B&Q owner Kingfisher to return £130m in Covid rates relief

Kingfisher

KingfisherB&Q owner Kingfisher has said it will return £130m in business rates relief it has received from the government during the Covid pandemic.

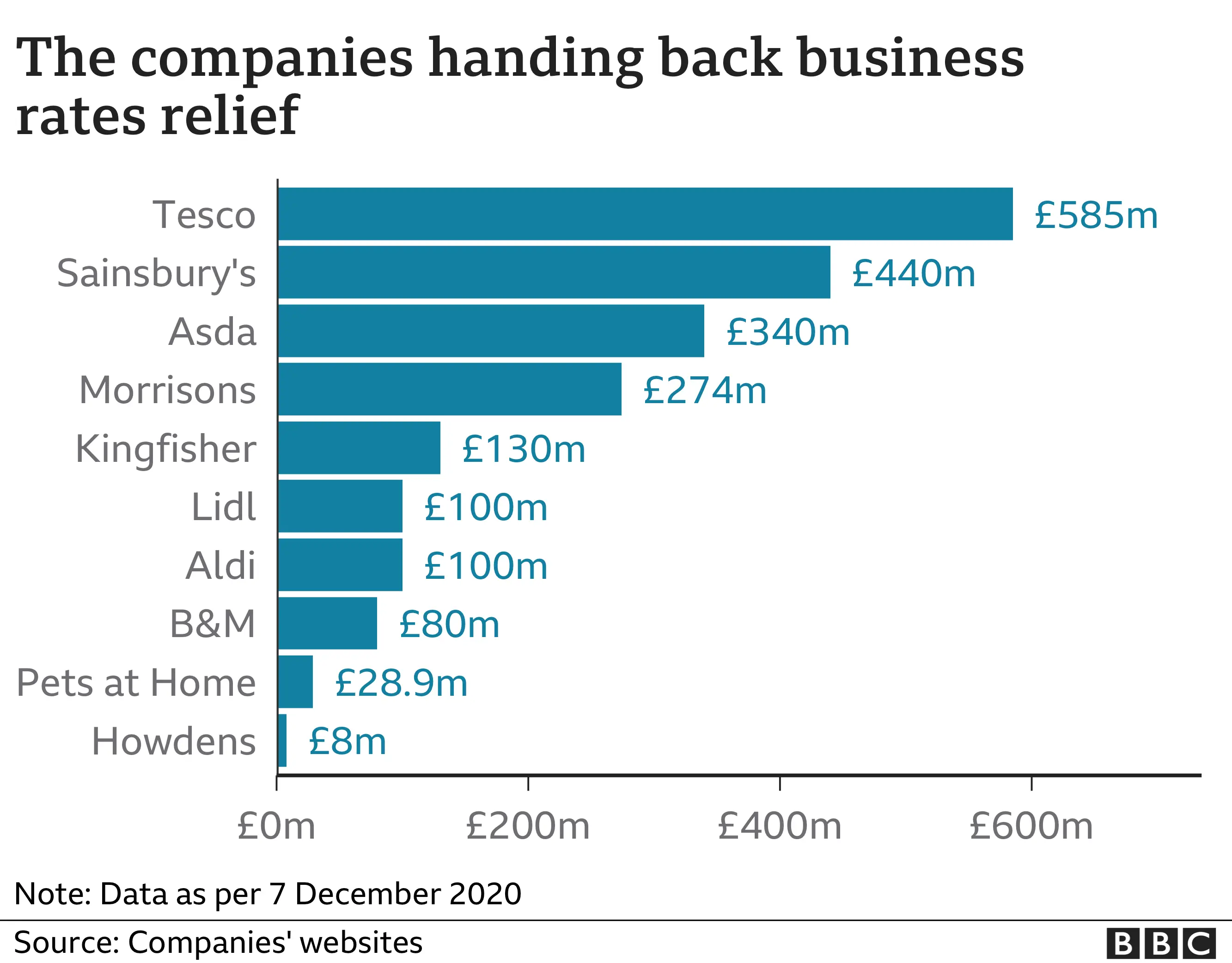

It is the latest retailer to announce it will hand back the tax break, taking total promised repayments to more than £2bn.

Kingfisher said since reopening its shops in April and May during the first lockdown, sales have been "strong".

It said business has been driven by "higher demand for home improvement".

Some retailers who are classed as "essential" - meaning they were allowed to stay open during the Covid lockdowns - have been criticised for taking government support while announcing dividend payments to shareholders.

Kingfisher has suspended its dividend because of "continuing uncertainty" linked to coronavirus.

The company closed its B&Q and Screwfix shops, apart from for click-and-collect sales, during the first weeks of lockdown earlier this year but reopened in late April and May.

Since then, sales have boomed as people used their time to make home improvements.

In its most recent trading update, Kingfisher said group like-for-like sales rose 12.6%, which it said reflected the "impact of more recent temporary lockdown measures" in England which began in November and ended last week.

In March, all retail, hospitality and leisure businesses in England were given a business rates holiday for 12 months to support them through the crisis.

Christmas boredom can be alleviated by a game of hide and seek, and this year retailers have got in early with their own version of the game. Who will manage to hold out longest and hide from paying back business rates relief?

Tesco was the first to be found - it is quite hard to hide when you are by far the biggest player - and its actions frightened others out into the open.

Morrisons, Sainsbury's and Asda have all said they will repay the financial assistance the government had offered them.

This morning it was the turn of Kingfisher, the owner of B&Q and Screwfix, to reveal itself - it will not take about £130m in rates relief, much less than the big supermarkets, but sufficient for it to have to issue revised profits guidance for the year.

Still hiding are The Range, the homewares chain owned by Chris Dawson, and Iceland - not to mention hundreds of other small retailers who will almost certainly never repay the relief granted.

At least one more of the big players is likely to follow the others' example and give the money back. The only exception is Marks & Spencer, which is hiding in plain sight - it has said it will not repay rates because, unlike the others, its clothing shops had to be closed throughout this year's lockdowns.

Tesco was the first major retailer to announce it would return the government support when it said last week it would hand over £585m in business rates.

The UK's biggest supermarket had been criticised for pledging to pay £900m to shareholders earlier this year despite staying open during the lockdowns and receiving the tax break from the government.

Labour MP Rushanara Ali, who is also a member of the Treasury Select Committee, described the rates relief for Tesco as "completely disproportionate" and "an absolute scandal".

Tesco was followed by the UK's other major supermarkets - Sainsbury's, Asda and Morrisons - as well as German discounters Aldi and Lidl, and Pets at Home.

Kingfisher said that since reopening its stores it has returned £23m it received from the government through the furlough scheme. It added that "given the resilience of our business" the board decided to hand back the tax break.

Offsetting costs

Among other retailers classed as "essential", Wilko said it would not pay back business rates relief. "Today the High Street continues to remain under significant pressure with an on-going reduction in footfall which means that right now, we're not in a position to pledge to pay back rates relief," a spokeswoman said.

It said the tax break "has gone some way" to offset the costs of investing in "enhanced safety measures", adding that it had not accessed the government's furlough scheme and continued to pay its staff in full.

A spokesman for the cycling to vehicle repair retailer Halfords, which has seen a big rise in bike sales during the pandemic, said no decision on returning rates relief had yet been made.

It is not clear how much Halfords has benefitted from the government support. In its last full financial year to 3 April, Halfords paid £36.3m in business rates.

Other "essential" retailers including The Range, Iceland, Home Bargains and Homebase have been contacted for comment.