'My bank is shutting my account because of Brexit'

BBC

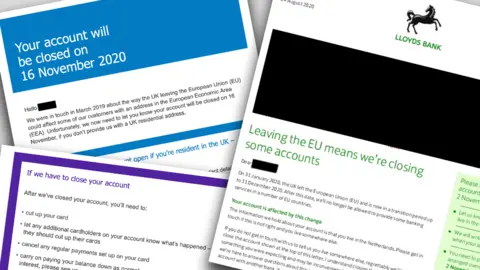

BBC"I was shocked to receive a notification saying that my bank account is going to be closed in two months," says Sharon Clarke, a Briton who has been living in the Netherlands for 20 years and who banks with Lloyds.

"They said that unless I provide a UK address, my account will be closed and I'll have to cut up my card."

She is one of thousands of British expats living in the EU who are being told their bank accounts will be closed because of Brexit.

Lloyds Bank has written to 13,000 personal and business customers, saying it will no longer be able to offer banking services once the Brexit transition period ends on 31 December.

And Money Box found Barclays, Barclaycard and Coutts - which is owned by NatWest Group - are taking similar action.

Experts say it is because lenders will lose their EU banking licences, making operating in some countries too costly.

However, HSBC and Santander say they have no plans to close British expat accounts in the EU.

Ms Clarke says she has been given until early November to close her account and transfer all monies, standing orders and regular payments to another bank.

She says she has never had any financial problems with Lloyds, having banked with them "for decades".

Britons living in the Netherlands, Slovakia, Germany, Ireland, Italy and Portugal have all been sent similar letters.

One of them is Robert Kane, who lives in Spain and has a Barclaycard credit card.

"I find this an unbelievable situation that Barclaycard will lose so many thousands of customers because of Brexit," Robert says.

"I don't have a UK address as I live in Spain and have done for the last 14 years. They did not offer me any advice other than cut up my card, cancel any regular payments and carry on paying outstanding balances."

A source at NatWest, which owns Coutts, says it has no intention of closing accounts unless there is no other option and any customers who may be affected will be contacted.

'Postcode lottery'

Sarah Hall, a fellow at UK in a Changing Europe, a research unit at King's College London, says that EU-wide banking rules will not apply to Britain after Brexit.

UK banks will no longer be allowed to provide services to customers in the EU without the right banking licences.

This is known as passporting, a system for banks in the EU which allows them to trade freely in any other state in the European Economic Area (EEA) without the need for more authorisation.

Sarah said that although HSBC and Santander will still offer banking, others feel it is not worthwhile commercially.

"Some UK banks decided the size and scale of the client base is small, not profitable enough to warrant a subsidiary, so they have determined they will exit that market. It's a potential postcode lottery.

"This means the market will be harder to navigate as a customer. It's less certain and could mean less choice and maybe higher interest and lower saving rates because of less competition."

Variable impact

In a statement, Lloyds said: "We have written to a small number of customers living in affected EU countries to let them know that due to the UK's exit from the EU, regrettably we will no longer be able to provide them with some UK-based banking services."

Barclays would not reveal how many accounts are going to be closed, but said it would be contacting affected customers.

The UK trade body UK Finance said the finance industry had been working hard to get ready for Brexit.

"Where possible, firms want to keep providing banking services to customers living in the EEA after the transition period.

"The impact on each customer will vary depending on the operating model of their bank or provider, the product or service being provided, and the legal and regulatory framework in the country in which they are resident."

You can hear more on BBC Radio 4's Money Box programme by listening again here.

Follow Money Box on Twitter.