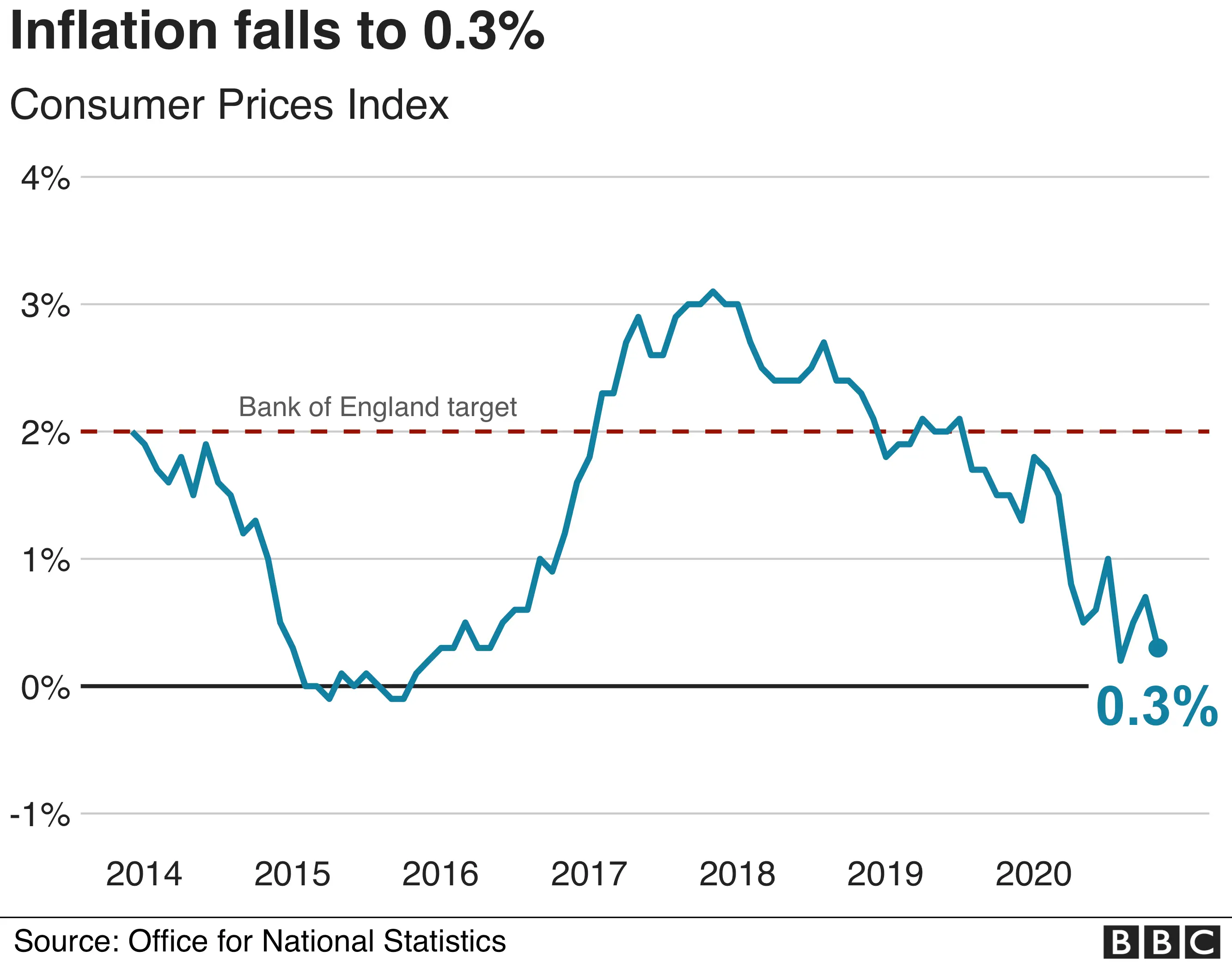

Getty ImagesThe UK's inflation rate fell dramatically to 0.3% in November from 0.7% in October, official figures show.

