Five ways the virus has changed Netflix

Netflix

NetflixDemand for online entertainment surged when the world went into lockdown earlier this year. But how is Netflix faring after that initial boost?

1. Growth is slowing - even more than Netflix had expected

According to its latest results, Netflix added just 2.2 million new subscribers in the three months to 30 September, as the surge of demand for its services prompted by the pandemic faded.

While it had warned that a slowdown was likely, the final figure came in below its July forecast of 2.5 million, sending the firm's shares down 5% in after-hours trade.

"The pandemic streaming party has come to an end," Paolo Pescatore, analyst at PP Foresight, declared.

Still, Netflix reminded investors that it's still on track for a record number of 34 million new subscribers in 2020 - or more than 200 million overall.

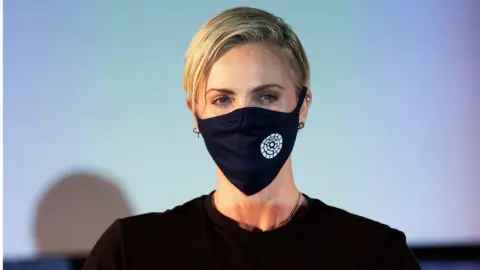

2. The Old Guard, an action film starring Charlize Theron, was the Netflix hit of the quarter

Reuters

ReutersNetflix said 78 million member households watched The Old Guard, a Netflix original, in the first four weeks after its launch, making it the firm's most popular title of the quarter.

Enola Holmes, Project Power and The Kissing Booth 2 were also popular, attracting 76 million, 75 million and 66 million households in the first four weeks after their debut.

Of course, those figures should be taken with a grain of salt - Netflix counts any viewing time of more than two minutes towards its tally. And the viewer numbers it shares are focused on its own original productions.

3. Markets outside of the US are absolutely critical to the business

The number of international subscribers to Netflix had already eclipsed those in the US - and overseas growth continues to be critical.

In the most recent quarter, the strongest subscriber growth occurred in its Asia Pacific region, which accounted for more than one million new subscribers - almost half of the sign-ups. The firm boasted that it now claims memberships in a "double-digit" share of broadband-connected homes in Japan and South Korea.

But the firm still makes its most revenue per user in the US, so retention in its home market is key, especially as competition from rivals like Disney and HBO heats up.

On that score, Netflix sought to reassure investors, writing in its quarterly update that "retention remains healthy and engagement per member household was up solidly" compared to last year.

4. Now the race is on for more content

The shutdown in film and television productions, forced by lockdowns this spring, has placed a major focus on how Netflix and its competitors will get hold of new offerings to retain their members.

Netflix downplayed those concerns, saying it was making "good and careful progress" in production and it expected the number of Netflix productions launching next year to exceed 2020 in every quarter.

Netflix stands to benefit from the struggles of cinema operators, said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown. But as homebound audiences burn through material at a faster rate, costs will increase - and could push the company to raise prices, she warned.

"Original content might keep customers, but it costs a pretty penny, and is downright ghoulish for the bottom line," she said. "If consumers are expected to burn through content at a faster rate, the cash flow hole will in theory get bigger."

5. The slowdown in production has helped its profits

The firm reported a record $790 million in quarterly profit, as revenue increased more than expected to $6.4bn, thanks in part to the appreciation of the euro against the dollar.

And the firm said its profit margins have also improved, due to the temporary slowdown in production.