Why are there so few black tech entrepreneurs?

Jobble

Jobble"I think a lot of folks like myself never even get a chance, because folks don't answer their phones, or listen to their idea, but put them in a box they shouldn't be in," says Zack Smith, the founder of Boston-based Jobble.

He's talking about how hard it can be for black tech entrepreneurs to raise money.

But Mr Smith saw it as a challenge.

"It doesn't matter what box they put me in to begin with, I'll get out of that box and prove to them I'm bigger and better. I think this fuels me," he says.

His firm is a US platform for jobs in the gig economy, offering work to those who want flexible hours.

'Supportive'

According to a study of 9,874 US business founders by California-based social enterprise RateMyInvestor, only 1% of start-ups receiving venture capital were black.

But Mr Smith was fortunate to have New York-based Harlem Capital Partners, which focuses its investments on minority and women founders.

"They've been extremely supportive, as an investor and also a friend and a partner," he says

Black Lives Matter not only shone a spotlight on policing, but also on other fields, like the technology industry.

In the US, 13% of the workforce is black, but at Google that proportion is just 3.7% and at Facebook 3.8%.

Phillip Faraone/Getty Images

Phillip Faraone/Getty ImagesTo understand why this is, follow the money, says Sydney Sykes, a Harvard graduate and venture capital investor who in 2018 co-founded BLCK VC.

Venture capital - that is, early investments in a company of between $1m (£750,000) and $30m in return for shares - is how most new start-ups get out of the blocks.

But 81% of venture capital (VC) funds specialising in making these types of investment lack a black partner.

Partly as a result, 75% of fundraising rounds go to all-white founding teams, says Marlon Nichols, a founding managing partner at California's MaC Venture Capital.

'Exciting investments'

Sydney Sykes says investors in tech start-ups "go by their gut feeling, and that's where bias creeps in".

She says investors financially back someone if they are "connected with this person", or perhaps an entrepreneur reminds them of Elon Musk or Mark Zuckerberg.

Sydney Sykes

Sydney SykesBut she believes "when you close your mind to different types of entrepreneurs, you're missing out on exciting investments and great companies".

And Marlon Nichols asserts that ethnically diverse founding teams deliver investors better returns - on average 3.3 times their invested capital, compared with 2 times for all-white founders.

Ms Sykes started a network of black investors.

She and another VC principal, Frederik Groce, held a dinner and invited all the black people they knew in VC in the San Francisco Bay area, as well as other friends.

Benedicta Banga

Benedicta Banga"We ended up being about 30 people, and most of the black investors in California, which is pretty wild," she says.

Dinner went on "very much longer than it was supposed to" and by the end they'd started a network to encourage and mentor black people wanting to enter venture capital.

Duplicating excesses?

Black business founder Donnel Baird says raising funding has been "far and away the hardest part".

Mr Baird's start-up, Brooklyn-based BlocPower, hires local unemployed workers to replace apartment blocks' antiquated climate systems with modern heat pumps.

These are 20-50% more efficient than air conditioners and two to three times more efficient than boiler-based furnace systems, he says.

The biggest challenge is documenting each building well enough to attract crowdsourced finance, so systems won't cost residents anything up front, and can be paid for out of future savings.

Roy Rochlin/Getty Images

Roy Rochlin/Getty ImagesThey've developed a modelling tool called BlocMaps that quickly integrates city data sources with on-site observations, while drawing on the 1,000 buildings they've worked on so far in New York.

He says as founders like him make profitable exits, and have access to capital to invest in new start-ups, Silicon Valley will change.

"I don't think it's going to be a very long time from now," says Mr Baird. "I think it's going to be five years."

But he asks of his generation of black founders: "Are we going to try to help Silicon Valley build the better world it says it wants to build, or are we going to duplicate the same excesses just with a black person in charge?"

Growth circles

Turning to the UK, lack of funding has also been an issue, one which the Black Lives Matter (BLM) movement has helped highlight.

In the wake of BLM, many British people, both black and white, want to support black-owned small businesses, says Benedicta Banga, who was born in Zimbabwe and lives in Solihull in the West Midlands.

So she started Blaqbase, a marketplace platform, largely because she wasn't finding things she needed locally "like makeup for my skin type, and black-owned brands weren't very visible online".

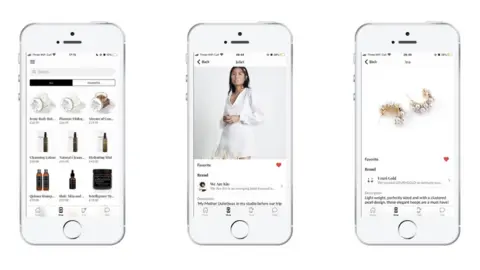

Blaqbase

BlaqbaseBlack-owned businesses are the least-funded businesses, she says, and this is problem is compounded if you aren't visible.

"Then you don't grow, and you don't get funded because you're not growing," she says.

While she initially thought of the platform as just being UK-based, most of the businesses on it ship worldwide, and her platform has gained users in the US, Asia and the Caribbean, she says.

'Beacon of hope'

Another British-based tech entrepreneur, Ikenna Ordor, has started a sharing economy platform for higher-end vehicles - Starr Luxury Cars - which has expanded into private jets.

A few of his car clients turned out to be private jet owners, who were keen to earn money from renting their aircraft out.

Ikenna Ordor

Ikenna OrdorWhen coronavirus struck, these services were suddenly in demand. City workers who would always take the train into London, started to rent cars twice a week to drive to the office, says Mr Ordor.

As a Nigerian-born male, he says there is a stigma associating Nigerians with fraud. He also says black-owned businesses are less likely to be offered bank loans than other companies.

So he ultimately hopes that his example can be a "beacon of hope for young men thinking about starting businesses".