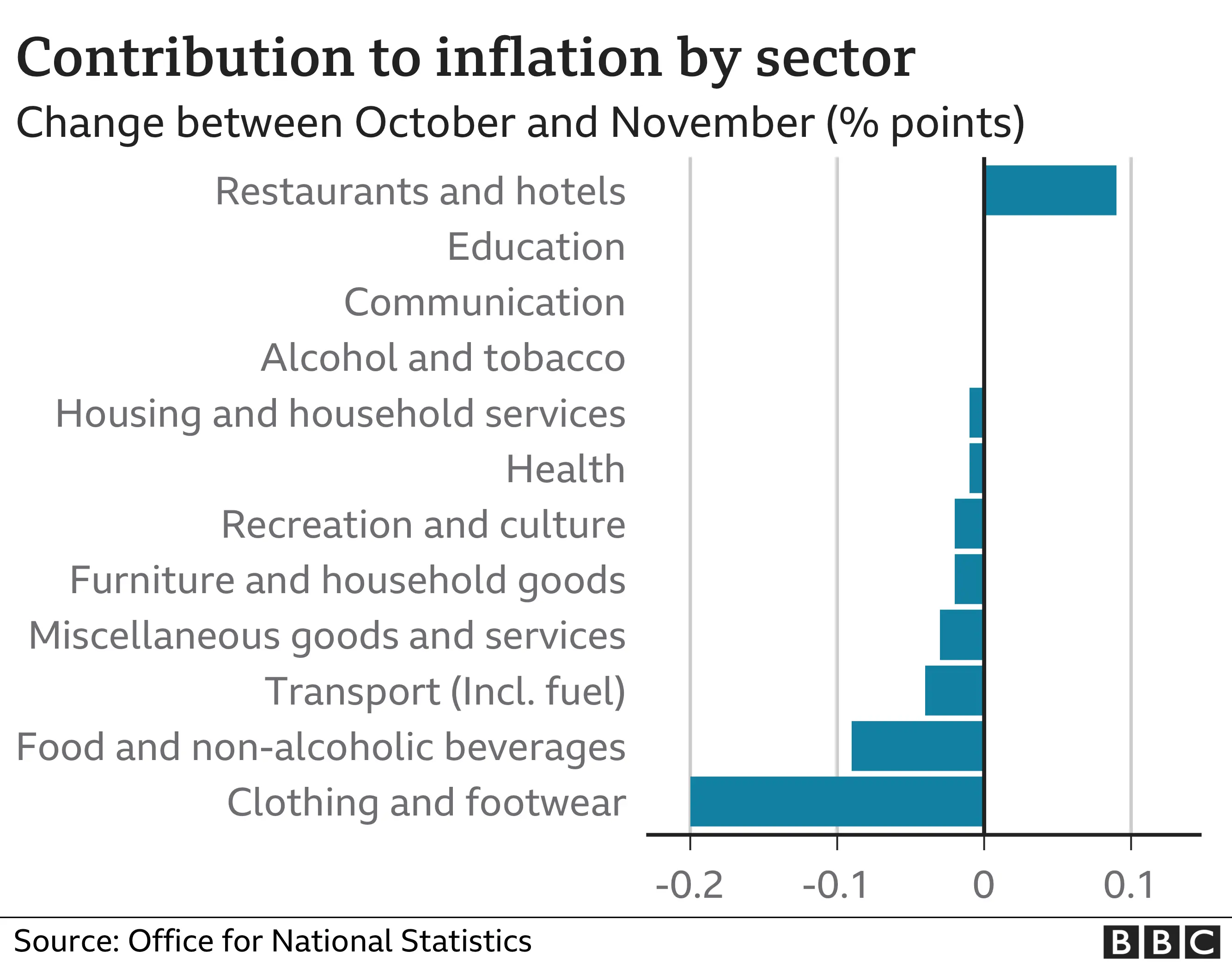

Lower prices for clothing, food and non-alcoholic drinks made the biggest contribution to the fall, the Office for National Statistics said.

However, games, toys and hobbies increased in price, partly offsetting those declines.

The figures reflect the fact that most of the country was in some form of Covid lockdown during the month.

Analysts also pointed to November's Black Friday sales, saying clothing retailers offered bigger discounts than usual this year.

The ONS said there had been media reports that some Black Friday sales might have spread further across the month.

Games and toys became more expensive as people tried to amuse themselves while their movements were restricted.

Normally, prices for clothes fall each year in summer sales before autumn ranges come in, then rise before further sales towards the end of the year, the ONS said.

Clothes would usually go up in price in November, the ONS said.

However, the coronavirus crisis has changed how prices move.

What is inflation?

NurPhoto

NurPhotoInflation is the rate at which the prices for goods and services increase.

It affects everything from mortgages to the cost of our shopping and the price of train tickets.

It's one of the key measures of financial well-being, because it affects what consumers can buy for their money. If there is inflation, money doesn't go as far.

The latest Consumer Prices Index figures come amid evidence that shop prices are falling in the run-up to Christmas, as retailers race to clear stock and deal with a "deepening" High Street crisis.

"With significant restrictions in place across the UK, inflation slowed, predominantly due to clothing and food prices. Also, after several months of buoyant growth, second-hand car prices fell back a little," said the ONS deputy national statistician for economic statistics, Jonathan Athow.

Discounts are most common at retailers selling fashion and DIY goods, according to the British Retail Consortium's (BRC) Shop Price Index.

The sharp fall in inflation "came as a bit of a surprise", said Ruth Gregory, senior UK economist at Capital Economics.

"What we hadn't anticipated was the slump in food inflation from 0.6% to -0.6%, which came despite the boost to demand for food in the supermarkets during the second Covid-19 lockdown."

However, she added: "This does not change the big picture that inflation will start to rise more sharply from April when the temporary VAT cut for the hospitality sector is reversed and the downward drag from the previous plunge in fuel prices drops out of the annual comparison.

"Together these forces could lift inflation to 2% by the middle of next year. But given there will still be some spare capacity in the economy, there seems little danger of inflation rising sustainably above the 2% target unless there is a no-deal Brexit."

Steep and unseasonal

Laith Khalaf, financial analyst at AJ Bell, said there had been a Black Friday effect, with increased discounting by retailers pushing down the cost of clothing and footwear.

"Of course, Black Friday occurs every year, but this time around, discounts were particularly steep in clothing sales, which led to an unseasonal fall in prices," he said.

"That highlights the continued pressure on the retail sector, and while price cuts on the shelves are good for consumers, they don't bode well for profits."

Hannah Audino, economist at PwC, said: "The acceleration of consumer price growth over the past two months has been cut short.

"Most of the main groups of goods and services experienced a fall in prices between October and November, including transport, health, recreation and culture.

"The largest drop in prices came from clothing and footwear as retailers discounted products for Black Friday."